Hello QAV Light Brigade

It’s another Monday.

The AORD had a positive week, ending slightly higher than where it started, but nothing to write home about. Still, after the last seven months of extreme turbulence, a non-eventful week is worth celebrating.

Let’s have a look at how our portfolios are doing and what we have to buy this week.

PORTFOLIO UPDATES

Last week one of our listeners pointed out that Navexa’s comparison against the benchmark (STW) was out, because they weren’t showing us the total return for STW, only the capital return. I emailed Navexa and they have fixed it. This is obviously going to make a difference in how we compare. Let’s have a look.

22.1 Portfolio

As of this morning, since inception (18 April 2022, which is also when the market started to correct), we are down 7.7% vs the benchmark which is down 1.34% over the same period. So although we’re improving, we’re still behind the benchmark, which is improving slightly faster than we are.

You can see the full chart and transactions on the Light homepage.

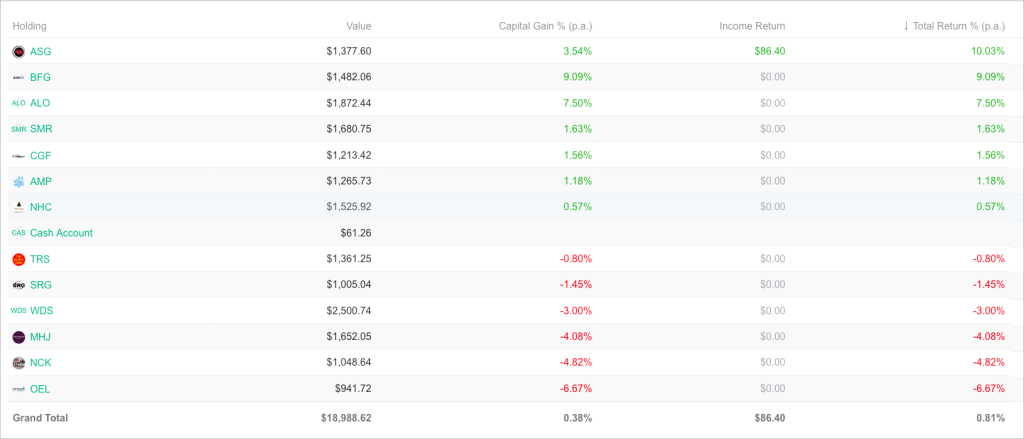

The best performers in the last week were:

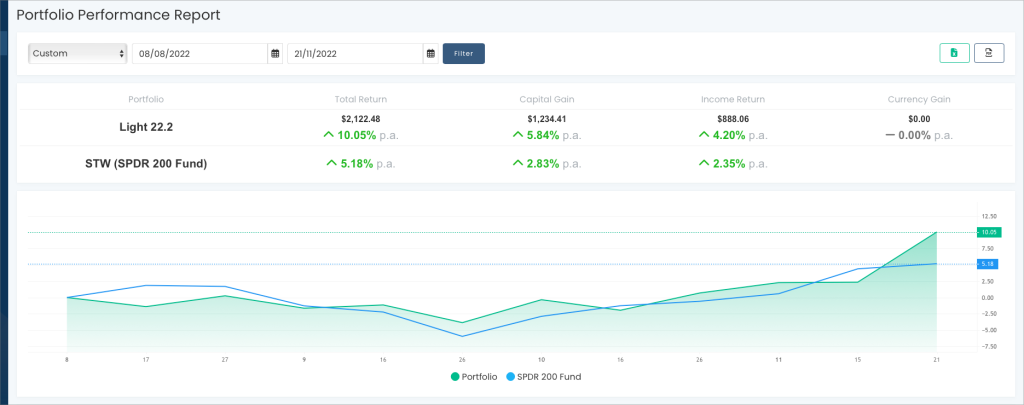

22.2 Portfolio

Inception date 08/08/2022. This portfolio had a good week. Last week it was up 1.86% – this week it’s up 10% vs the benchmark which is up 5%. However, I’m not 100% sure that this is right. See below.

Our performance is mostly thanks to SKT, which finalised a very generous capital return of NZ$2.40 per share, which also involves the cancellation of one share for every six owned. It halted trading last Thursday and resumes tomorrow. I can see Navexa has processed the return of capital, but I’m not sure they have reduced our shareholding or if I have to do that manually. I’ll find out from them this week.

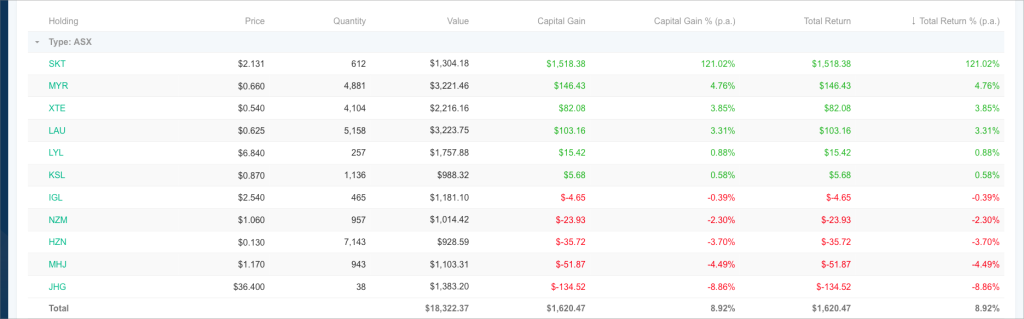

Anyway, for what it’s worth, the best performers in the last week have been:

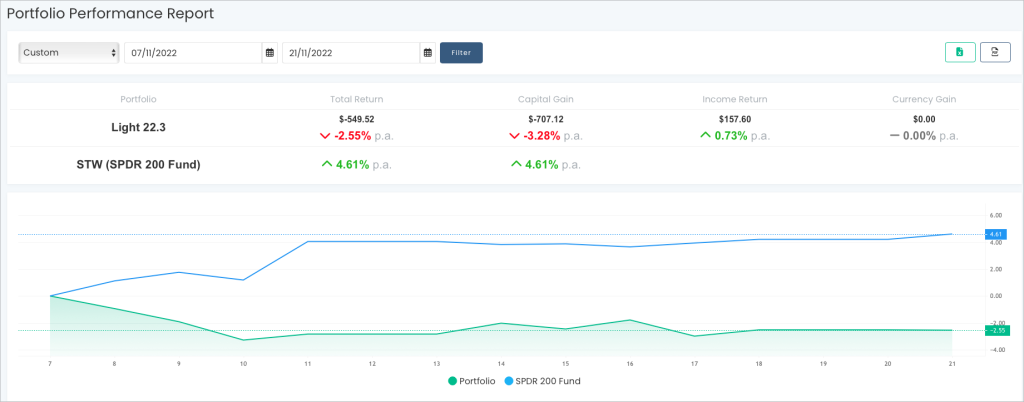

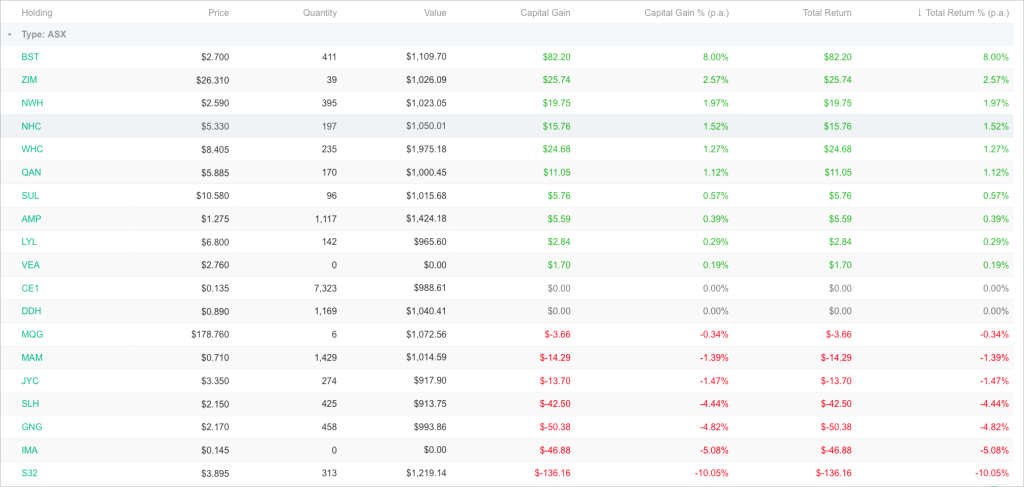

22.3 Portfolio

Filled 7/11/2022. Now that we’ve filled it, I’ll start tracking its performance from the filled date. We are down 2.5% versus the benchmark which is up 4.6%.

The best performers in the last week have been:

The decline in S32 in that table is weird. It’s really only down 1.89%, so I don’t know why the table is showing it as 10%. I’ll take it up with Navexa. I do that to sell SLH from this portfolio today, though, as it’s breached its 3PTL. Details below.

SELLS

THIS CONTENT IS ONLY AVAILABLE TO QAV LIGHT AND CLUB SUBSCRIBERS.

BUYS

THIS CONTENT IS ONLY AVAILABLE TO QAV LIGHT AND CLUB SUBSCRIBERS.

** Please remember to review our Buying Guidelines to understand which cap bands you should be looking at and other important considerations.

DISCLOSURE

In the interest of full disclosure, we would like to advise that, as of the date of this email, the QAV team currently hold these stocks in their personal portfolios:

ALO AMP BPT CGF IGL JHG MQG NAB NHC NWH QAN QBE VEA WAM WDS WHC XTE S32 PRU

Please note that our personal holdings might not include the stocks we recommend in QAV Light. This is because we already have full portfolios (15-20 stocks) and can only add new stocks if we have to sell something.

If you’re interested in learning more, please review our trading and disclosure policy.

FOR NEW MEMBERS

If you’re new to QAV Light, here’s a quick reminder on how it works.

- We send you an email every Monday advising which stocks we are adding to our Light portfolio.

- You can copy our trades, but please remember to review our Trading Guidelines to understand which cap you should be looking at and other important considerations. And consult a financial planner before making any decisions.

- We don’t recommend that you add stocks which are already in our portfolio. Their position on our buy list might have changed since we recommended them. Just start with the stocks recommended after you become a member.

- If one of the stocks we add breaches one of our sell conditions, we will sell it from our portfolio and you’ll get an email advising of the trade. Again, you can copy our trades, but seek financial advice before making any decisions. And please check your Rule #1 price (see Trading Guidelines).

That’s it for today!

If we decide to buy or sell something, we’ll let you know.

Got a question?

info@qavpodcast.com.au