Season 1, Episode 44

Bravo Hertz

Our last show of 2019! Our guest this week is listener Andre Bravo, a Canadian who has a Masters in Applied Computational Economics and works in the weed industry. Oh NOW I have your attention! Andre joined us this week to talk about the app he has written to speed up his own QAV analysis, and then we get his help to analyse our first US stock – Hertz (HTZ.N). It’s an interesting one because we couldn’t use our usual tools and had to resort to pulling up numbers manually. The basic lesson is that the checklist can be used to analyse US stocks. Andre also asks a few really great questions about how Tony uses the checklist and gave a refresher course how on to simulate Stock Doctor’s financial strength rating using other sources of data.

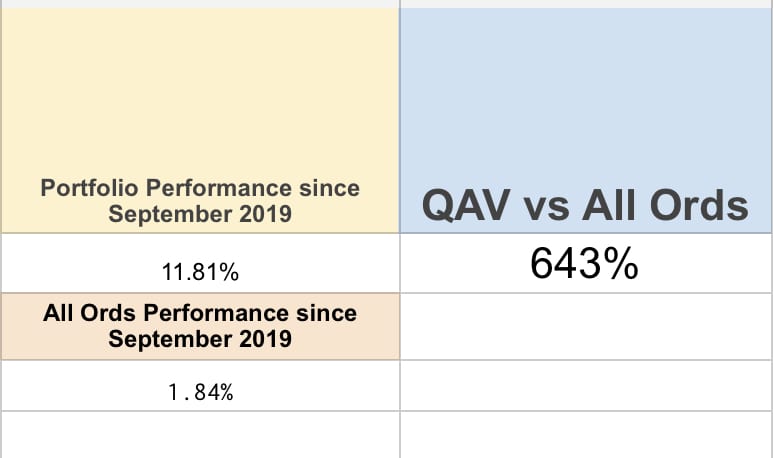

Meanwhile our portfolio finished the calendar year well.

Thanks for all of your support this year! We hope you learned a lot and are feeling more confident in your ability to analyse stocks. We’ll be back next week with Season Two of our investing podcast!!

Please note: If you want to listen to the premium content, sign up to QAV CLUB.

Related

QAV 736 – RECENCY BIAS

In this episode of the QAV value investing podcast, Tony and Cam review the impressive US portfolio performance with a rise of 44%, compared to the S&P’s 27%, and compare with the Australian portfolios. They discuss the recent performance of big caps versus small caps, MMS setbacks. Behavioral economics insights from ‘What Works on Wall Street’ by Shaughnessy are explored, focusing on recency bias and overconfidence. They cover Resimac (RMC) CEO’s sudden resignation, financial implications for Australian Clinical Labs (ACL), Stock Doctor data integrity issues with SCL, and delve into Judo Holdings’ (JDO) market position in the ‘Pulled Pork’ segment. Listener questions about SMSF strategies are addressed. The episode closes with After Hours, emotional updates on Tony’s horse racing ventures, tales of Cape Schanck, Dave Grohl’s autobiography, The Room, Brahms Intermezzi, and the joys of old Jackie Chan and Donnie Yen films.

QAV 735 – F SCORES

In this episode, Tony and Cam discuss the performance of stocks in the US dummy portfolio, working with F Scores and Z Scores, with a deep dive on ENVA’s 39% rise and the risks of investing in some US-listed stocks like Chinese online tech company, STG. They cover recent events around YAL, ANZ, BXB, ING, LFS, AX1 and BOQ and a regression test on “Recovering” stocks. Listener questions explore charting QAV scores over time and the potential buy of AFI. In After Hours, they discuss Tony’s horse racing adventures, books, films, and the future impact of AI on industries and investing, wrapping up with Cameron’s Tommy Hilfiger fashion shoot.

0 Comments