QAV PORTFOLIO REPORT

INCEPTION REPORT

We’re still outperforming the STW by ~2.5 times since inception (02/09/2019).

You can always check out the live version of the portfolio chart here.

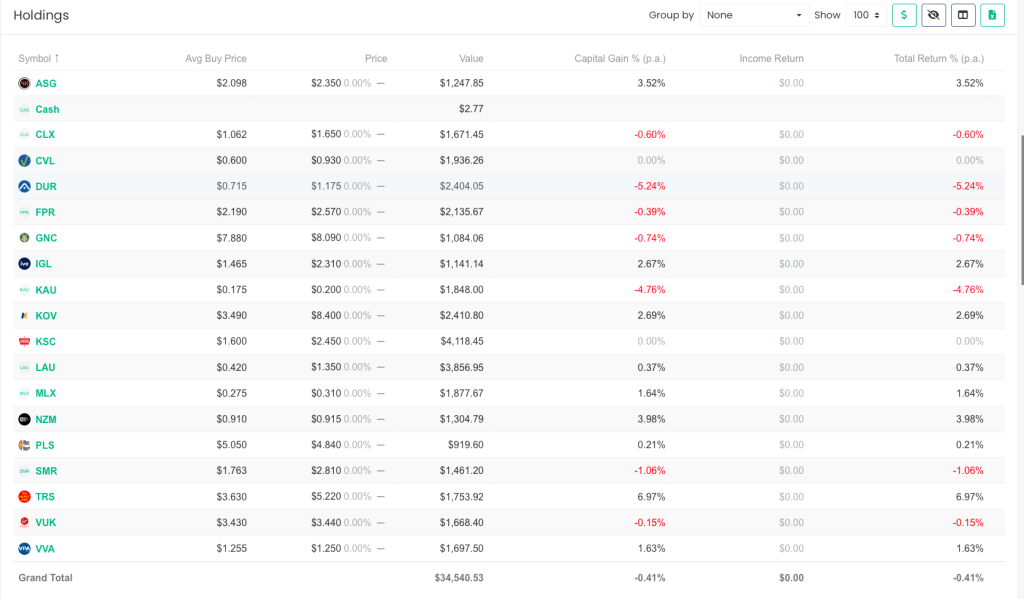

Here are how the stocks have performed in the last 7 days. Old mate TRS was the stock of the week. I wonder what that says about the market’s thinking about where the economy is going?

RECENT TRADES

We sold RSG yesterday (3PTL sell but at a nice profit) and replaced it with VUK.

STOCKS OF THE WEEK

** As always, please check our work, DYOR, and consult a financial advisor before making any investing decisions.

BUY LIST

Each week we produce a buy list that we share with our members. The intended primary purpose of this buy list is for club members to use as a reference for comparing their own buy list. In theory, all of our buy lists should look pretty similar each week.

THIS SECTION CONTAINS CONTENT WHICH IS VISIBLE TO QAV CLUB SUBSCRIBERS ONLY.

LAST WEEK’S EPISODE

THIS SECTION CONTAINS CONTENT WHICH IS VISIBLE TO QAV CLUB SUBSCRIBERS ONLY.

Detailed highlights of the episode:

THIS SECTION CONTAINS CONTENT WHICH IS VISIBLE TO QAV CLUB SUBSCRIBERS ONLY.

Episode Transcription

QAV 630 Club_mixdown

Cameron 00:03

Welcome back. This is QAV episode 630. This is the club edition. You’ve made it. You’re in the special club. We’re recording this on Tuesday, the 25th of July, around about two o’clock in the afternoon. A little bit of a weird introduction, just me in the editing booth — by booth, I mean the office — because we had a guest on today, Brent Sweeney. He’s talking to us about his visit to Berkshire Hathaway’s annual general meeting that he did back in May, telling us that story. We decided to hold it back for next week, because this is a pretty long show as it was, and Tony is still travelling, at Cape Schanck, not sure where he’s going to be next week. So, I thought I’d hold back on the interview, and we can put it out next week and give Tony a little bit of a week off, or we can maybe do a little bit of additional stuff next week. We’ll see how it pans out. Anyway, let’s just get into the me and Tony part of the chat and then we’ll throw the Brent interview into next week’s episode. He’s got some great stories about his time in Omaha, Nebraska, with Warren and Charlie. But next week for that. How’s Cape Schanck going, Tony? Having fun?

Tony 01:11

Yeah, having fun. It’s wintry down here. It’s 12 degrees. Overcast, so misty drizzle. Speaking of Scotland, it’s very good Scottish golfing weather.

Cameron 01:23

Perfect. We’ll talk about more about what you’ve been doing in after hours. Let’s get into investing news. Gold is a buy. Gold AU is a buy this week.

Tony 01:32

Oh, good.

Cameron 01:33

I don’t think that brought anything in particular into our buy list this week. Let me just… I didn’t pay too much attention. Buy list, what’s gold? Oh, that means Perseus mining is a buy. What else? Swoope holdings, no, Kaiser Reef, sorry, KAU. Tribune resources, West African Resources. They’re all on the buy list and they’re all gold related. But when I was doing my buys yesterday, I didn’t need to buy anything, because I didn’t have to sell anything and we’re full, but there was a lot of stuff that I could have bought if I wanted to buy it. It’s one of those nice Mondays. I do the buy list and go wow, look at that. Lots of stuff we could potentially buy if we needed to buy, because it’s been tough to buy things. Have you bought anything recently?

Tony 02:31

No. I think the last thing I bought was Pilbara Resources and it was down 5% yesterday, so not much fun.

Cameron 02:39

But up 6% today.

Tony 02:41

Oh really? Oh fantastic. That’s great.

Cameron 02:43

I had to sell a parcel that was rule 1d this morning, and then it went up by 6% today. But I’ve got a few other parcels, earlier parcels that I bought that are still okay. But yeah, it rebounded nicely today, PLS. Lithium has come off. The lithium price is dropping, and I know a company called CXO was announced that they’ve got some delays to some of their mines. It’s been all over the Fin and they took a beating. I think they fell 70% yesterday. PLS somehow got roped into all of that, I think, but rebounded today, which is nice.

Cameron 02:45

No, it’s good. So, the market worked it out. Shot first and then asked questions the day after.

Cameron 02:54

Speaking of shooting first. This isn’t in our talking points, but I just noticed before we went to air that the AFR was running the list of the Top 10 super funds for FY22-23. And again, it’s just the annual reminder for me that super funds really struggle to meet the index over the long term. This is the chart from the Fin, and their source is a mob called Super Ratings. Top 10 balanced option over ten years percent per annum. The number one ranked fund is Plus, Host Plus with their balanced option: 8.9 per annum over ten years. That’s the number one. Then you’ve got Australian Super, my superfund. They’re balanced option 8.6 per year over ten years, and it goes down from there. So, not particularly inspiring.

Tony 04:25

Yeah, so what I was gonna say is, I mean, balanced funds are there because people worry as they’re getting close to retirement that the per share market could crash. And so, the idea is that these particular funds are balanced across shares and other asset classes; bonds, property, these days a lot of unlisted assets, which I think is another issue altogether. So, if the share market does crash then you’re not gonna lose your retirement savings in a big way. However, last time the share market crashed so did the balanced funds because everything else went down. I think it’s a great furphy, myself. And the better strategy, you know, if you were getting close to retirement and were worried about preserving some of your capital, is to, you know, work out something you did feel comfortable with, like real estate or whatever, and get out of the share market, get out of balanced funds and put it into something you didn’t think was suitable to your risk appetite. Why anyone would go into a Balanced Fund has always beat me because they underperformed the index, and you could have been buying a share market ETF.

Cameron 05:34

That’s what I was going to ask you. Why aren’t people just buying ETFs?

Tony 05:39

Exactly? Well, they can’t charge fees if they…

Cameron 05:42

No, I know some of these super funds are employment related, they’re industry funds, but even the people running the industry funds, can’t they just take everyone’s, all of their employees’ money, and just put it in an ETF and go home?

Tony 05:55

Yeah, exactly. No, exactly. And even if you get questions from your members about, “oh, the US stock market’s beating the Australian stock market,” by two index funds. It’s not hard, especially if you’re young and you’re starting out. Like I said, I kind of understand people who are in their 50s or 60s and thinking, “I’m about to retire, I don’t want to face a big loss when I’m starting to live off the earnings.” But even then, the Sammartino effect or principal, whatever you want to call it, where you put your money in an index fund and forget about the capital, it can go up and down, but they always pay dividends. They’ve never stopped paying dividends and they never will. So, you know, do that. But if you’re starting out in in your career, don’t put your money in a Balanced Fund. Super funds generally have a growth option, which is better. That’s the one probably to benchmark against the index, and if that’s not achieving index returns then definitely put it into an index fund.

Cameron 06:53

This article that I looked at today just had the balanced funds, it didn’t show anything else, so I don’t have anything to compare it with. But I do have another article from the Fin, this is a Chanticleer article from July 24, so yesterday: “Why the ASX is stuck in a trading dead zone.” I partly liked that because it reminded me of the old great Christopher Walken film, The Dead Zone, which I rewatched again a few years ago. Yeah, great film.

Tony 07:21

Isn’t it?

Cameron 07:21

“All the uncertainty has investors sitting tight trying to work out what’s going on before making any substantial trades.” It goes on to say, “it’s a bit quiet out there in equities desks. How quiet? Summer holidays quiet. Repeated days with only 5 billion or 5.5 billion in Australian shares traded, which is about 20% less than last year. Everyone has pulled their heads in. Institutional Investors are sitting on winners longer and trading less.” Sounds like they’re listening to QAV. “Retail investors look fatigued, although still don’t mind the red-hot lithium names.” They’d be unhappy if they were in CXO. “And the big superannuation and pension funds seem more interested in buying bonds, just ask Australian super. It’s a six-month story. The market never really sparked back up after the last summer break. Why? Because no one knows what to do according to Bell Potter’s Richard Coppleson, who has watched volumes closely for years for a read on investor sentiment. He says it all boils down to the prospects of a US recession. Major institutions globally have followed the same recession playbook for years, and that playbook says the economy should be contracting. The usual indicators all light up; bank failures, high interest rates, for example, but the recession has yet to hit. That playbook has been thrown off course by a hot jobs market, which is a hangover from labour shortages caused by the COVID 19 pandemic and has kept the economy bubbling along. Which gives first, the economy or the jobs market?” So, it goes on, but that’s part of the explanation. We’ve talked about these things before, obviously, but just more grist for the mill. Our markets been doing nothing for a long time.

Tony 09:06

Yeah, because everyone who’s trying to predict what’s happening can’t predict it and therefore, they’re sitting on their hands waiting to see what happens. So, in the meantime the markets up and people that have been fully invested are saying, “thank you, so long suckers. Just go and buy some bonds. Off you go.” It comes back to prediction. Like, the whole central core of that argument was no one knows what to do because they think a recession is coming. Well, a recession is always coming. Just, is it this year, is it next year, the year after? No one ever knows.

Cameron 09:40

Yeah, that’s true. What do they say? Economists have predicted 10 out of the last two recessions or something like that.

Tony 09:49

Nine out of the last seven. Yeah, that’s right. And we might go into recession. But, you know, have a system that takes that into account for goodness’ sake. These are meant to be professional investors. They’re sitting on their hands. What am I paying you to do?

Cameron 10:04

Yeah, it’s the thing that always boggles my mind. Like, what is going on? Why are these people getting paid millions of dollars?

Tony 10:12

Well, the reason is, because what generally happens in the fund management industry is that if you take a risk and it goes against you, instead of people saying, “oh, that was a mistake, but your long-term returns are good,” they leave you in droves. They take their money out and put it somewhere else. So, therefore, fund managers hug the index and don’t want to be seen to stick their heads up and have it shot off. They’re being paid to take risks for goodness’ sake, you’ve got to accept that they may get some wrong occasionally.

Cameron 10:41

Speaking of the market having a good month or so, as I’ve been saying to a few people, in my experience doing this last four years or so, it seems to me that when the markets doing badly, when it’s turbulent, we go along with it. We have a rough time, but hopefully we don’t get down as much as the market. Sometimes we underperform. When the markets having a good time, we have a good time. We go up as well, not as well perhaps as the hot tech stocks or the crypto stocks or whatever. We don’t get shoot the lights out crazy performance across our portfolio, but it’s nice and healthy and steady during the boom cycles, the bullish cycles. Just in the last month, the last thirty days according to Navexa, our dummy portfolio was up 7.29% per annum versus the STW in the same period, which is up 3.8%. So, in the last thirty days, the market’s been healthy, we’ve done about two times the STW over that period. Comes and goes in cycles, right? We have our good cycles and then we have our not so good cycles, but the good cycles tend to negate the bad cycles.

Tony 12:02

Yeah, that’s exactly right. That’s exactly what the stock market does over the long term. If you look at a graph over a hundred years, it’s in the bottom left and the top right of the page. There’s lots of squiggles in between. But that’s, you know, over your lifetime, that’s how it goes. And you said before that we generally, you know, follow the market up and down, and we kind of do because we’re tethered to the market, but I have had years where the market has gone negative, and I’ve gone positive. That’s not unusual as well. Because, you know, by the nature of value investing we’re buying stocks which the market doesn’t like, and then they come good, and we can be holding those even though the markets dropping. Like gold stocks, for example. That’s the classic one. The market can be going down, which means — in the past anyway — people had gone for a safe haven, and they bought gold. So, the price of gold went up and the gold miners improved. So, I’ve seen that many times in the market.

Cameron 12:57

I look forward to seeing one of those cycles. Meanwhile, I just have to live with the squiggles. I think it’s a fish. Turn it upside down, Miss Jane. I think it’s a fish with a hat on smoking a cigar. Indeed. Another article in the Fin that I found interesting. This is this morning actually. “A crucial $40 trillion week looms for high flying stocks. It’s shaping up to be a pivotal week for global stocks as companies with a combined 27 trillion US dollar market value gear up to report quarterly earnings. As Netflix and Tesla showed last week, the pressure is on to deliver or face a sharp sell off. Coming into the season, investors were focused on bets that central banks would stop raising interest rates soon and the US economy could avoid a contraction. Looking past a steady whittling down of near-term earnings estimates, they lifted the MCSI All Country World Index as year-to-date gains past 15%, and at almost twenty times forward earnings, the S&P 500 is trading at a premium to its long term price valuation.” What’s Buffett’s metric on the PE of the S&P?

Tony 14:17

There’s a couple. One is the ten-year average. I think he wanted it to be around more like sixteen rather than twenty. And then there’s one where he compares the size of the market to GDP from memory as well. If it gets ahead of GDP, he doesn’t like it.

Cameron 14:32

Twenty times sounds expensive.

Tony 14:34

No, not overly. I don’t know what the average is in the US. In Australia, it’s about sixteen. The US might be slightly higher. Like, a few years ago it was thirty.

Cameron 14:46

Okay. It says, “more than five hundred major companies worldwide will reveal how they fared this quarter and how they expect coming months to shape up. In the busiest week of the season. earnings reports will flow from the likes of Microsoft, Google parent Alphabet, LVMH, Banco Santander, Volkswagen, Airbus, Sanofi.” We should expect a little bit of fun and games in the market while these companies… Nothing to do with Australia directly, but no doubt it’ll have an impact on the Australian market in some way, shape or form.

Tony 15:18

Well, it will. And it’s one of those… The US reports quarterly, and we report six monthly, but we’re coming into our reporting season starting first of August, which is next week. Some companies will start to report. We’ll probably see a couple of early birds out of the gates this week. But it’s going to be an important reporting season, because six months ago in Australia there was less talk of recession, interest rates weren’t as high, and we were still awash with COVID cash. So, it’ll be interesting to see what happens. Confession season has shone a light on discretionary retail in particular, and we’ve seen those stocks come off. I mean, the market has been tricky up and down. But generally, by now I would have thought if the market was expecting horrendous, results in the Australian context anyway, it would have factored that into the share price, and it’d be a lot lower than what it is now. So, yeah, who knows what will happen? There’s always surprises in reporting season, we’ll see. But I guess my point is we can’t do anything about it, except be diligent over the next four weeks and adjust our portfolios if we need to, as new numbers come out. And it’s just a reminder for people that August is one of the months of the year when we do a little bit more work than normal and in other months during the year.

Cameron 16:37

Not really. Back in the days before QAV when you only did a buy list four or five times a year.

Tony 16:44

Correct.

Cameron 16:44

Now we’re doing it every week anyway. Might have to do a couple more a week, but yeah. The only other thing I had to talk about, Tony, was just to let people know that I’ve started a trial using Stockopedia as a data source as an alternative data source to Stock Doctor, for a couple of reasons. Number one; Elio D’Amato, who used to be the public face, the chief analyst or something like that, of Stock Doctor, left a couple of years ago. He’s now, I think, the managing director for… He reached out to us a while ago and said, “hey, would you be interested in using Stockopedia as a data source?” I’ve been trying to build a checklist to use their data, and I’ve finally finished a version of it a week or so ago, and I’ve built a test portfolio using their stocks. They don’t have some stuff that Stock Doctor does. Some of the stuff they do have that Stock Doctor has doesn’t always line up, like ADT and things like that, that I’ve been playing around with. But basically, it’s pretty close. The checklist that I’m generating out of Stockopedia each Monday is the same as the checklist, the buy list that we’re getting out of Stock Doctor. And the other reason we’re doing it is because Stockopedia has US and UK stocks, where Stock Doctor doesn’t and doesn’t look like they’re going to have in the near future, and we have listeners in the US and the UK who want to apply QAV in their geographies. I’m hoping that this will be a way of helping them do that if this checklist can… If I can build a version of this for the US and the UK, which I’m working on now. The reason I mention this on the show today is because if people have a Stock Doctor annual subscription renewal coming up, you might want to think about your options. Stockopedia is a little bit cheaper. We haven’t done a deal with them yet, but we’ll work on that, too. Tony shaking his head.

Tony 18:49

I love Stock Doctor. I’ll be keeping my subscription going.

Cameron 18:53

Sure. If people are looking for options, and particularly if people are interested in playing with the US or the UK markets as well, it may become an option with Stockopedia.

Tony 19:02

Yeah, well, hopefully we haven’t jumped the gun here. I think I think we need to run a dummy portfolio for a while with both and see how that performs.

Cameron 19:11

I agree with you. We’re going to run it for a while and test it. I’m letting people know that we’re working on it. I’ve told a few people via email, just to give them a heads up. Yeah, I think it would be good to have an alternative data source in case Stock Doctor goes out of business next week.

Tony 19:32

We used to have two data sources in QAV when we first started. Yeah. That’s great. Well, maybe a bit of competition might get Stock Doctor to do their US version, which they’ve been talking about for a long time now.

Cameron 19:45

Maybe.

Tony 19:46

Anyway, maybe. Yeah, that’s good. Well, thanks for your work on that, Cam.

Cameron 19:50

That’s alright. What have you got to talk about today, TK?

Tony 19:53

I’ve got a few things. So, following on from stocks in the news, just a couple of articles caught my eye in the Fin Review this week. One was that URW, the pulled pork from a few weeks ago, Unibail-Rodamco, which is the shopping centre owner that bought the Westfields overseas, an international chain of shopping malls, has been selling down their US malls. So, they took on a lot of debt to take over Westfield and now it looks like they’re paying off some of that debt by selling some shopping centres, and particularly those in the US. So, that was interesting for people who own that stock. Obviously, interest rates have been biting the debt load in that company. But I think from memory that pulled pork showed they have lots of cash as well, operating cash flow anyway. And now that COVID is subsiding, they should be paying off that debt with cash flow, too. So, that’s URW. The other one…

Cameron 20:53

Before you move on.

Tony 20:54

Yeah, sure.

Cameron 20:55

Just want to point out that the URW share price is up 10% since you did your pulled pork. The pulled pork curse, I think, is officially spent.

Tony 21:07

Well, the second article that caught my eye was one on Rio Tinto, and it was about their push into recycling metals. So, of course, they’re a big iron ore exporter, and recycled steel is another source of steel for people who want to use it. And it has been a competitor to Rio for a long time, although the industry isn’t that big. But Rio have now been acquiring scrap recyclers and getting into that market, which I guess is, you know, trying to burnish their green credentials, I guess, because it’s easier to smelt the recycled scrap than it is to smelt iron ore originally. And it just caught my eye because one of the stocks that I own, and it’s on the buy list, I think, or it was, is SGM.

Cameron 21:58

Yes.

Tony 21:59

And they’re a big recycler. So, you know, I don’t know what this means for Sims. I guess it could go one of two ways. Potentially they could be a target for Rio going forward, or one of the other iron ore miners. Or Rio could end up being a big competitor for Sims. But I thought it was interesting that Rio was buying into this market.

Cameron 22:24

What’s happened to SGM’s share price recently? It’s up a lot since the end of May. It’s 14 bucks at the end of May. It’s now 15.49. It’s been on a bit of a good run.

Tony 22:35

Well, maybe people are also thinking the way I am, that it could be a potential acquisition for Rio. But who knows. That’s a prediction. SGM is a good stock without that. So, happy to hold it. What else have I got? I’ve got stocks of the week in terms of performance, and the best performing stock this week was Credit Corp, our old friend Credit Corp, which I also own. Up 12.7% according to both Navexa and the Fin Review. They’re stock for the week in the Weekend Fin Review’s rank of the week.

Cameron 23:10

That might have been before it dropped by 10% today.

Tony 23:13

Did it really?

Cameron 23:15

Yeah.

Tony 23:16

Oh, okay.

Cameron 23:17

Somebody posted on the Facebook chat group earlier, “anyone know what’s going on with CCP today?” Dropped from $23.54 down to $22.18, so not quite 10% but 5% maybe. But it’s been on a hell of a run. It was, like, 70 bucks back at the beginning of June. So, it’s had a good couple of months. I said it might just be some profit taking, might just be taking something off the table.

Tony 23:46

It’s quite possible. You know, on the other hand, I thought it would be a good sign going into reporting season that it was up 12% last week, but it could also be a bad sign if it fell off today. Because typically, Credit Corp is one of the very early reporting stocks in reporting season. But we’ll know in a few days how it’s gone. The other stock that was up last week in our portfolios is SMR. That was up 8.7% according to Navexa last week. Stanmore Resources. The last thing I wanted to talk about, and it wasn’t in the notes because I came across it after I sent them through to you; this is a quote from Jennifer Hewitt’s column in today’s AFR. I just want you to think about the logic of this, right. It’s about the RBA, and it says, “departing Reserve Bank Governor Philip Lowe has been warning for months about the impact on inflation and interest rates given that rents are the biggest single contributor to the consumer price index. That vicious circle is showing no signs of easing, with an average rent increase expected to be up to 10% this year alone. For the bulk of mum and dad investors, or even larger financial institutions and developers, higher interest rates translated into higher rents to help compensate for higher costs.” So, Philip Lowe, the head of the RBA is saying, rents are the biggest part of the Consumer Price Index, and they’re going up. But I’m not hearing him saying, why are rents increasing? Why are rents increasing, Cam?

Cameron 25:16

According to the article you just read, and the fact that you’ve been beating out about this for a month, rents are going up because interest rates are going up. What do we do? We have to put interest rates up, because rents are going up.

Tony 25:27

To bring inflation down. So, fair dinkum, can we just take the RBA out and shoot them? It’s officially now gone through the looking glass. They’ve come out and said, “we’re causing inflation.”

Cameron 25:39

We need to bring Rob Sitch in on this conversation. This is the kind of conversation that he would have in Utopia. “Why are we putting up interest rates?” “Rents are going up, Tony.” “But why are rents going up?” “It’s because interest rates are going up.” “So, why are we putting up interest rates?” “Because rents are going up, Tony.”

Tony 25:55

To bring inflation down. What’s the cause of inflation?

Cameron 25:59

It’s Dawe and, what’s his face? Who were the guys who used to do 7:30 report until one of them passed away?

Tony 26:07

Oh, yeah, Brian Dawe and I keep thinking of him as Fred Dagg.

Cameron 26:12

Yeah, that’s what I was thinking, too.

Tony 26:13

John Clarke.

Cameron 26:14

Clarke and Dawe. Yeah, that’s a Clarke and Dawe routine, which is pretty much what Utopia is. Utopia is like episode length Clarke and Dawe routines.

Tony 26:24

I was just listening to some early John Clarke recently, too. The farnarkling episodes. They’re fantastic.

Cameron 26:31

Oh, yeah. Yeah, I vaguely recall those.

Tony 26:35

Yeah. Well, I guess they’re on YouTube now, but they were on New Zealand television. Fred Dagg’d come out as a farmer in a blue singlet and gumboots, and he’d go, “yeah, g’day. I just want to talk to you about the philosophy of Kierkegaard now,” and he’d just go on. And that would morph into the Farnarkling Championships, where the Sorenson brothers were playing on the wing and the centres. It was just hilarious. So good.

Cameron 26:58

Clever guy.

Tony 27:00

Yeah. So, anyway, I think the RBA hopefully will improve after the review and the appointment of a new governor. But gee, I mean, seriously. Yeah. Rob Sitch needs to go and sit down with him and just point out that they’re eating their own tail at the moment. That’s incredible.

Cameron 27:18

A new governor, but the same board, right?

Tony 27:20

Yeah.

Cameron 27:21

As we mentioned last week, I think the only job she’s ever had has been at the RBA. I don’t know I would expect her to come in and revolutionise things. She’s part of the furniture.

Tony 27:33

I agree. I don’t. It’s a shame, isn’t it? I used to particularly like the RBA board, because half the people were external appointments and you’d get some, you know, heads of industry. Lindsay Fox, or maybe Solomon Lew. People who would come in and talk straight with them, you know, with all these economists who get, you know, right down into the brush and don’t see the wood for the trees. That’s not happening now. I don’t know who’s on the RBA board now. One of the points of the review was that they did think that the business leaders on the RBA were being captured by the economists. But anyway, I think it’s a shame, it’s hurting everyone and they’re to blame.

Cameron 28:14

None of your extended family are on the board anymore.

Tony 28:17

No, that’s right.

Cameron 28:18

That’s when it all fell over?

Tony 28:21

Maybe. But I think what’s happened, and maybe it was always happening, is that the appointments of the RBA have tended to follow the government of the day. It’s a bit like the Supreme Court in the US. I don’t know who’s there now, so I won’t criticise them, but, you know, someone pull a mirror out and have a look.

Cameron 28:38

Tony’s not going to criticise the RBA, people.

Tony 28:40

I’m criticising the governor. He’s come out and said, “here’s the problem.” He’s the governor. He can fix it. He’s causing the problem. He’s not fixing it.

Cameron 28:48

Yeah. Where did you read this? The Australians? Maybe he said to them, “listen, I know that I’m part of the problem here because…” And they went, “no, we don’t need to say that. We’ll just leave that bit out.” Maybe he hasn’t been quoted in full. That happens on Utopia all the time. Rob Sitch’s character didn’t even-they just took the soundbite. “They didn’t include everything that I said, it makes me look bad.” Maybe that’s Philip Lowe’s problem. I was gonna say Rob Lowe’s problem, but Rob Lowe’s problem was a sex tape with two sixteen-year-olds.

Tony 29:25

I watched Rob Lowe last night. We’re not into after-hours yet. In a new Netflix series, which is quite fun.

Cameron 29:35

Oh, really? Okay.

Tony 29:36

Yeah. I forget what it’s called. Unhinged or something like that. He plays a Silicon Valley genius whose wife died and he’s gone a bit crazy. It’s actually really good, but it’s very light. But yeah, it’s actually quite watchable. Sam Seaborn caught my eye.

Cameron 29:50

Sam Seaborn. Yeah. Would also be a good title for a series about Philip Lowe and his interest rates strategy.

Tony 29:58

I don’t think it’s called Unhinged. It’s called something like that but I’ve forgotten it.

Cameron 30:03

All right. Are you gonna do a pulled pork?

Tony 30:07

I am. Yes. Hastily cobbled together before the show.

THIS SECTION CONTAINS CONTENT WHICH IS VISIBLE TO QAV CLUB SUBSCRIBERS ONLY.

Cameron 1:02:25

The QAV Podcast is a production of Spacecraft Publishing Proprietary Limited, authorised representative of AFSL 520442, AFS representative number 001292718. Please don’t make any investment decisions based solely on listening to this podcast. This is presented as general advice only, not personal financial advice. We don’t know your personal financial circumstances. Please see a financial planner before making any investing decisions.