QAV PORTFOLIO REPORT

INCEPTION REPORT

We’re still outperforming the STW by ~2.5 times since inception (02/09/2019).

You can always check out the live version of the portfolio chart here.

FY REPORT

The DP is up 5.92% vs the STW up 2.47%.

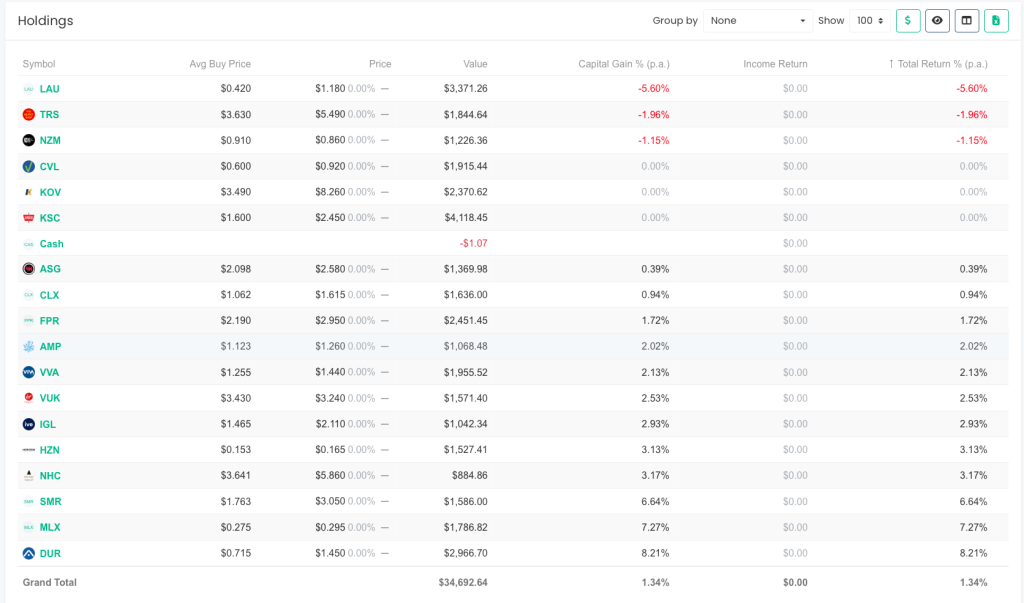

The portfolio was up 1.34% in the last week.

Here are how the stocks have performed in the last 7 days. SMR, MLX, and DUR were the winners, LAU the biggest loser.

RECENT TRADES

No trades in the last week.

NEW FREE WEBINARS

I’m running weekly webinars on Thursday nights (8pm Brisbane time) over Zoom. These are an opportunity for everyone interested in value investing, whether you are new to QAV or an existing QAV Club or Light member, to ask questions and share learnings with each other. I will run through the QAV system and explain how it works in detail.

Click for the Registration Link for this week or a future webinar

STOCKS OF THE WEEK

** As always, please check our work, DYOR, and consult a financial advisor before making any investing decisions.

BUY LIST

Each week we produce a buy list that we share with our members. The intended primary purpose of this buy list is for club members to use as a reference for comparing their own buy list. In theory, all of our buy lists should look pretty similar each week.

As always, please check our work, DYOR, consult a financial advisor before making any investing decisions.

THIS SECTION CONTAINS CONTENT WHICH IS VISIBLE TO QAV CLUB SUBSCRIBERS ONLY.

LAST WEEK’S EPISODE

Detailed highlights of the episode:

- Reporting season results and market reactions, stocks going down on good results

- Commodity prices and impacts on stocks like GrainCorp and iron ore companies

- Takeovers of QAV stocks, premiums paid in takeovers

- FMG results and management changes, iron ore price outlook

- Market volatility, best and worst days for returns, staying invested

- PLS results and lithium demand outlook

- AFG results and dividend policy changes

- Using volatility/beta to adjust rule one percentages

Episode Transcription

[00:00:00] Cameron: Welcome to QAV, TK This is Tuesday, the 29th of August, episode 635 By the looks of the fancy background There you are in Wagga.

[00:00:25] Tony: I am, yeah, enjoying, Mark Rudd’s hospitality.

[00:00:31] Cameron: Have you played golf yet?

[00:00:32] Tony: No, unfortunately, I’m still getting over a calf strain, so, just trying to exercise it and get it good for the golf tournament coming up, but, may only play in a week’s time or so.

[00:00:45] Cameron: What tournament are you playing in?

[00:00:47] Tony: It’s called Black Snake It’s a, an event up in Bonneville in, in Coffs Harbour So it’s the regular guys we go away with often that do charity work and, I’m not sure if this one’s for charity I played Bondville once before with Ruddy, and it’s such a great golf course, I wanted to go back, so I joined the, group that’s going up there soon.

[00:01:07] Cameron: The Black Snake Tournament?

[00:01:09] Tony: Yeah, they give each different tournament a name It’s, Scallywags, I think Scallywags Cup goes to Tasmania The December one we play in is Ned Kelly Cup, and this one’s Black Snake.

[00:01:24] Cameron: Good stuff And you’re still recovering from your chest cold.

[00:01:28] Tony: Yeah, no, getting better, thank you You can probably hear from my voice, it’s a bit stronger, clearer,.

[00:01:36] Cameron: Well, not with the shitty microphone, the AirPods microphone that you’re using while you’re traveling, but yes.

[00:01:43] Tony: Do you reckon, do you think people really care? Is it about the content or is it about the quality of the recording?

[00:01:49] Cameron: Oh yeah, no, I think it’s the content, as long as it’s listenable I don’t think people mind too much Yeah,.

[00:01:55] Tony: I had this debate with Phil Muscatello on Friday when he was helping me.

[00:01:59] Cameron: Oh, .

[00:02:00] Tony: To install a quality microphone he recommended and then dissed and then threw out Now we’re getting another one.

[00:02:07] Cameron: Fail,.

[00:02:08] Tony: Which is not the microphone’s problem He gets to my place and he goes, no, it’s Too much glass here It’s gonna just keep echoing and reflecting Mmm.

[00:02:17] Cameron: That’s the problem.

[00:02:18] Tony: Mmm.

[00:02:19] Cameron: Well, I want to start the show by congratulating the Prime Minister on his pay rise today,.

[00:02:25] Tony: Seriously? Really?

[00:02:28] Cameron: No, not really, facetiously.

[00:02:31] Tony: No, I mean really, he’s got a pay rise He’s giving himself a pay rise.

[00:02:35] Cameron: Oh, they all got a pay rise today He got a pay rise Dutton got a pay rise Adam Bandt got a pay rise They all got a pay rise MPs are getting a pay rise.

[00:02:43] Tony: That’s why no one opposes.

[00:02:47] Cameron: Well, yes, exactly But I love, I love the photo in the ABC Congratulations to the ABC Like they, they picked the cheesiest photos of those three guys, Albanese, Dutton and Bant, big shit eating grins on their faces to run with the story of getting a pay rise Classy Yeah, ABC is so classy these days It’s,.

[00:03:10] Tony: Yeah, I hadn’t been aware of that I mean, politicians work hard, so you can’t begrudge them what they get paid And I guess there’s lots of,, agitating for pay rises given inflation in the economy, but it’s never good when you see politicians unilaterally get a pay rise I’m sure it wasn’t debated.

[00:03:29] Cameron: Aren’t they causing the inflation? Shouldn’t they be like managing the inflation better and then.

[00:03:34] Tony: Well, that’s right.

[00:03:34] Cameron: Rise when you’ve Manage the inflation,.

[00:03:37] Tony: Is one of the, one of the problems with democracy is that, they’ve got a vested interest in not solving these problems A bit like, cigarettes and gaming and liquor They get so much taxes from all those things, they’re never going to go away Or, or, you know, have some kind of, health management program or framework around them.

[00:03:54] Cameron: It’s like the military industrial complex in the US, why would we want wars to go away when that’s how we make 10% of our income every year?

[00:04:01] Tony: Exactly.

[00:04:02] Cameron: Moving on to other issues, wheat price, Tony Speaking of wars, wheat price became a sell this week in our checklist, which meant we had to sell GrainCorp because it’s attached to the wheat price, and I went digging into the whys of the wheat price collapse And, it’s kind of funny, I was on this website called foodbusinessnews net and, going back over the last week of reporting, so, August 23rd said wheat futures climbed Wednesday as traders monitored news of a Russian drone attack on the port of Itsmail along the Danube River in southern Ukraine, which Ukrainian Deputy Prime Minister Kubrakov said destroyed 13 tons of grain So they blow up this, grain silo, price of wheat futures go up The next day, August 24th, wheat futures closed mostly lower Thursday as traders weighed wheat demand for U S wheat against strong global supplies exemplified By consultancy, Agritel’s Thursday forecast for Russian wheat exports at 49 million tons in 2023 24, which would be a record high So, wheat price, wheat futures went down The next day, August 25th, wheat futures were mixed Chicago’s soft red winter contracts declined under pressure from plentiful global supplies and a strengthening U S dollar Still, there were signs of concern in some wheat growing regions such as Argentina and Ukraine, which helped support KC and Minneapolis wheat futures So, it seems to be up one day, down the next day, bit like a market but anyway, it’s down for us, so we had to sell GNC,, and, we own several parcels in our different portfolios It had barely moved, I think one of the portfolios was up 1%, one of them it was down 2% since we bought it, because we bought them, a couple of weeks apart So it really went nowhere for us, GrainCorp, and, who knows, it could be a buy next week again But, as I said in my post, we don’t predict, we just play it day by day.

[00:06:13] Tony: Yeah We’re certainly not experts on the wheat, industry and certainly not experts on the Russian and Ukraine conflict I would, it’s, it’s, it’s strange to me that I would have thought that the Russia conflict would have been pushing wheat prices up, but, Yeah, because the wheat has been flowing, I know, until recently when Russia decided not to let wheat out of Ukraine, so I would have thought that would have pushed wheat prices up, but it didn’t, so I’m not sure what’s going on, nor do I have the expertise to judge.

[00:06:42] Cameron: Well, I was watching a, TikTok series about Ukraine war, live thing this morning, an American guy who does a day by day analysis of what’s going on And he spent quite a bit of time talking about how Ukraine is still able to ship their grain They’ve just found different shipping routes that bypasses Russia and stays in NATO waters So Russia can’t do anything about it without, setting themselves up for a NATO reprisal So Apparently Ukraine is still shipping grain,.

[00:07:11] Tony: Okay, that makes sense then.

[00:07:13] Cameron: So that might have something to do with it Well, speaking of playing things day by day, Tony, Fortescue’s, Revolving Management Door, is sort of a day by day thing Who’s in? Who’s out? It’s a bit like Musical Chairs in Fortescue Their freshly minted CEO of the mining business, Fiona Hick, who I think had only been there for six months, she replaced Elizabeth Gaines, has left after Jimmy Barnes Did you read, the blow by blow in the Financial Review this morning?

[00:07:44] Tony: I did, yeah Yeah.

[00:07:46] Cameron: About flame trees, yeah, taking the lyrics from Flame Trees and then.

[00:07:51] Tony: Oh, right I didn’t see.

[00:07:52] Cameron: That was good.

[00:07:53] Tony: Skimmed through it I love that song It’s one of my favourites,.

[00:07:58] Cameron: Me too, he was like, number one is to find some friends who say you’re looking well Everyone was telling Andrew Forrest on Saturday night that he was looking very well.

[00:08:08] Tony: Ha, ha, ha, ha,.

[00:08:09] Cameron: Number two is the happy hour at one of two hotels They go, Oh, there was a lot of happy hour going on at.

[00:08:16] Tony: Ha.

[00:08:16] Cameron: Pilbara The drinks were flowing Number three is never say her name And, then they were talking about Fiona Hick So they.

[00:08:25] Tony: Was that, was that who they were talking about? Not Mrs Forrest?

[00:08:28] Cameron: Well, so many, so many, yeah And then they were also talking about the number of, sexual harassment, cases in at Fortescue this year It’s gone up.

[00:08:42] Tony: Ooh,.

[00:08:43] Cameron: Year, and a lot of people have been fired, removed from the company because of sexual harassment investigations Twiggy Forrest, not one of them No, no foul calls on Twiggy Forrest, but Their financials came out, declared a fully franked final dividend of 1 a share We’ve always talked in the past about how they’re very generous dividend issuers,.

[00:09:10] Tony: They were That’s one of the issues why the share price went down.

[00:09:14] Cameron: Really? Dollars not good enough?

[00:09:16] Tony: Yeah, it’s lower than it may even be hot, but it’s been in the last couple of years.

[00:09:21] Cameron: Their revenue decreased 3% to US$ 16 9 billion Its underlying earnings before interest taxes, 6% to US$ 10 billion Net profit after tax fell 23% to US 4 8 billion and Dino Otranto has been appointed Chief Executive in the wake of Fiona Hicks departure So what do you make of all of that, TK?

[00:09:53] Tony: Well, I’d have to take it at face value The Fin Review reported that, Ms Hicks, who’s leaving, Fiona Hick, who’s leaving, came out of some of the big energy companies in Australia I think it was either Woodside or Rio And, brought that kind of Big sort of corporate culture to an entrepreneurial company and the mesh didn’t gel That’s what’s being reported So you have to believe it That is, I mean, to me, it’s a red flag I mean, that’s probably the third senior executive to turn over in the company probably this year So we had Elizabeth Gaines leaving, who was their longtime CEO Now, Fiona Hick, Guy DeBelle, who was CFO of the Future Industries side left So there’s a lot of change in the executive ranks, which is not that unusual for a sort of a, I’ll call it a family company It’s, you know, it’s Andrew’s way or the highway, I guess, and that makes sense because he’s in charge and knows what he’s doing So there can be clashes of cultures So, but the other side, I think all the executive turnovers are a red card for me They called out that cost inflation is hitting their business and there’s a,, mine expansion project called Iron Bridge, which has just taken a 700 million plus write down, so that was a lot And there was also some discussion by Twiggy about the future, I think it’s called Fortescue Future Industries, that’s the part of the business which is not iron ore, it’s, it’s, investing in, alternative energies in the main And he was saying that he fully expects that to not return as much as the iron ore business on an IRR basis And of course, analysts scratch their heads and go, well, why the fuck are you doing it then? Why don’t you take the money you’re putting in that and put it into iron ore, which is, as you said, returning higher So there’s a question mark over that And then there’s also a bit of angst in the market about the future of the iron ore price, because China is, awash with, finished but unoccupied apartments, and so the CCP came out, I think, in the last few days and said that they weren’t going to increase steel production this year, so most people think the steel price The iron ore price will drop So all these kind of things, I think, coalesced around the results announcement A few other things like the dividend going down didn’t help and, yeah, shares have been sold off.

[00:12:26] Cameron: Yeah, well, when you say it’s a bit of bad news We often talk about bad news sells, and you’re very strict in your limiting of the criteria for a bad news sell Sudden departure of a CEO or a CFO is usually one of those,, But we also usually wait and see how the market reacts to the announcements Like there was a dip in the share price, but it also coincided with their report coming out on Monday So hard to know whether or not it’s related to her departure or the results or both and how much is one or the other The share price has been recovering since yesterday morning’s dip So what’s your read on it? Is this a bad news sell for us or do we hold?

[00:13:19] Tony: Oh, it’s always a hard call, I think it’s a bad news sell myself,, even though there’s explanations for why the CEOs have gone,, it’s two CEOs CFO, I may have got that mixed up, but I think it’s, that’s the case in the last sort of nine months So, something is enjoying in Fortesque, whether it’s A culture clash with the owner founder, or whether it’s the future industry side of the business is not working or,, attracting too much attention from the founder, I don’t know, but there’s something going on there I’d rather just, sit aside and,, at least wait for our share price to improve It is, even though it’s turning up today, it’s It’s,, off its highs It’s, what is it today? 20 20 And it’s been, it’s down about 10%, I think, in the last couple of months.

[00:14:13] Cameron: Yeah,.

[00:14:13] Tony: Yeah, so it’s not near its sell I’ll give it that, but,, yeah, I’m not encouraged to hold it I’d be selling.

[00:14:21] Cameron: Well, I don’t hold it in any of my portfolios or the QAV portfolios We did, but we had to rule one it back in June So it’s not in my personal portfolios I don’t think it’s in yours either by the.

[00:14:34] Tony: No, same So,, yeah, it’s a moot point for us But,,, it’s not the kind of thing you like to see happening in a large company.

[00:14:42] Cameron: Yeah Particularly when iron ore is still a buy I’m looking at the iron ore chart again now I mean, it’s been, it’s down from, where the price was in June of 2021, but it’s been picking up since May So the iron ore price is on its way up It’s still a buy for us, usually when iron ore is a buy, we’re buying iron ore companies left, right and center because we’ve done so well out of them in the past, but, this is not one of those times.

[00:15:10] Tony: Yeah, and it’s tricky because,, I find all remains a buy I’m a bit sceptical about that, given where China is, and I suspect that China will go through a period of less steel production, but that’s a prediction, so who knows But yeah, if Fortesque does turn up, it’s, I mean, I don’t have a rule for when the red card, how long the red card suspension lasts for, whether you wait for a CEO to come in and last for 6 months or 12 months and make sure they bed down, I don’t really have a rule for it So that’s a hard one.

[00:15:43] Cameron: I also had to rule one,, FEX this morning from one of our portfolios, so that’s also interesting.

[00:15:52] Tony: Well, I suspect that people, I suspect that the fundees and the analysts are predicting the iron ore price to drop even though it’s not going up in the current graph.

[00:16:03] Cameron: Yeah.

[00:16:03] Tony: And so they’re getting out of iron ore BHP was also, I think, having a tough run at the moment too I’ll just call up, call up the graph for that.

[00:16:13] Cameron: FEX just came out with their results, I think, today, 29th of August, yeah And,, got a two cents per share, fully frank dividend Flicking through the highlights of their results, I don’t see record, the word record in here anywhere, so Their financials are probably down a little bit as well, like Fortescue’s, so,.

[00:16:39] Tony: Yeah, And BHP, so I’ve just looked at the graph, it’s at Josephine and heading down It’s above its sell line, but below its buy line.

[00:16:47] Cameron: So what are those Interesting situations? Interesting situations It’s an interesting situation for us where iron ore is a buy, but the iron ore companies aren’t doing well.

[00:16:57] Tony: Yeah Which, which to me is the market predicting the iron ore price will turn down.

[00:17:02] Cameron: All right, where were we? PLS Oh God.

[00:17:06] Tony: Yeah, gosh That’s a hard.

[00:17:09] Cameron: Talk about, let’s talk about PLS Oh my God So, Pilbara, lithium, the only lithium stock on our buy list We were quite excited by PLS and, and with good reason So they released their results on the 25th of August Amazing results 224, sorry, 242% Increase in revenue to 4.1 billion 464% Increase in cash balance to 3.3 billion 307% increase to their ebitda 14 cents per share Fully franked dividend, and,, 326% increase in their profit after tax to 2 4 billion What did the market do? Dropped it, dropped them by 8% within minutes of the results coming out I was explaining this to Chrissy the other,, last night I was like, normally the QAV model is to find good companies, companies that are being managed well, generating cash, good history of generating cash, investing in them when we can buy them at a discount to their valuation Normally when you do that and they come out with a good report, the share price goes up because everyone goes, Oh, well, look at that.

[00:18:29] Tony: Yeah.

[00:18:30] Cameron: Doing well Let’s buy it Let’s get in on that But this funny, this reporting season No, they go, wow, look at that They’re going to probably suck next year So let’s, let’s dump it while the going is good is my take on what’s happening What do you think?

[00:18:45] Tony: Yeah, I think you pretty much summarised it There it is It is strange because the results are so good and probably the biggest thing which I focused on was how much cash has been thrown off by this company It’s just a wash in cash, like this just Yeah, so, that, I mean, you, I forget now what the number was when we did the, the pulled pork We were buying it at like, two times cash or something for this company, which was incredible, couple of, couple of things I think people have focused on, number one, they’re using that cash to invest an increase in production So they, I think it was about 40% over five years, they’re going to mine more And the market already has concerns that the lithium mining sector is growing too quickly and that will depress the price And they’re also focusing on the price, which has come off a lot in the last few months, it’s been high during the year, which has driven all this cash flying into Pilbara I guess, my, who knows? I don’t want to predict My take on it is, whenever I’ve seen this happen before, they eventually recover They find a way of, either hoarding cash I mean, they’re going to be smart operators If they think that, if they expand mine production, it’s going to depress the price They’ll get the balance fairly right, even if the market’s concerned about the lithium price not recovering The other thing I want to mention is, and I was going to do a quick update on,, Fleet Partners, which I’ll do now, FPR, they actually report March and September, so they haven’t,, reported their annual results, but they have given the market update, I think it was the end of last month, actually,, and the, and the shares have been going great,, and it’s been on our buy list for a while,, but the thing which I wanted to highlight now when we’re talking about Pilbara is that Fleet Partners, which is a company which provides leasing,, systems, I guess, to large companies, so they look after the fleet for a large company, obviously it’s their name, but they also provide,, employees with salary packaging so they can lease a car That’s usually called a novated lease, so you lease it for 3 or 4 and then,, you agree to either sell it and give them the profits or pay back a bubble at the end So,, the cost depreciated down to maybe 30 or 40% and that is what you owe the fleet partners And you may have made a profit or not on that along the way Anyway, the thing I wanted to highlight was they came out and said last month that In the last quarter, 45% of the new vehicle leases were electric vehicles And that’s one of the things that’s driven their share price up, because electric vehicles cost more than internal combustion engine vehicles And so, Fleet Partners is, in terms of its leasing dollars, has had a bump in sales, which is good for them But, 45% of new vehicles being leased are electric vehicles It’s hard to see how the lithium market is going to stay depressed, even if there are new mines coming on So, one of those things doesn’t add up, and I guess we’ll have to wait and see what happens But,, it’s a shame we had to rule one Pilbara out of the dummy portfolio I haven’t had to rule one yet, I bought it a little bit earlier But it’s getting close, so we’ll see what happens But I’m hoping I can hold on to it, because you’re paying so little for this cash balance And management’s been successful so far in terms of, growing that cash balance and there’s no reason to doubt they won’t be going forward There.

[00:22:12] Cameron: Well, if I’d held onto it to today, Tony, I wouldn’t have had to rule one It it’s gone back up above the rule one price I still hold it in the light portfolios It didn’t quite breach the rule one yesterday And now it’s gone back up today So it was a bit of a crazy overreaction And, you know,.

[00:22:33] Tony: Supports the rule one being 20, 20% again, doesn’t it? Yeah.

[00:22:37] Cameron: Yes, if that had been the official rule, I would have held onto it But anyway, them’s the breaks when you’re playing the game that we play Disappointing, but there you go Win some, you lose some.

[00:22:52] Tony: Well, I mean, the good, the good thing is it’ll, I think it’s still a buy, it’ll stop being a Josephine soon on the short term and it’s still on the buy list after those results So they come back into the portfolio at some stage.

[00:23:05] Cameron: I think it was like number two on the buy list when I sold it I was like, Oh, this is insane But rules are rules Speaking of,, Other stocks I had to sell, AFG, Australian Finance Group They came out with their results Again, really good results They did forecast a more difficult year ahead and I had to sell that as well.

[00:23:29] Tony: Yeah It’s a, it’s a shame, isn’t it? We seem to be saying that a lot this year, but, the market thinks last year was the good year and the coming years are going to be the bad years, it’s, who knows, the market may get it wrong, they may get it right I guess the, the thing that,, I wanted to focus on from AFGN, people don’t know it, it’s a mortgage broking business, and they did, the thing that they did which I think upset the market was they decreased their dividend payout ratio to 60% So, in the past they’ve been paying out nearly 80% of their profits as dividends And the current yield is, before this announcement, was 7 28%, which is quite high, so that will drop, because they’re going to pay out less in dividends and reinvest more into the business, which again comes back to this US versus Australia sort of dichotomy So I’m quite happy for a company to pay out no dividends or to pay out, less dividend as long as it’s reinvesting the money adequately and getting a better return doing that So, I’m not perturbed by that, but the market is, and they expect the dividend to reduce, which will make the stock less attractive in the Australian market, they did call out a whole heap of issues, as you said before, going forward I guess I wanted to highlight, and this often happens, is I read the release announcement, and it wasn’t until I think the third last paragraph, and the second last paragraph was about how much they appreciate their staff, and the last paragraph was, they look forward to the future sort of thing But in the third last paragraph of the document, they start to talk about, this is the direct quote, net interest margin enjoyed over the past few years will be further challenged as the business bears the full 12 month impact of higher warehouse costs on facilities rolled over Thank you From the end of,, the,, last financial year, 23 financial year So it’s, it’s burying the lead right down the end of the document But that’s the thing that people know to expect And it’s a bit like an annual report You often read these releases from the bottom up and see what they’re trying to,, What they’re forced to say is a disclosure, but they’re trying to avoid highlighting Again, I’m not that disturbed by it I mean, you have to be blind pretty not to know that interest rates have gone up and therefore,, these guys are in the market borrowing money and then lending it, but that’s going to have an impact on their margins given that It’s harder to borrow now because interest rates are high, so it’s surprising that the market waits until the day of the results to come out and mark it down,, but that’s what’s happened .

[00:26:02] Cameron: Well,, just by the by, I just got a notification Oh no, ignore that NTD became a three point trend line cell for one second there, but now it’s gone again So it must’ve changed.

[00:26:17] Tony: So.

[00:26:17] Cameron: An alert pop up saying it was a cell, but.

[00:26:19] Tony: Until the end of the market, see what happens.

[00:26:22] Cameron: Yeah Well, I, I have a script that pops up and tells me stuff these days, but,, that I wrote some code anyway, Jordan Yeah, I mean, man, GPT has turned me into a coding monster.

[00:26:37] Tony: Wow.

[00:26:38] Cameron: Jordan posted a nice little graphic in our Facebook group, the cost of timing the market Nice little chart here that I borrowed from somebody called Visual Capitalist, some research outfit And they got the data from J P Morgan, but it says bad timing can take a bite out of returns Below we show the risk of trying to time the market by simply missing out on the 10 best days an investor could lose the majority of their overall return Now we’ve talked about this concept or this data before, but it’s always a good reminder, I think, that, well, why you need to be fully invested So it comes down to literally days over the course of 10 years, this says that the value of 10, 000 invested in the S& P 500 from January 2003 to December, 2022, if you kept it invested for the entire period, the value of it would be 64, 844 If you missed the 10 best days over that 20 year period, your return would be 29, 708 That’s a huge difference That’s 50% difference.

[00:28:02] Tony: And it’s only 10 days.

[00:28:05] Cameron: 10 days If you missed the 20 best days, you’re down to 17, 800 If you missed the 30 best days, you’re down to 11, 700 And it goes down and down and down If you missed the 60 best days, it’s down to 4, 205 Your 10, 000 invested actually gets halved over that period Now, obviously this isn’t talking about playing the market or any kind of system, et cetera, et cetera But I think the point stands true that there are very good days that come and go And if you’re not fully invested in those days,, you’re missing out on a huge amount of your long term returns.

[00:28:50] Tony: Yeah I’d just like to add here, I’m going to read out those 10 days just quickly The best day was October 13th, 2008 The second best was October 28th, 2008 and March.

[00:29:05] Cameron: Weren’t we in the middle of a global financial crisis then?

[00:29:07] Tony: Yeah Towards the, yeah, middle or towards the end But anyway, so all these dates, I won’t read them all out, they’ll read a GFC, pretty much, I think there’s, one.

[00:29:18] Cameron: Five of them at 2008.

[00:29:21] Tony: Yeah, so, there’s majority of 2008, 2009, so that’s eight of them, and two were 2020, March 2020, so.

[00:29:31] Cameron: Yeah,.

[00:29:32] Tony: So, they’re basically saying, don’t be a dummy and sell out when the market goes down, stay invested.

[00:29:38] Cameron: And like those are the two biggest crashes in the last 20 years, and they also contain the top 10 best days of the top 20 years.

[00:29:49] Tony: Yeah So it’s kind of counterintuitive, I mean, you feel like you want to get out of the market whenever it’s gone bad, but if you do, you can see how it affects your returns.

[00:30:00] Cameron: Yeah, I mean that’s, it’s such a simple idea, but,, something that I think is just counterintuitive for most amateur investors When the market’s, you know, down and it’s, everything’s depressing Like we’ve lived through the last couple of years Instinctively, you just want to get out It’s emotionally,, it can be, if you don’t have a system to follow that removes the emotion like we do, it can be emotionally,, turbulent,.

[00:30:33] Tony: Yeah And even, even if you do feel like getting out, don’t, or you feel like your system’s failing you,, you can stay, but,, as we’re doing, look, let’s research the system and see if there are any things we can improve on,, which we might do differently going forward, rather than saying, I’m going to sell out and go away.

[00:30:51] Cameron: Go suck my thumb in the corner.

[00:30:53] Tony: Yeah,.

[00:30:56] Cameron: All right.

[00:30:56] Tony: The classic buy high, sell low strategy, which most retail investors fall into, but,, is the opposite of What they should be doing.

[00:31:04] Cameron: Yeah What else you got to talk about TK?

[00:31:09] Tony: , I had a pull book to do I’m just looking, sorry, we spoke about the fleet partners Return, Qantas has also had a good result, and it’s on our buy list,, and the share prices come off And it’s been a, it’s been on the front pages of the paper, so it’s been a political event as well as a, a share market event, and it’s been interesting, it’s, the airline industry has long been, I guess, supported by state, by different states around the world, and I think that’s behind what’s happening now It seems to be centred on the fact that the federal government, I’ve declined to let Qatar Airways have more flights, or slots as they’re called, into Australia, there’s been some suggestion that’s been The pressure of Qantas, but I think Qantas has probably just been saying, Hey, if you do that, we’re going to be less profitable And that means jobs going in Australia And the bottom line is that the airline industries around the world typically have varying degrees of state support They’re almost nationalized industries in some respect And that goes for Qantas because the government’s intervening in the market So, It’s, I think it’s an interesting dynamic I’m still happy to stay invested in Qantas, but it does rely on some sort of government support because pretty much every other states, every other national carrier around the world gets some kind of level of state support And I’ve, you know, it’s particularly the biggest in the Middle East with Emirates and Etihad and Qatar So it’s never a level playing field So it’s always a tricky decision by the federal government to support it So it’s a bit like,, it reminds me a bit of the Manufacturing business when, when Ford used to come to the government, every new government and say, Hey,, unless you prop our industry up and give us these subsidies, we’re going to close down and you’ll lose all these manufacturing jobs And guess what? They’re in marginal seats So you’ll probably lose the next election So,, eventually I think it was Tony Abbott bit the bullet and said, no more support And they closed down and moved off It’s a bit like that with the airline industry, I think, they don’t get necessarily Money from the government in the way the car manufacturer is used to but they get support every now and then in terms of not allowing the subsidy subsidised, national lot carriers from other parts of the world to gain equal access to our market And that’s just how it operates around the world that sort of restriction applies in places that Qantas want to fly into as well So, interesting times The other thing I thought was interesting was, our old friends Steven Jones The Assistant Treasurer entered the market yesterday and said that this was all about profitability for Qantas And then the other minister who was responsible said,, I wouldn’t have used those words myself Mr Jones often pops up when there’s some kind of quid pro quo going on for the government, whether it’s super or some other industry, and he has again in this case Anyway, that’s just an aside Qantas has come off a bit since its results, but the results were record profits again 2 point, I think it was 8 billion, they, they are changing over their CEO The current CEO on Joyce has been pretty successful, certainly at navigating his way through COVID and these kinds of issues and, and taking costs out of the company and therefore controversial because he’s polarized a lot of people who think the service should be better and workers who think they shouldn’t have lost their job So that’s always a tough A tough,, line to walk,, but the big issue facing Qantas going forward is it needs to,, replace its fleet eventually And I guess the big argument during this reporting season was, hey, we have enough cash to do that and still pay a dividend and still make profits, which are attractive So,, we’ll see how it plays out, but I just thought it was an interesting result that came out.

[00:34:55] Cameron: And it’s just become a rule one.

[00:34:57] Tony: Has it?

[00:34:58] Cameron: For us in one of our live portfolios Yeah, we bought it back in March, but, it’s fell, fallen now, 11% down since we bought it.

[00:35:08] Tony: And Stan, since his results are out for the same sorts of reasons, I guess.

[00:35:12] Cameron: Hmm.

[00:35:13] Tony: Yeah, anyway, that’s, that’s Qantas, we’ve seen this, as we’ve said elsewhere in the show, a number of times that record profits come out and the stocks get sold down, which is a very unusual situation, but, we don’t change what we do Okay, I have a pulled pork to do, which is, which was a request, MAH, which is MacMahon Holdings Interestingly,, since, I mean, the, the buy list went out on Monday and MacMahon Holdings wasn’t a buy, but I checked it today and they are just slightly above the, the buy price, so I,, went through and populated the manually entered data for them and they’re quite high up on the buy list, so have a look at them if you’re,, if you’re interested,, you might have to do your own download to get the most recent data or at least plug your own numbers into the manually entered data sheet that we use, but,, yeah, it’s a recent three point trend line buy, which are always interesting, I think So, MacMahon Holdings, it’s a buying services company It’s been around for a long time, 60 years in fact Started in 1963, like a lot of other good things, and it operates,, in Australia and around the world, New Zealand, South East Asia and Africa Had also operated in,, Mongolia for a while,, and it’s big in Indonesia I said South East Asia, but a lot of it’s in Indonesia They constantly, I mean, they, they cover the whole waterfront for mining services, both surface, underground mining, engineering of new equipment and maintenance of existing equipment So, yeah, it’s a large mining services company, but not large in terms of the ADT for this stock, which is 128, 000 And one of the reasons for that is that There’s a 45% shareholder which contracts the liquidity, I guess I’ll get to it in a minute, but as I go through the history, the company was founded by, believe it or not, Brian MacMahon back in 1963, it was an engineering company It’s currently based in Perth 20 years on, in 1983, it listed At that stage, it was doing a lot of civil engineering work, not just mining work, so building roads and bridges and things, but,, I think is, it did in 2013 sell off its construction, civil engineering business,, and became solely focused on mining, but since then, it did come back in and board a civil engineering business, but it’s predominantly a mining services business In 2016, it was awarded, what was, I think, at the time, the biggest mining services contract in the world for 2 8 billion to, help with a mine in Indonesia, the Batu Hijau mine, and I hope I’ve pronounced that right, but I probably haven’t, but the company, that mine is,, is operated by Aman Minerals And as part of the deal, they took a 44% ownership in MacMahon,, and they still retain that,, ownership now It’s not a new thing for this company to have large owners, I was reading through its history,, it was They did have latent as a big shareholder,, when they, when they were doing,, civil construction because Latent is a big civil construction firm And in 2013,, they sold their construction arm to latent who had a 24% shareholding at the time, which is now not there, and they all, and Layton also owned the road, a, a large capital raising for the company back then, so they’ve, Both acquired companies and they’ve had other larger companies taking stakes in them So a lot of M& A activity for this company over the years One sort of puzzler piece I haven’t been able to fit in was what happened to the MacMahon family So they’re not there at the moment Perhaps they sold down in listing I’m not sure or they sold to one of the other M& A partners who’ve come along from time to time, but certainly this isn’t a company which has an owner founder Which is a bit surprising given that they still carry the name MacMahon in their, in their title So,, yeah, that’s, that side’s interesting We don’t score it for an owner founder, which,, was a bit surprising to me, but, it’s been going for 60 years, so the original founder would have moved on, but oftentimes in these circumstances, or sometimes in these circumstances, a family member is Continued to be on the board, but not the case with this one, it’s large around the world, 27 sites, 4 offices, including one in Jakarta, 4 large engineering workshops,, Yeah, that’s probably all I can say about it, it generally works in the gold copper space,, in terms of the mining it supports, which is Probably a good thing at the moment, because as we said before, iron ore, is, it’s, even though it’s a buy,, there’s a lot of conjecture that it won’t be going up any time soon because of what’s happening in China, and,, coal might be in that same boat too, although, the Australian coal miners have found other places to sell their coal, so who knows, but yeah, gold and copper in the main,, which I think is important,, both as a risk and, and,,, a potential upside, as I said, if iron ore comes off Anyway, the numbers, and we do have recent numbers in Stock Doctor from their recent results And,, as I said before, ADT is 128, 000, which is not overly large given the size of the company, but it will, will suit,, all of our listeners, share price I’m doing this at is 15 5 cents, which was just above its buy price of 15 cents,, and it’s 62% below, or 62% of the consensus target, so it’s well below consensus target Yield for this company is 4 84%, so it’s a decent yield, but it’s not above the,, the mortgage rate that we like to see, so I’m not going to score it for that Stock Doctor financial health is strong and recovering, and I do like to see recovering, because that’s a good sign for the company It’s getting its finances under control If anyone’s interested, the ROE is 20%, which is not too shabby for a mining contractor, I guess the real eye opening numbers are on the valuation for this company The PE which is the lowest in six halves, so we score it,, well there The price to operating cash, cash flow is only 1 28 times, so it’s Amazing again that we have another one of these companies which are trading at almost what you get back in a year in terms of cash flow So that’s pretty good IV1 is 15 cents, which is about what it’s trading at IV2 is 37 cents, which is more than twice the current share price, which I like to see And that’s, that scores a point for that We don’t often see companies trading at half their IV2, it’s, it’s also trading at less than book value and therefore book plus 30% So net equity per share is 28 cents Share price is 15 5 So it scores for that, forecasted earnings per share growth is 27%, so that’s good Growth over P is nearly five times So our hurdle for that is 1 5 times So it scores for that So everything’s looking good on the valuation and a growth side for this stock, there’s no owner founder, I spoke of Directors only hold 1 5% of the company It’s a new three point upturn, so since the results, people are liking what they see, at least a little bit anyway It doesn’t have consistently increasing equity, so it gets a zero there, but it’s close So there was a slight decline in one of the halves, but it’s generally been going up, which is good But all in all, this company scores 17 out of 17 for quality, which is 100%, and has a QAV score of 78 When it comes, when it’s just come back onto the buy list, it comes back near the top So it’s hard to see why this company is being kind of, shirked by the market, given that you can buy it so cheaply But I suspect That’s got a bit to do with the liquidity and having that large shareholder there on the market So a lot of,, it’s, the ADT is going to be too small for a lot of fund managers and a lot of fund managers won’t want to buy into a situation which is controlled by,, or so heavily controlled by another party, so they, it can, those fund managers exert less influence So,, I think that’s why it’s undervalued, but it might suit,, retail,, shareholders We’ve seen that before in other stocks which have had large shareholders on the base, it can be, can be good buying, but there is also a risk too that something happens with that large shareholder They decide to sell their stake or sell it down or,, exert some influence on the company which may not be in the best,, best interest of the other shareholders And given that they, operate the mine that, that MacMahon is contracting to, you can see how there can be a conflict of interest there So that’s a, that’s obviously a risk for this company, but you’re being well compensated for that risk So it might be worth looking at Some of the other risks you need to bear in mind, of course, is it’s, it’s, it’s going to be leveraged to the commodity cycles And,, even though it’s largest Exposure is to Goldmine, which is an upturn Eventually that might turn down So, that’s,, that’s going to be an issue eventually And it’s also exposed to a couple of large companies So, 90% of its work is with Anglo Gold Ashanti, AGU, which was on our buy list before it was being listed, and then I think the second biggest company is Armand, which is the largest shareholder So,, a little bit of concentration in terms of its customers there There’s also the usual ones for this kind of business cost inflation, given that wages are the last exposure, largest exposure in the cost base for a mining services company Contractor, but, often times these guys are really good at making sure the contracts have CPI clauses in them, so if wages go up it may not be, a hit to margin if they can get a raise in what they’re being paid I haven’t done a deep dive in to see if that’s the case for this company, but it’s usually The case in all these companies like they back to back or flow through inflationary increases, the other risk with this one is that it’s a lot of this mining services business is a lot of margin business a bit like most engineering businesses like they bid for large contracts and if they get one quite wrong, that can be, a large influence on their profit for the year So even though they’ve got tremendous experience and a lot of history of doing this, it doesn’t mean it’s not going to be a risk going forward So It’s, have a look at MacMahon, it’s, it’s really well priced, it’s just back on the buy list,, but not without it’s risks.

[00:46:07] Cameron: Thank you TK and thanks to Carolyn for suggesting we take a look at MacMahon and for pointing out that it wasn’t in our buy list this week I think we had it down as negative sentiment, but I don’t think it, I don’t think that got updated this week and it’s, just gone back above.

[00:46:22] Tony: Yeah, I think, I think the buy price is 15 cents, which it was on Friday, and it’s like 15 and a half cents when I had a look this morning on Tuesday morning, which was just above it’s buy price.

[00:46:33] Cameron: Good stuff All right, thank you again Carolyn Let’s get into questions Alex?

[00:46:41] Tony: Yeah Hi, Darl.

[00:46:43] Alex: Hello.

[00:46:44] Tony: How are you, Alex?

[00:46:45] Alex: I’m good, thank you.

[00:46:47] Tony: You nervous?

[00:46:49] Alex: Yeah.

[00:46:52] Tony: Getting ready for your first art exhibition.

[00:46:55] Alex: Yeah, Yeah, No, I’ve got like a detailed itinerary for the next day and a half That’s like every hour That’s what I gotta do to get ready, so yeah, no, I’m looking forward to it.

[00:47:09] Tony: Yeah, good We all, we all are.

[00:47:11] Alex: Thank you No, I’m thrilled you guys will come down for it So that’s great Thank you.

[00:47:15] Tony: Yeah Where, Cam, have we had any take ups on our offer for tickets to the show? Do you.

[00:47:22] Cameron: I, I, I wouldn’t see it It’s just a.

[00:47:25] Tony: No Okay Just a link.

[00:47:27] Cameron: It’s a, yeah, it’s a link to the Affordable Art Fairs website So to go through them thing.

[00:47:33] Alex: Yeah I think it goes straight to Eventbrite Miranda can see the,, uses of the code though So we can find out at the end how many subscribers came.

[00:47:42] Tony: Okay.

[00:47:43] Alex: Yeah.

[00:47:44] Tony: And where’s the link, Cam, if anyone wants to take it up who’s listening?

[00:47:49] Cameron: , I put it in the blog post and the show notes and all of that sort of stuff last week.

[00:47:55] Tony: Okay.

[00:47:56] Cameron: Yeah I’ll do the same this week.

[00:47:58] Tony: Yeah Maybe put it in the Facebook group or something too.

[00:48:01] Cameron: I did that.

[00:48:02] Tony: We did that Okay Yeah, cool.

[00:48:03] Cameron: Yeah Yeah It’s a long link, so I can’t even read it out on the show It’s.

[00:48:08] Tony: Okay.

[00:48:09] Cameron: An unintelligible sort of link Yeah.

[00:48:13] Tony: Yeah Well, looking forward to it, Al.

[00:48:16] Alex: Yeah, me too.

[00:48:17] Cameron: Exciting.

[00:48:19] Alex: Yes, thank you.

[00:48:22] Cameron: , all right So, what question are you,, asking us this week, Alex?

[00:48:27] Alex: I have a question from another Alex? I thought it was apt to read it There were quite a few, so it sounds like it’ll.

[00:48:34] Tony: Do we know if it’s a, do we know if Alex is a boy or a girl, Cam?

[00:48:39] Cameron: , I haven’t personally done a physical inspection, but I believe that, I believe that this Alex,, likes to be represented as a,, male Yes.

[00:48:49] Alex: Yeah, I had a look on the Facebook,, members page and it looked like all the other Alexes were boys, so hello male Alexes Yep,, so Alex says, I follow US value investors that claim their methodology returns 30% to 60% per annum Does TK think returns like this are possible, i e the US market is more favorable to growth or is this marketing spin? And then he, presumably, has put a link to a I guess an investing kind of similar thing to QAV It’s a service, but not really I didn’t tell Called,, Tykr I think you would pronounce it Yeah.

[00:49:34] Tony: Yeah Thank.

[00:49:35] Cameron: Tykr com.

[00:49:37] Tony: Yeah Thanks, Alex, I, I’m not familiar with TYKR, tykr com, I just had a quick look through their website I couldn’t see any claims on their returns, whether it’s as high as 30 to 60%, it wasn’t obvious, but maybe, they talk about it in one of their,,, documents or shows or whatever they do, I’ll have a look at it next week or so and see if I can come up with something more But, be that as it may, I think you’ve asked two questions which are probably more important One is, are returns of 30 60% per annum possible? And, I think that’s possible over the short term, I don’t think it’s possible over the long term it sounds It sounds too high to me, how do I know that? Because I think if someone was over the long term getting as high as 30 to 60 percent returns, they’d be absolutely swamped and probably be the richest person in the world And that’s doesn’t seem to be the case, given it’s the first time I’ve heard of tykr or anything to do with it So,, I’d be skeptical I’m not saying, I probably am saying it can’t happen,, it’s, I, think about it If you were, that’s basically saying you’re doubling your money in less than two years So if it’s been going for ten years, it’s, you know, two to the fifth, which is what,, 16 times And,, if it’s been going for 20, it’s astronomically large, it just, it seems unlikely that someone has this kind of long term return and stayed under the radar and hasn’t been at least snapped up by someone, some billionaire on Wall Street to do their investing for them or, or made a lot of money as a fund manager,, rather than selling a subscription service to how they did it So,, I’m skeptical, in terms of whether the U S market does better than the Australian market, that’s an easy one, they, over the long term, they tend to do about the same,, and there are pros and cons for both markets, the U S market probably is a little bit more growth orientated than the Australian market, there’s a lot more tech stocks over there, biotech stocks over there,, there’s a, a lot more,, successful entrepreneurs who’ve really struck Rocco Rich, Steve Jobs, Elon Musk, people like that So, that market does tend to support that kind of unicorn style company, however, the volatility comes along with that And so you have big crashes as well, like the tech crash in 2001 So it does tend to even out over time,,, that most indexes around the world tend to average around 10%,, they all have their pros and cons The Australian market’s known for paying frank dividends, so we tend to be seen as being lower growth, but if you add the dividends back, we also get a similar sort of volatility And if you look at sort of short term periods at the moment, I think in the last sort of four or five years, the US market has outperformed the Australian market But as I said before, over time there are big corrections in the US and longer term So the last hundred years they’re both getting nine or 10% type returns So,, I don’t, I’ve never felt the need to invest in the US market,, as opposed to the Australian market I think there’s plenty of stocks here to invest in and plenty of stocks with overseas exposure that does become attractive, so yeah, so I’m skeptical of a high returns that are being talked about and I’m happy to stay At home, I’m close to my meeting with the companies I walk past every day and read about in the paper every day.

[00:53:19] Cameron: I did a quick search on the most successful investors in the United States and of course It’s all the usual names, Benjamin Graham, Warren Buffett, Jack Bogle, Peter Lynch This is a Motley Fool article, by the way They talk about Cathie Wood ARK,, Innovation, ETF, says that her fund, and she does high growth stuff, obviously, that’s her whole thing, says that,, her fund targets a 15% annualized return over a 5 year period.

[00:53:51] Tony: And that’s in a high growth fund?

[00:53:53] Cameron: Yeah, that’s high growth stuff So, you know, if the US was a better market for high growth stuff And those sorts of returns could be achieved consistently You would think Cathie Wood would probably be aiming for those sorts of returns as well, but 15% sounds more realistic.

[00:54:13] Tony: Yeah, and I mean, you could have lucked out and bought Apple when it floated and Amazon when it floated and, have a lot of money now, but your average fund manager, I don’t think, would have just bought two stocks They would have bought another 20, and now those 20 are probably all bankrupt FryFly and Pet com and other things that crashed in the com bubble.

[00:54:39] Cameron: But by all means, Alex, go follow those.

[00:54:41] Tony: Yeah, tell us more Alex, we’d love to make.

[00:54:44] Cameron: Come and report back, as.

[00:54:45] Tony: Per round, that’d be great.

[00:54:50] Cameron: Long as it’s your money you’re doing it with.

[00:54:52] Tony: Yeah,, Well thank you.

[00:54:55] Cameron: Yeah, look, I, in terms of, sorry, in terms of returns, when people ask me about, those sorts of numbers from time to time, I really always say, look, Buffett and Munger are considered the most successful investors or up there with the most successful investors of all time, they tend to report 19 5, 19 8%, averaged out over the long haul compound annual growth returns If they’re, if they’re A, known as the most successful investors and that’s 20% roughly is what they are able to achieve I think that’s sort of the high watermark for long term success investing is 20% That seems to be what is achievable if you’re the best of the best, which is what Buffett and Munger, if not the best, certainly up there with the best, any list of the most successful investors in the world or in the US is going to have those guys up in the top, one, two, three, and that’s the sort of numbers that they achieve So it.

[00:55:53] Tony: Yeah, and I mean, there’s a book I read ages ago about, I think it’s called Double Market, but it talks about how your team growth,, at twice the market rate and I can’t remember the detail now, but there was a mathematical proof which said it’s very hard for a business or an investment to grow at more than twice market consistently for a long period of time, because to some extent you’re tethered to the market because you’re investing in it So you know, if there’s an economic crash or a war or whatever that comes out, even if you’re outperforming, it’s going to drag you down as well as the market as well So there are other reasons why That’s the case But,, yeah, it’s kind of like a standard deviation thing You can get better returns in the market if you’re careful, but,, they can’t be infinitesimally better returns in the market,, over a long period of time, statistically anyway.

[00:56:45] Cameron: Speed of light in physics there’s.

[00:56:47] Tony: Yeah Well, so someone, yeah.

[00:56:49] Cameron: Natural limit to how fast you can go before you break the laws of physics.

[00:56:54] Tony: Yeah And look, from time to time, I read articles about people who have had fantastic returns and even over a decent period, maybe 10 years, they tend to be concentrated in one particular industry or involved in something like venture capital or private equity, and good luck to them, but they also, you and I can’t, when we invest with them, we pay them fees and that generally brings the returns back to earth as well.

[00:57:18] Cameron: And,, I I fully believe that there are probably people out there that have a high level of domain expertise, and really good contacts in a particular sector, and they know who’s who in the zoo, and they know what’s coming up in the research, and they can probably dance between the raindrops, but Most of us don’t fit.

[00:57:40] Tony: Yeah, that’s right.

[00:57:42] Cameron: We’re limited to,,, human levels of access and skill You know,.

[00:57:47] Tony: Yeah, we’ve got to be realistic, but not even that, like, if you do have that kind of domain experience,, and I guess people like Bill Gates and Steve Jobs do, and they’ve been very successful, but there’s also been a lot of people who have The main experience like in retail or whatever, and they’re billionaires for sure,, but a lot of that comes from corporate activity, they’ve raised money from someone and then invested it and shared the profits and taken on lots of debt, that kind of thing So,, it’s not something that’s readily available to you and I to do that.

[00:58:22] Cameron: Thank you, Alex and Alex and good luck with your art fair Alex, number one, number one, Alex,.

[00:58:30] Alex: Yep, number one.

[00:58:31] Cameron: The only, the only female, the only female Alex that we know of in the.

[00:58:35] Alex: We know of Yeah, there could be, there could be a female Alex out there, who knows? I hope so.

[00:58:40] Cameron: There is Well,, one of the actresses on the original season of the white Lotus, was an Alex So,.

[00:58:48] Alex: I haven’t watched it.

[00:58:49] Cameron: You watched it finally, Tony? Did you get around to it?

[00:58:51] Tony: I can’t get past the first episode.

[00:58:55] Cameron: You said that about Succession, too.

[00:58:57] Tony: Yeah, I did go back and watch it, you’re right Good point.

[00:59:02] Cameron: Yeah, there are other female Alexes out there, Alex, but none of them are you None of them are as.

[00:59:07] Alex: Yeah, thanks Thank you.

[00:59:10] Cameron: ,.

[00:59:10] Alex: Number one,.

[00:59:11] Cameron: In the world Alexandra Daddario.

[00:59:15] Alex: , yep.

[00:59:16] Cameron: Yeah?

[00:59:16] Alex: Yep She’s cool All the boys in my year at school had a crush on her? and still do.

[00:59:21] Cameron: Mmm Yeah, me too, just quietly, but let’s not, let’s not talk about that or get in trouble.

[00:59:27] Tony: ,, we thought we were finding an exotic name calling Alexandria Alexandra Alexandra, but then all these guys got called Alexandria, Alexander at the same time.

[00:59:39] Alex: Well I get called Alexander as well sometimes, there’s no winning.

[00:59:43] Cameron: Is that what, your parents call you when they’re cross with you? They say Alexander!.

[00:59:47] Alex: No, my uncle, but to be fair, he’s got a real Queensland drawl, so I think he’s saying Alexandra, but it sounds a lot like D E R.

[00:59:57] Tony: Yeah Okay.

[00:59:59] Cameron: Go Thanks.

[01:00:00] Alex: Yeah, alright, see ya, bye.

[01:00:06] Cameron: Alright, another question from Alex I think it’s the same Alex as before Who knows? Who can keep track of the Alexes? Hey Cameron, has TK ever spoken about his decision, too many Alexes?

[01:00:18] Tony: The Alex’s,.

[01:00:18] Cameron: Yeah Could have Alec Baldwin in there too, the Alex And the Alex’s, yeah Hey Cameron, has TK ever spoken about his decision to use momentum indicators, aka 3PTLs, rather than stockpiling and dollar cost averaging? If not, could you please ask him his thoughts on these two different approaches and why he chose one over the other? What’s stockpiling? Just buying more when the share price goes down? Isn’t that dollar cost averaging? It’s the same thing?

[01:00:48] Tony: Yeah pretty much I mean, stockpiling is that As the stock price reduces, you buy more Dollar cost averaging is just, you don’t care whether the stock’s going up or down, you’re just going to buy a certain amount every month or whatever the time period is Dollar cost averaging is usually more associated with someone who’s buying an index fund So they don’t buy it all in one day and then find out that by the end of the year, the market’s gone down, they buy bits Drip feed, they’re purchasing over the year and get the average results So,, but that can also work for value investing I’ve heard people say, well, the share price is going down, I’m going to buy a quarter of my position now and wait, see what happens and then buy more and then buy more and then buy more And hopefully if it all works out, they’re going to U shape type buying So, two of the prices were on the way down, two of the prices were on the way up And it’s, it’s averaging out close to the bottom, but that’s if everything comes off To plan, and as we know, they might get four on the way down and still drops, which I remember doing that during the GFC I, used to use these kinds of techniques before I came across three point trend lines, and that happened during the GFC And I remember, plain as day, buying stocks,, when the GFC first happened, thinking, this is great, because they’re They’re dropping in price, I’m going to buy some, I’m going to wait and buy some more, and 18 months later I was noticing some pretty heavy losses because they just kept dropping, so dollar cost averaging didn’t work in that case, and,,,, neither would,, stockpiling, I think, pretty similar in that case,, but they are generally what value investors do, and Buffett certainly has used those kinds of things, in the past, he finds something which he likes the price of and he doesn’t care the price is falling because you’ll know he’ll buy some now and he’ll buy some in the future But that’s oftentimes as much about, Buffett having to ease his way into a purchase because he has such a large amount of cash to deploy If he just goes out in one hit, he’s got to pay a takeover premium for the stock or whatever he’s buying But if he does it in dribs and drabs, he gets in at a cheaper price, so that’s a different dimension, how does that compare to 3PTLs and other similar type,, ways of,, deciding when to buy and sell? Well, the, I mean,, two things,, I remember when I read the little pamphlet on three point trend line investing,, a long time ago They claimed that if you did, if you followed that way of investing, you’re getting 15%, which was, better than the market And I also remember listening to an ASX podcast and various other ones,, back when the ASX used to have podcasts that did themselves I know Phil Muscatello has resurrected that again recently, but way back in the 90s, the ASX kind of pioneered podcasting,, in the financial space anyway And they had,, people on, and I remember there was a,, a fundee who came on and talked about using moving averages, like, the 30 day stock price over the 120 day moving average,, and then, when the lines cross,, when the graphs cross, you can buy on the way up and so on the way down, and They also claimed above index returns, and that makes sense to me as well, so,, I tend to gravitate towards those, certainly the 3PTLs work for me The difficulty I have with dollar cost averaging and stockpiling is what are the rules? And how do that you’re not buying a falling knife? Whereas the attractive 3Point Trendline is We know we’re not going to buy the cheapest price because we’re waiting for an upturn to establish itself, but we know we’re buying up on, we’re buying on the way up and the, and the falling price finished And,, I find that attractive that rather than trying to guess how many dollar cost averaging purchases to make and at what stage on the way down, you make them, if you make them too late, you invest A quarter of your amount and then the stock price goes up and you stop buying, and if you go too early, you’ve spent your powder before it reaches the bottom So, the only way you can solve that is to wait until there’s an established trend going up or an established trend going down in reverse So that’s why I favor that way of investing over dollar cost averaging.

[01:05:01] Cameron: Hmm We were talking about Warren easing his way in I just had this vision of Sir Les Patterson talking about how he used to ease his way in because he was a very considerate lover Well, I make love to a lady I like to enter her slowly and then I walk slowly towards her.

[01:05:22] Tony: Alex is going to regret asking that question now, I’m pretty sure.

[01:05:25] Cameron: No, he’s going to love it.

[01:05:27] Tony: Anyway.

[01:05:28] Cameron: Yeah, so getting back to the GFC stocks that you were buying on the way down, have you ever done any analysis as to how that would have worked out if you just kept doing that and held on to them until today?

[01:05:41] Tony: , it’s a good question It’s hard to do because I did hold onto them and they, my portfolio basically halved during the GFC, at least on paper, and then I tended to, As opportunities came up on the way out, liquidate something which hadn’t worked, took a capital loss and then bought into something which I saw as being more compelling, like, rights issues from Commonwealth Bank when they raised capital And I can still remember March 2009 being the best time I’ve ever seen on the share market to buy, because the market was still very negative, it was company reporting season, and these companies just, time after time, it’s kind of the reverse of what’s happening now They report returns like we’re seeing, hey, we’ve had a great 12 months,, the consumer sentiment’s returned, everyone’s buying, shopping happily along again But the market hadn’t caught up with that, so they were still being marked down, and so I bought them, and then they just all shot through the roof in 2009 As we saw in that graph, that, that most of those good returning days happened at the end of a GFC, so, yeah, I can’t really say I did the analysis on whether I, if I had sold, held the ones that went down, whether I would have gotten the same return But certainly along the way it was very painful.

[01:07:03] Cameron: All right Well, thanks for going over that Hope that helps Alex, just don’t think about Sir Les Patterson too much RIP Barry Humphreys Jon, new member Jon says, Hi, how are you doing today? Finished the course last night and enjoying the podcast Congratulations on finishing the QAV course Jon, you could be the first person I think that’s ever finished it, I haven’t looked at the stats for a while, but most people don’t seem to get very far into the course for whatever reason I’m so glad that I spent a couple of weeks of my life putting it together Glad to know that somebody’s using it, Jon, curious to know what QAV think with the AUD exchange rate dropping Will more Aussie companies be attractive takeover targets for overseas businesses slash investors? And have any past QAV identified companies turned into takeover targets? I’m hope I’m not asking questions brought up in past sessions Well, You are in part, we often talk about,, QAV companies becoming takeovers and yeah, it happens on a fairly regular basis.

[01:08:09] Tony: Yeah, it does Yeah Thanks, Jon Congratulations on completing the course and we’ll send you a certificate in the mail It’s like a mortarboard and a gown Yeah.

[01:08:21] Cameron: Mm-hmm.

[01:08:22] Tony: But okay, so you may have asked a couple of questions there Does the lower dollar exchange rate accelerate takeovers? My experience is not so much because the Australian market’s quite small and we’re not the only currency that’s been going down, so Canada’s been going down, UK’s been going down, parts of Europe are going down, so there are, we’re part of the market that people are scanning from the US, and other places that have a higher currency, but we’re only a small part of that, so yes it will happen, I don’t know if it’ll be any faster than what it normally is, But the second question is, yes, we do have QAV stocks all the time being taken over, usually if we find them attractive,, the professionals find them attractive too And I, I did go through and pull out some examples So last year there was a company called Empire Red Which was on our bio list It was acquired by Capgemini in the last six months Even there was,, C6C, which was a copper stock,, was taken over by Hudson Bay or HUD Bay, which was a Canadian mining company, breaker resources BRB was taken over by Ramelius Resources, which I think is, was on our buy list It may not be anymore, but B BRB certainly was,, Biota group was taken over in the last six months I dunno if it was on the buy list when it was taken over, but it was on the buy list in times past, I think Suncorp was,, from memory, didn’t go back into the buy list and had a look, but,, it recently was denied being taken over by ANZ, but that’s under appeal, so,, that might go ahead DDH was one of our buy list companies, and they’re under a takeover offer from Perenti So, yeah, there’s, I think that’s five or six I’ve just named in the last 12 months, so yeah, it happens all the time.

[01:10:10] Cameron: And usually a good thing If, if for us, if we own them, usually it was a premium.

[01:10:16] Tony: Well, it’s a two headed, it’s a two edged sword because,, we get a bump, so it’s usually they’re going to pay sort of 25 30% premium to take it over before the board will engage and accept,, but it’s a, the downside is we’re not going to get more than that because these companies were usually incredibly undervalued and throwing off lots of cash, so, if they don’t get taken over, we enjoy the ride up as they get bought by the fund managers in the stock market anyway So,, but it’s usually a short term sugar hit and we can invest the profits somewhere else, meaningfully.

[01:10:45] Cameron: Short, short term sugar hit,.

[01:10:48] Tony: Yeah.

[01:10:50] Cameron: That’s going to be the title of this episode It’s another good name for a band.

[01:10:54] Tony: Yeah.

[01:10:55] Cameron: Term sugar hits.

[01:10:56] Tony: Yeah The Alex is supported by short term sugar hit.

[01:11:05] Cameron: All right Hope that helps John,, Phil Several stocks have had good results and price dropped obviously because of selling, where do you think this money goes? Has to go somewhere as likely funds aren’t staying in cash I mean, how do you think they are choosing to sell these stocks and then choosing to buy elsewhere?

[01:11:25] Tony: Yeah Interesting question, Phil, it’s a hard one to answer generically, we’ve certainly seen As we said before, the selling is going on, which is based on the outlook, so either analysts are trying to forecast commodities or inflation or discretionary spending or interest rates or all of the above, and not liking what they see,, but, you know, the good results trump all those, we’ll have to see over time, but what happens when someone sells, I the mandate, so oftentimes it’ll be big sellers in some of these stocks which will drive the share price., if it’s a, if it’s a fund manager, they’ll probably go back into another stock If it’s a,, super fund, it might go into stocks or bonds or international shares You don’t, I don’t really know, but I did pull up Pilbara Resources and have a look at their trades recently, and the list,, isn’t up to date, so it may not take into account the most recent selling, but it does give you a flavor of what happened So, for example,, Blackrock, Blackrock Group bought a big stake Back in July, that was bought from J P Morgan Chase, so that’s probably someone acting for a fund manager as a stockbroker or a custodian, J P Morgan Chase eventually sold,, State Street Corporation, so another big sort of,, fund, bought some shares They were sold by a company called Contemporary Ampex Technology from Hong Kong, so not sure if that’s a fund or whether it’s another company who’s taken a stake in Pilbara Thank you very much, it goes on and on BlackRock is in there a lot Australian Super is in there a lot, another list of,, miner called Mineral Resources is in there So, I think what tends to happen with companies like this one, like,, Pilbara, is that it’s kind of trade amongst the funds, whether it’s super funds or, or,, index funds like BlackRock or,, even other ASX listed mining companies who often take stakes in up and coming miners like Mineral Resources So, I think that’s probably What generally happens and then the share price goes down when you have a bit of a mismatch when the last seller has a big parcel to sell and can’t get it away so they drop the price.

[01:13:40] Cameron: All right Thank you, Phil Sam, we were talking about PLS on Facebook I think or on Whatsapp or somewhere, Sam said Last, how does TK look at the difference in volatility between different shares? For example, a share that has an average volatility of X, not referring to Elon Musk’s,, social media company,, which is pretty volatile, but an average volatility of X compared to one that has a volatility of two times X Based on that, which I think is called beta in finance, perhaps that could be part of the trial with the higher 20% rule one, as in use it for those shares that have an existing higher level of volatility TK always says he sees volatility as an opportunity, but I don’t think he’s ever mentioned the past volatility as an estimate or guide for future volatility Given he considers previous trends as an indicator of future trends, which is hopefully correct 60% of the time, how about past volatility? What do you think, TK?