Hello QAV Light Brigade

It’s another… Wednesday? Why am I working this week? I’m calling today “No Rest For The Wicked Wednesday”.

I hope you all had a safe and happy Xmas. Fox got a drum kit, so if I seem rattled this week, that could be why. It also explains why I screwed up the intro in #551 a couple of days ago. A new fixed version will be up shortly! Sorry about that.

Well… we had yet another disappointing week for the AORD. Let’s hope Santa stuffed a little something in the ASX’s stocking and we see it spike up this week.

Let’s have a look at how our portfolios are doing and what we have to buy and sell today.

PORTFOLIO UPDATES

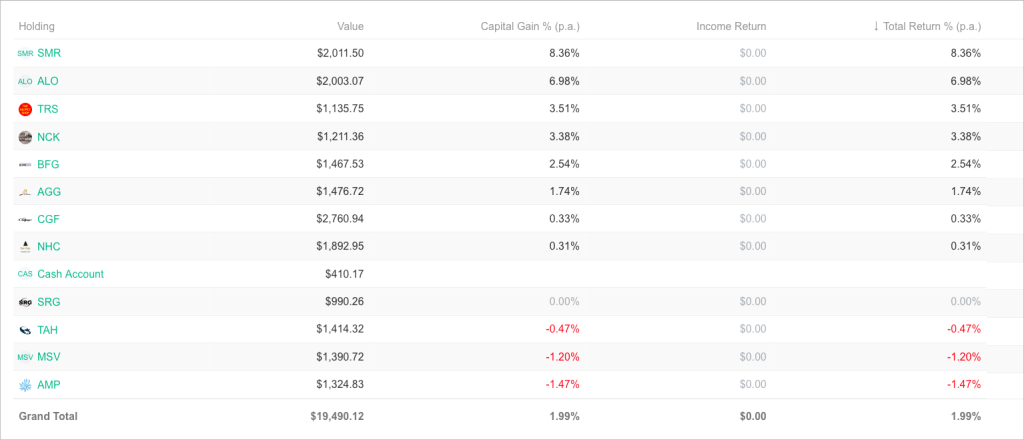

22.1 Portfolio

Inception date 18/4/2022. It has improved slightly this week – 221 is down 6% vs the benchmark which is down 1.9% over the same period.

You can see the full chart and transactions on the Light homepage.

Here’s the performance over the last week:

ALO continues to perform, currently up 48% since we bought it in September. SMR is up 37% since I accidentally bought it on 4/10. 🙂

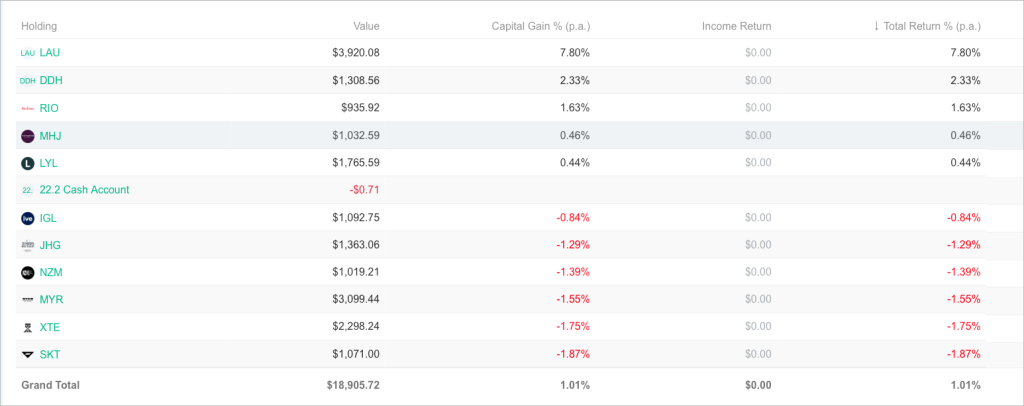

22.2 Portfolio

Inception date 08/08/2022. It is up 10.8% vs the benchmark which is up 4%.

Here’s the performance over the last week:

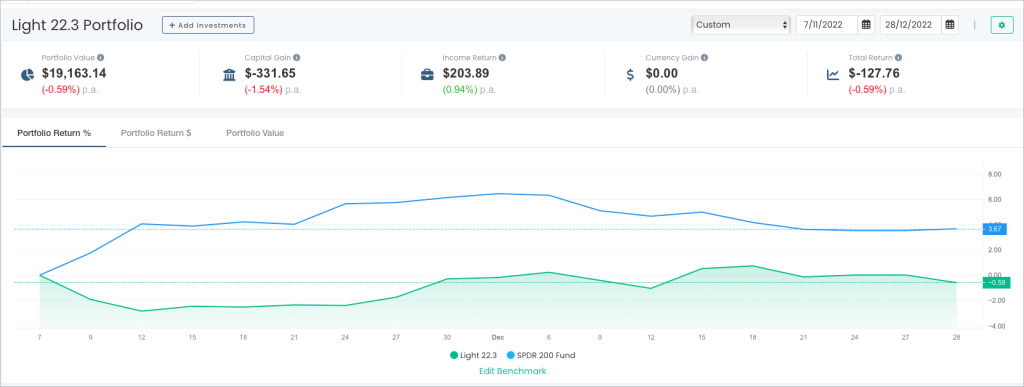

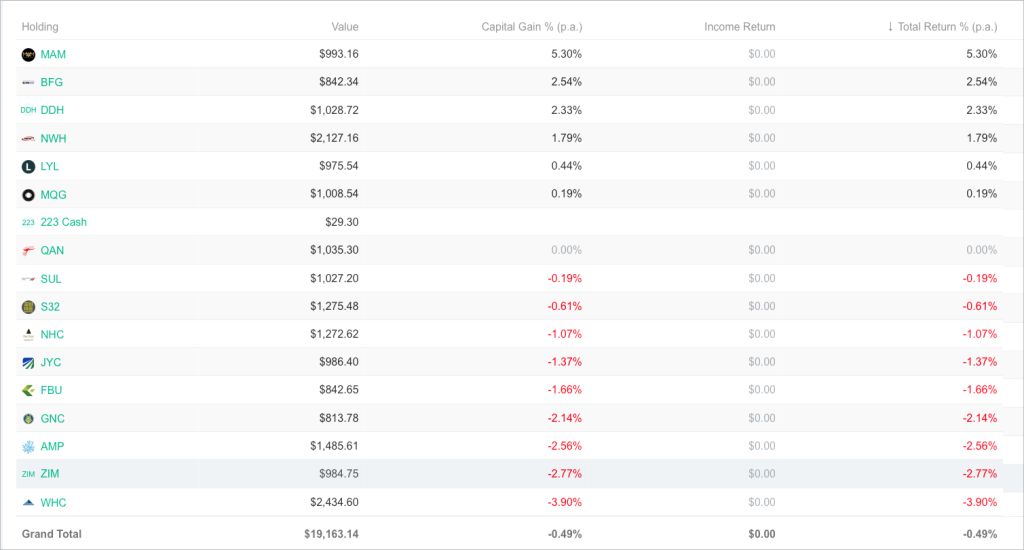

22.3 Portfolio

Filled 7/11/2022. We slipped a bit this week, and are down -0.5% versus the benchmark which also slipped but is up 3.6%.

The best performers in the last week have been:

GROUP SUMMARY

The Light portfolios as a group are up 4.3%, versus the STW which is up 5.7%. So while we’re still currently behind the benchmark, we’re not far behind it and I think we’re doing okay for what has been a very turbulent period. Obviously we expect to do better than the benchmark over time. Our goal is to double the benchmark, like our QAV Dummy Portfolio has done (16% v 7%) since inception (2/9/2019).

SELLS

THIS CONTENT IS ONLY AVAILABLE TO QAV LIGHT AND CLUB SUBSCRIBERS.

BUYS

THIS CONTENT IS ONLY AVAILABLE TO QAV LIGHT AND CLUB SUBSCRIBERS.

** Please remember to review our Buying Guidelines to understand which cap bands you should be looking at and other important considerations.

DISCLOSURE

In the interest of full disclosure, we would like to advise that, as of the date of this email, the QAV team currently hold these stocks in their personal portfolios:

AMP BPT CGF FHE GRR IGL JHG MQG NAB NHC NWH PRU QAN QBE RRL S32 WAM WDS WHC

Please note that our personal holdings might not include the stocks we recommend in QAV Light. This is because we already have full portfolios (15-20 stocks) and can only add new stocks if we have to sell something.

If you’re interested in learning more, please review our trading and disclosure policy.

FOR NEW MEMBERS

If you’re new to QAV Light, here’s a quick reminder on how it works.

- We send you an email every Monday advising which stocks we are adding to our Light portfolio.

- You can copy our trades, but please remember to review our Trading Guidelines to understand which cap you should be looking at and other important considerations. And consult a financial planner before making any decisions.

- We don’t recommend that you add stocks which are already in our portfolio. Their position on our buy list might have changed since we recommended them. Just start with the stocks recommended after you become a member.

- If one of the stocks we add breaches one of our sell conditions, we will sell it from our portfolio and you’ll get an email advising of the trade. Again, you can copy our trades, but seek financial advice before making any decisions. And please check your Rule #1 price (see Trading Guidelines).

That’s it for today!

If we decide to buy or sell something, we’ll let you know.

info@qavpodcast.com.au