Hello QAVvers

It’s another Tuesday.

The AORD is still up for the week, but not by much after Thursday’s drop. Still haven’t had anything to sell from the DP, although I did let go a parcel of PLS from one of the Light portfolios this morning, as it was a Rule 1. Of course, it went up 6% today AFTER I sold it… grrrr.

Let’s have a look at the portfolio.

QAV PORTFOLIO REPORT

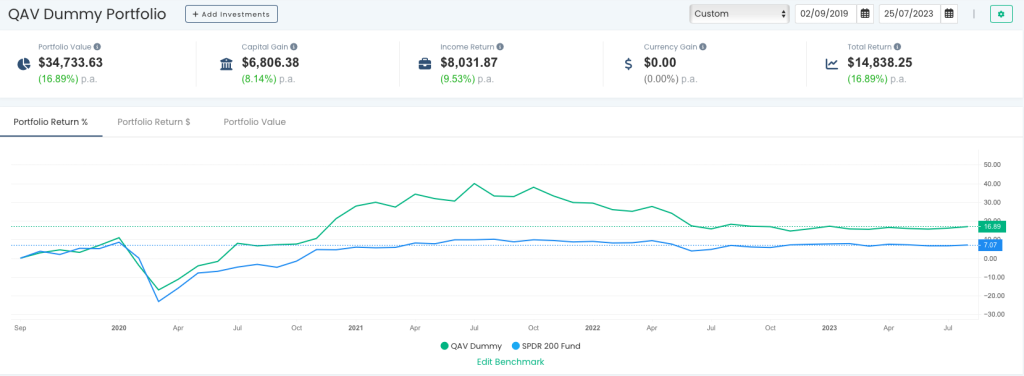

INCEPTION REPORT

We’re still outperforming the STW by ~2.5 times since inception (02/09/2019).

You can always check out the live version of the portfolio chart here.

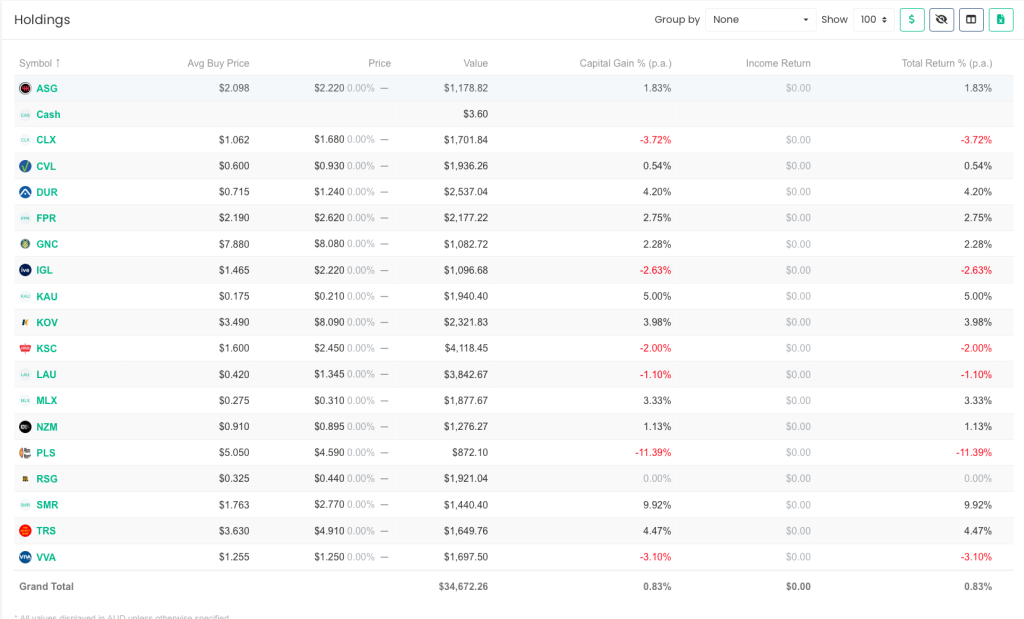

Here are how the stocks have performed in the last 7 days. SMR was clearly the stock of the week.

RECENT TRADES

No trades in the last week.

STOCKS OF THE WEEK

** As always, please check our work, DYOR, and consult a financial advisor before making any investing decisions.

BUY LIST

Each week we produce a buy list that we share with our members. The intended primary purpose of this buy list is for club members to use as a reference for comparing their own buy list. In theory, all of our buy lists should look pretty similar each week.

THIS SECTION CONTAINS CONTENT WHICH IS VISIBLE TO QAV CLUB SUBSCRIBERS ONLY.

LAST WEEK’S EPISODE

THIS SECTION CONTAINS CONTENT WHICH IS VISIBLE TO QAV CLUB SUBSCRIBERS ONLY.

Detailed highlights of the episode:

THIS SECTION CONTAINS CONTENT WHICH IS VISIBLE TO QAV CLUB SUBSCRIBERS ONLY.

Episode Transcription

QAV 629 Club final mixdown

Cameron 00:03

Welcome back to QAV episode 629. Recording this on the 18th of July 2023. I’m in Brisbane, Tony’s in Wagga, and we’ve got a big show. Big show. Lots of questions. Lots of stuff to talk about. How’s Wagga, TK?

Tony 00:20

It’s friggin cold. I don’t know why I left Sydney. Sydney is beautiful at the moment. It’s 20 degrees, sunny days, haven’t had rain for months. And then zero degrees in the morning. It’s probably about 12 or 13 now at two o’clock in the afternoon.

Cameron 00:36

Why are you in Wagga?

Tony 00:37

Why? I’m on my way down to Melbourne to Cape Schanck, which is going to be even cold. But I get to see Alex, see my mates, going to the Bledisloe Cup rugby match at the MCG. Have some fun.

Cameron 00:49

Racing still going on? Got some horses running down there?

Tony 00:52

Not until probably August. So, a couple of weeks away. Late August, maybe six weeks away.

Cameron 00:59

Will you still be down there, or you’re only down for a week or two. Right?

Tony 01:01

Yeah, down for a week or two, heading back and then going back down at the end of August for Alex’s art show and racing.

Cameron 01:08

Maybe we should do an event in August.

Tony 01:11

Maybe.

Cameron 01:11

No? Too much work.

Cameron 01:13

Okay. Well, the market’s had the best week it’s had in months, Tony. For the first time in I don’t know how long, my alert sheet when I checked it this morning had nothing even close to a sell trigger. I’ve got it set up so when it gets close it says there’s nearly a rule one, nearly a three-point trendline. I looked at it this morning. Nothing. Not even any nearlys. I was like, wow, look at that. A clean sheet of good-looking stuff.

Tony 01:13

Yeah.

Tony 01:44

That’s great, isn’t it?

Cameron 01:45

I’d almost forgotten what that look like.

Tony 01:47

There’s a lot of questions this week, everyone’s woken up now with the market.

Cameron 01:51

That’s right. When the markets dead, no one’s got any questions. When the market picks up, everyone’s interested.

Tony 01:57

Well, that’s good. Thanks for the questions. Yeah, I checked a fifty-two-week highs and lows in the AFR, and they’re back in favour of highs again. So, yeah, things are good.

Cameron 02:09

It’s come off a little bit yesterday and today, but not by much. We’ll see how long it lasts. This could be it. This could be the big turnaround we’ve been waiting for. But it also could not be it.

Tony 02:24

Hope so, but who knows? A fool’s game, predicting.

Cameron 02:27

Stepping back in time. Somebody for some reason liked a tweet of mine from January 28, 2020, which happened to alert me to it. I went back and had a look at it. Tell you what, talking about predicting. I am the king. I am the king of predictions.

Tony 02:46

We should use that.

Cameron 02:49

On the 28th of January 2020, Max Markso, Australian PR gadfly tweeted… I tweeted an article from the Fin, which was an article quoting Brett Gillespie, hedge fund manager. He said, “prepare for a massive bubble in shares,” January 28 2020. I replied 1:44pm, “I think he’s a bit late. Aren’t we already in one? I’m waiting for the bubble to pop.” No sooner have I spoken then the bubble popped. Well, you know, February the bubble pops, and it crashed down, and we had the COVID crash. So, I think that is all the evidence that we need, Tony, to market myself now as the guy who can predict the stock market. Absolutely perfectly.

Tony 03:40

Well done.

Cameron 03:40

Yeah, Thank you. Thank you very much. Speaking about prediction, Twiggy Forrest and his soon to be ex-wife tried to convince the market that their impending divorce wouldn’t have any impact on FMG. I don’t think the market believed them. FMG’s share price went down yesterday, but it’s back up a bit today.

Tony 04:06

Yeah.

Cameron 04:09

I’m surprised nobody’s asked us if that’s a bad news sell, Tony, we normally would get that.

Tony 04:13

I am surprised too. I think normally it would be, because there’s been plenty of other cases of people with large holdings in companies that they founded splitting with their wife, and the share market tanks because the wife goes, whether it’s for sound business reasons or because it’s spite, they sell their shares, and it’s a large chunk to sell and tanks the share price. So, hopefully, Twiggy is looking after his wife even though they’ve separated, and she doesn’t sell the stock. But that’s what the market thinks. I was surprised, too, I thought it would come off a lot.

Cameron 04:44

So, what do we do? Just sit and wait.

Tony 04:47

Yeah, well, we’ll have to use the three-point trendlines, I think.

Cameron 04:50

Not bad news sell if the market doesn’t freak out.

Tony 04:53

Well, I mean, as I’ve said before, bad news sells are about people leaving the company who have a position of insider knowledge unexpectedly resign and you can’t work out why, that’s the red flag. Yeah, potentially this is bad news. The market doesn’t think so, she’s saying she’ll keep her holding intact. But I wouldn’t be surprised if at some stage in the future she starts to sell down, whether it’s orderly or disorderly, who knows. And I could be wrong in this prediction. But I remember an asset management Kerr Nielson, he split with his wife and the share price tumbled at Magellan. He split with his wife and the share price tumbled. So, it’s a well-worn path. We’ll just have towards the space and see.

Cameron 05:37

Yeah, I think, you know, I think in the Magellan case there was also some underlying problems with the business. This business seems to be going well, despite predictions that Twiggy has been distracted in hydrogen and all that kind of stuff.

Tony 05:54

Not just distracted in hydrogen. There was also an article where he was reviewed because someone had sent an anonymous letter in saying he was shtooping someone in the company. So, whether that’s true or not, allegedly, I don’t know.

Cameron 06:08

I think there’s two articles that connect it. Well, there are two articles, and they came very closely together, that he and his wife are splitting up, oh, and he’s been accused of having an affair with someone in the office.

Tony 06:23

Yeah. Which he was cleared of, by the way, all clear. I think he was cleared of impropriety, so I don’t they actually came out and said yes or no as to whether there was an affair going on. Although I think his wife has made that clear.

Cameron 06:38

That’s what I’m saying. I think the jury come to a conclusion on that.

Tony 06:46

Yeah. And iron ore has just become a buy, I think, this week, and China’s stockpiling and buying our iron ore again. So, it’s quite possible that’s what’s supporting the FMG share price, and when that goes away then yeah, maybe it’ll come under some pressure.

Cameron 07:04

Yeah, well, that’s what always happens when iron ore comes off, right?

Tony 07:08

Yeah. Well, added pressure if the wife decides to sell down. I apologise for forgetting her name. Mrs Forest-ex Mrs Forrest.

Cameron 07:16

Mrs Twiggy. “Bond payouts match stocks for the first time in over a decade.” Shout out to Jeff on the WhatsApp group for posting this in the last week. This is an article in the Financial Review by Jonathan Shapiro and Joanne Tran. “A surge in short term interest rates means that Australian investors can now earn the same income from buying ultra-safe government bonds as they would from share market dividends. For the first time since July 2011, the three-year bond rate of around 4.2% is equivalent to the nominal dividend yield on the benchmark S&P ASX 200 Index. The convergence comes amid signs more Australian households and institutions are shifting their money out of risky assets, such as equities, and into higher yielding fixed income and cash.” Somebody, I think it was Ally posted on our Facebook group earlier today a chart of the business cycle, and was asking where do you think we are in the business cycle? And I said, I think somewhere between capitulation and depression. When I read articles about people pulling their money out of shares and putting them into bonds, that’s a sign of capitulation.

Tony 08:37

Absolutely. And I mean, first of all, the share market dividends have a franking credit and the bond dividends, the bond yields don’t. So, it’s not quite one for one. However, you’re right. I mean, I’ve seen this play out before. People leave the share market for, you know, whether attractive bond yields or term deposit yields, which are funded by bonds that the banks offer, the banks buy up and then offer term deposits against. And you know, it’s the classic selling at the bottom of the share market, buying at the top of the bond market, right. Because, you know, people do want some kind of certainty in their retirement. But if people leave the share market, the share market gets depressed, and then they start buying bonds, the bond prices go up, which depresses the yields. When the yields go down, interest rates go down. Guess what happens to the share market? It takes off. So, yeah, it’s a classic sell at the bottom of the share market, buy at the top of the bond market behaviour that’s going on at the moment, and that’s probably a good sign for the share market, I think.

Cameron 09:46

Yeah. I like the stages of the business cycle here. It starts with optimism, excitement — there’s one I can’t read, it’s all handwritten here. I can’t read the next one. Then it goes to euphoria, then anxiety, it starts to turn to anxiety, denial, fear, desperation, panic, capitulation, despondency, depression, then it starts to tick up again, hope, relief, and back to optimism. And you know, Ally said, “I found this interesting and wonder where we are.” Richard replied, ‘if it’s like the weather in Melbourne, all of them in one day.”

Tony 10:23

Yeah. People have often compared to share market to the seven stages of grief, you know; it’s anger, denial, bargaining, acceptance, etc., etc. And then we’ve spoken before about the copic indicator, which was using the stages of grief as a way of predicting how long it takes for the share market to start climbing again after a trough. And that’s about fourteen months according to Mr Copic.es. I suspect, well, I mean, I’m not alone in saying I think we’re getting close to the top of the interest rate cycle. Even the RBA’s coming out and saying things like there might be one or two more rate increases, but that’s probably it. And if the interest rate rise is coming to an end, the share market will take off.

Cameron 11:09

Speaking of the RBA, what are your thoughts on the appointment of Michelle Bullock who’s the new RBA governor?

Tony 11:14

A couple of people have told me she’s good. She’s pragmatic. She’s been easy to deal with in the past and has some commercial says, whereas they found Philip Lowe an asshole, allegedly. Found him difficult and dogmatic to deal with. So, that’s feedback of a couple in a sample. So, hopefully it’s good. Did I ever tell you I came close to meeting Philip Lowe? It was a quiet time in the Sydney CBD, and I was walking from the top of Macquarie Street down through Martin Place, and the RBA headquarters are on the left at the top of Martin Place. And I was the only person in that section of Martin Place in the middle of Sydney, except for Philip Lowe who was coming out of the RBA building, because they’re on Martin Place, or there abouts. So, he’s standing there, I’m standing there probably about twenty yards away, twenty metres away, and we lock eyes. He sees me recognise him, and he starts to run away. He just literally hikes his pants and start sprinting wherever he was going.

Cameron 12:21

Yeah, well, he knows your reputation. He’s like, holy shit! Kynaston!

Tony 12:26

I thought that was really funny. Like, he doesn’t want to interact with anyone in the public. He’s just like, “I’m otta here. Go away.”

Cameron 12:32

Its just you, I think he’s scared of you. So, you’ve got contacts in the rarefied world of high finance. So, you’ve got people who have given you the inside goss on Michelle Bullock.

Tony 12:47

Yeah. And they think she’s more approachable and more practical and more pragmatic than the last guy.

Tony 12:52

And a woman. So, that’s good. I mean, it was a tricky appointment, I thought, because on the one hand, the RBA has been reviewed and found wanting. So, pointing an insider to second in charge is, you know, a brave sort of move to make. She must have convinced them that she wasn’t part of the problem and that she could fix it. But on the other hand, she’s a female. So, it’s good to see a female leading the RBA, one of our institutions.

Cameron 12:52

And a woman.

Cameron 13:19

And she doesn’t officially take over until September.

Tony 13:24

I thought it was rich, too, that the front page of the Fin Review today was covering Philip Lowe’s speech where he was blaming the government for not enacting enough legislation to boost productivity for the inflation problems. I’m like, really? Don’t think raising interest rates has caused inflation, mate?

Cameron 13:41

Well, I know you think that. You know, yeah. So, what’s her background? She studied at the London School of Economics, has a Master of Science from there. What else has she done with herself before the RBA?

Tony 13:54

Well, Master of Science is a good indication, isn’t it? That she’s gonna have at least some kind of, well, you would hope a Master of Science would have some kind of scientific thinking about these things and not just, you know, blindly believing in things or applying dogma, which often seems to be the case in economics.

Cameron 14:10

You know what she did before the RBA?

Tony 14:13

No.

Cameron 14:14

Nothing. She went straight from university to the RBA.

Tony 14:18

But she’s not an insider and part of the problem.

Cameron 14:21

She completed an internship at the RBA, following which she began employment at the bank. Since then, she has been continuously employed by the RBA, holding various roles. Wow, okay. Yeah. Well, good luck to Michelle Bullock.

Tony 14:39

Yes. Good luck to her.

Cameron 14:41

Hopefully she can fix things. Rhino. Are you a RINO, Tony?

Tony 14:45

RINO was recession in name only, isn’t it?

Cameron 14:50

A new acronym. We had TINA, There is No Alternative; TARA, There are Reasonable Alternatives; and now we’ve got RINO, Recession in Name Only. it’s what they’re calling the US equities market, I think. Supposedly in a recession, but they’ve got a bull market at the same time.

Tony 15:07

I thought Trump called other members of the Republican Party RINOs, Republicans in Name Only. Is there gonna be a recession? Isn’t there gonna be a recession? It’s a, you know, again, it’s a tough prediction. As we know, I use my three-legged milk stool. Petrol prices have been coming down in the last six months, so that’s good. That’s one leg of the stool put back. But interest rates have been going up, so that’s bad. And the dollar has been fairly neutral, so that’s good. So, I think we’re probably one leg of the way towards a recession now, whereas in the past, I think it’d been a couple. So, it’s probably looking better, but could still easily slip into a recession. It won’t take much. I think the upcoming earnings season next month is going to be really interesting. It’s going to tell us just how badly the last six months have gone for corporate Australia.

Cameron 15:57

So, yeah, where are we? We’re in mid-July now?

Tony 16:01

We’re in confession season.

Cameron 16:03

We’re in it now. Right.

Tony 16:05

And there’s been a couple of confessions. Particularly amongst the retailers, who are always the canary in the coal mine for recession. So, Harvey Norman came out with a profit downgrade. Who else? Adairs, which was on the buy list a while ago?

Cameron 16:21

I think Twiggy Forrest doesn’t understand what he’s supposed to confess during confession season. He confessed too much to his wife, it seems. Sorry, Twiggy, we love you.

Tony 16:36

Yeah. So, you know, it’ll be an interesting reporting season. And I think, I mean, that’s looking backwards, so they’re not looking forward. But generally, when they present their results, they’ll give you an idea of what’s going to happen, or what they’re seeing so far in the early months of trading and if it’s going… It could be it-it’s one of those interesting reporting seasons where the numbers go down, but the share price goes up. If they say, look, we think we’ve come through a bad period, but we’re getting better. So, we’ll see. I’m not going to predict.

Cameron 17:07

Well, speaking of looking backwards, we were talking on the show last week about me providing a 3PTL sell alert each Monday when I put out the buy list. Thanks to Chris Stratton and Brett Fisher, they both approached me with solutions for doing it, and so I added something on Monday to the official buy list. I hope that’s helpful for some people. Any new 3PTL alerts, I’ll tag them into the spreadsheet each Monday moving forwards. Of course, if you’re not checking that, or checking my emails, then I can’t help you. Unless I come and knock on your front door.

Tony 17:48

Or if you want to buy or sell something later in the week, you should still also check as well in case it’s changed.

Cameron 17:54

Yeah, Chris suggested to me yesterday that maybe I should keep a running list of 3PTL sells on that sheet with dates beside them, so if people miss it one week, they can go back and see it next week. So, I’ll think about that. It might become a little bit unwieldly, but we’ll see how it goes. Speaking of Brett, though. So, Brett raised an interesting question with you and I via email this week: “do we still need the Josephine? Can we retire the concept of the Josephine and the second buy line and just call the second buy line, the buy line?” And I had been wondering the same thing for a while because when I’ve been doing my “how’s your father” chats with the new subscribers, when I give them the grand tour of QAV, and I’m explaining how the Brettelator works and I’m explaining how buy lines work, I’m always going, well, this is the buy line but we kind of ignore that one because we’ve got this other one here that we need to look at. And in the back of my head I’m thinking, why do we even have that one? I never use it anymore. It’s just the second buy line. Brett and I had a Zoom call yesterday and we were talking about this, among other things, the 3PTL sell alerts. Also, by the way, the regression testing. He’s going to have a think about how we can use Google Finance to pull down five or ten years of historical data and we might be able to come up with something for that. Lucky for us, Brett doesn’t have a job yet, so Brett’s unemployed. It’s good for us. He doesn’t understand why he’s not getting snapped up, he doesn’t know that I’m out there telling people, “don’t hire this guy. We need him to do work for us.” But, you know, he said that you said that there might be times when, like coming out of the COVID cough, when the first buy line was useful. So, what I did when I was talking to him yesterday, is I went back through Navexa to look at all the stocks that we bought coming out of the COVID cough, and threw them into the Brettelator with the dates that we’d bought them to see where they were with respect to the second buy line back then, and all of them would have crossed the second buy line when we bought them. So, I think we were using… Because as I recall, going back a couple of years we didn’t use a second buy line. The rule for a while was if something was a Josephine, we wouldn’t buy it until it had an uptick, a healthy-looking uptick. And that’s what we were doing coming out of COVID. We were waiting for things to have an uptick. You introduced the idea of, it has to cross a second buy line, a new buy line, or the latest buy line as Brett prefers to call it, I think at some point after that. But when we looked at it in the Brettelator, they had pretty much all-they’re either right on their latest buy line or had just crossed their latest buy line coming out of COVID when we were buying things anyway. So, we were trying to find an example yesterday coming out of COVID where the second buy line didn’t apply, and we couldn’t find one. We looked at six or seven stocks, all around the April/May timeframe when we were buying back in after COVID, and they were all above the latest buy line. So, yeah, I haven’t been able to come up with an example yet of where we wouldn’t have been able to use it.

Tony 21:19

I’d have to get back and dredge through my data to find an example. But okay, so if we go back to the start, there was no second buy line, there was only “the buy line”, which is what Brett’s putting in the Brettelator as the second buy line. So, it’s H1 and H2 are the highest points on the graph, and he draws a line. At some stage, which I think was coming out of COVID, I adopted the idea of the buy line follows the sell line. That was a thing we had to bring in for COVID because we found there was such a steep drop off that and then we were getting an uptick that we wanted to buy into, but we weren’t forming a second peak, I think from memory. I can’t remember the exact details. And so, he said, well, let’s go back, let’s go back prior to COVID and look at whether it was a buy or not previously, we’ve had a sell and now we can do a buy. So, that’s when that came in, and we then retired the original buy line, which became the second buy line. And then about a year or so later, we started to try and find a way of defining what a Josephine was, and that’s when we said, well, let’s just use the old concept of the buy line and call it a second buy line.

Tony 22:29

Right.

Tony 22:29

But I think what’s happened is, in the last couple of years, the concept of the buy line follows the sell line is the one that’s redundant, and a second buy line, which was the original way we used to do it, is the one that’s more applicable. But we have had experiences in the past where both or one or the other comes into play and is more appropriate.

Cameron 22:49

Yeah, well, there was one example. I think it was FMG we were looking at where it didn’t really dip much at all in COVID. It had a small dip, but very minor, it kept going up. So, the first buy line, the original buy line, just applied to that. It didn’t cross a sell line and you couldn’t draw a second buy line on it anyway, because it didn’t go down. You know, it kept going up on the right. It kept going up and up and up. So, you couldn’t even draw a second buy line after, you know, it had a bit of a Josephine. It’d go down for one month, and then it’d be back up the next month. So, that was the only one we could find.

Tony 23:32

Okay, have a look at, from memory it was CBA. And I just had problems calling up CBA in the Brettelator; might be one of those data issues with Google Finance. But anyway, I chucked in another bank, ANZ, and if you look at the graph, even using today’s date, you can see during the COVID cough it’s got a very u-shaped depression. So, it drops down and then comes back up again. And if we use the second buy line, or the original buy line, we wouldn’t be buying back into ANZ until it had almost reached its peak again because H1 and H2 were very similar in height prior to COVID. So, we didn’t get any of the upside of the COVID cough, we’d just have to sit on our hands and wait. And that’s when we brought in the idea of the buy line following the sell line, I think, from memory, so we could buy into the banks or any stock, I think, coming out of the COVID cough earlier than if we’d waited for that sort of flat top second buy line. So, my take on all of this is that we need them both from time to time. The second buy line is the original buy line, which is probably going to suit our purposes 90% of the time. It’s only when we have something like the COVID cough where things dip and then we want to buy into them on the way up that we need some other way of drawing the buy line.

Cameron 24:54

If you go into the Brettelator for ANZ and plug in the first May 2020, just the date, it’s actually got a much lower H2. It comes in late 2019.

Tony 25:09

Yeah, but look at the buy price. So, the buy price at that time is $27 and the share price is $15.60. But when we came out of the COVID cough and the share price started going up, we’re not going to get any of that upside, because we’re waiting for a buy price of $27. So, I think that’s when we, I think, from memory, that’s when the buy line follows the sell line came in, I think. And then we relegated and got rid of the original buy line, which is now the second buy line, but we brought it back in as the Josephine test later on.

Cameron 25:42

So, we would have been creating a new buy line to work out when it came out of being a Josephine.

Tony 25:49

I’ll just plug some more dates into the Brettelator. And I might have the wrong example, I may have to go back and play around with this to find a stock that is a good example. But from memory, that’s what it was. We were sitting on our hands waiting for those stocks to come out of a steep depression, because the buy line was too high, and we weren’t getting any of the upside. Yeah, so happy to have the second buy line be the buy line, but we just have to be aware that it’s not going to work when we have these short, sharp, deep sell offs and retracements.

Cameron 26:31

Yeah, Brett and I talked about that, and I said, well, you know, if we have another one of these, if we have another COVID cough style event, then you know, you’re probably going to rework the rules about how we respond to that. We’re always adjusting the rules when we have to, but in terms of the short term, if we can get rid of Josephines and first buy lines and second buy lines and just go back to “there’s a buy line,” I think it’ll make it easier for people to work out what to buy and what not to buy.

Tony 27:02

Yeah, so getting rid of the buy line follows the sell line if you wanted to do that. So, we’re going back to the second buy line being “the buy line”, but we still need Josephines because something could still be above its buy line but be dipping down. And then we’re where we were before, which is if its current price is less than a month end close prior, it’s a Josephine. And then people will say, “well, what about on the first day of the month? What do we do then?” So, yeah, there’s a few rules to work around there. I’m happy with that.

Cameron 27:36

Yeah. All right. Well, we’ll let you think about that when you’re playing golf in zero degrees temperature in Wagga.

Tony 27:45

Well, I’m happy to take the buy line follows the sell line out and make the second buy line the buy line, and then have a Josephine being if the price is less than the month end close of the prior month.

Cameron 27:56

And when does it cease being a Josephine?

Tony 27:59

When the price is above the closing price for the end of the last month.

Cameron 28:03

Right? Doesn’t have to cross a new buy line. It just has to be…

Tony 28:07

Well, it already comes into play when we’re above a buy line, otherwise it’s a sell. So, if it’s below the sell line, it’s a sell. If it’s between the buy line and the sell line, I don’t know what we’d call that. We just don’t touch it. It’s not a buy or a sell, so we’re not doing anything with it. And if it’s above the buy line, however, it’s trending down compared to the closing price at the end of last month, it’s a Josephine again.

Cameron 28:33

Right. And then when we get back to where we were earlier with Josephine’s where it just has to be above the EOM price.

Tony 28:41

Correct.

Cameron 28:41

Yeah. Okay. There you go, Brett solved.

Tony 28:45

Don’t throw the code away for the buy line following the sell line. I think we’re going to need it again.

Cameron 28:52

What have you got in your notes for today, TK?

Tony 28:55

A few things. So, speaking of regression testing, Ryan’s been doing some work for me, and he’s come up with some results, which we went through yesterday. So, he was looking at a couple of things. So, first of all, let me explain what he’s done. He’s taken all the buy lists that we’ve generated since QAV has been operational in its current form, and he’s using those to be the data feed for regression testing. And then he was going through creating-he was using ten stock portfolios, not fifteen or twenty because there was just so much grunt work in it, it was easier to work with a ten-stock portfolio. He was putting together ten stock portfolios at different starting points and then manually checking for their sell lines crosses, their buy line crosses, and the commodity prices, and also whether they were between a dividend payment and an ex-dividend date, all those kinds of things that we look at. He was comparing buying ten stocks from the top of the buy list with buying ten stocks from the bottom of the buy list starting at different times. And what he came up with was there’s a little bit of a better return from buying from the bottom of the buy list but given that there’s only about probably two and a half-three years of good data, it’s statistically not enough to say that one is better than the other. Which is my experience, that you can buy from the buy list, and it was to me whether the stock I was buying was high up on the buy list or low down on the buy list. So, Ryan’s work has borne that. He also in that analysis was basically saying there was no benefit whether you were using QAV 0.1 as the top of the buy list or 0.2-bottom, sorry. So, there seemed to be, again, no statistical difference in the cut-off for QAV. So, I’m going to park those and leave those there, because there were two things that I was investigating, but there kind of haven’t been conclusive results to make a change on either of those yet. The other thing he did for me was he also ran some analysis on portfolios with large ADT stocks. He used 500k ADT or above. It could often take some time to put together a portfolio because there weren’t enough on the buy list. And he was finding that they did underperform the other two pieces of analysis, top of the buy list and bottom of the buy list. So, there seems to have been a bit of a bias against large ADT stocks over the last two or three years, which I guess has been borne out and what I’m seeing in my own returns as well. So, that’s interesting. I don’t know if we can do much about that because I have seen it before, and it’s one of those things that sometimes-small caps do well and sometimes large caps do well, and they’re pretty hard to predict when they cross. But it was interesting to have the analysis to back up my findings as well as my own experience on that.

THIS SECTION CONTAINS CONTENT WHICH IS VISIBLE TO QAV CLUB SUBSCRIBERS ONLY.

Cameron 1:12:46

The QAV Podcast is a production of Spacecraft Publishing Proprietary Limited, authorised representative of AFSL 520442, AFS representative number 001292718. Please don’t make any investment decisions based solely on listening to this podcast. This is presented as general advice only, not personal financial advice. We don’t know your personal financial circumstances. Please see a financial planner before making any investing decisions.