Season 1, Episode 44

Bravo Hertz

Our last show of 2019! Our guest this week is listener Andre Bravo, a Canadian who has a Masters in Applied Computational Economics and works in the weed industry. Oh NOW I have your attention! Andre joined us this week to talk about the app he has written to speed up his own QAV analysis, and then we get his help to analyse our first US stock – Hertz (HTZ.N). It’s an interesting one because we couldn’t use our usual tools and had to resort to pulling up numbers manually. The basic lesson is that the checklist can be used to analyse US stocks. Andre also asks a few really great questions about how Tony uses the checklist and gave a refresher course how on to simulate Stock Doctor’s financial strength rating using other sources of data.

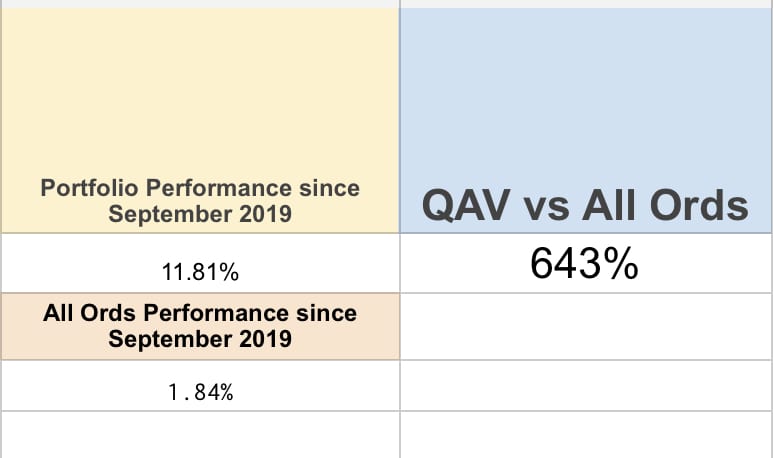

Meanwhile our portfolio finished the calendar year well.

Thanks for all of your support this year! We hope you learned a lot and are feeling more confident in your ability to analyse stocks. We’ll be back next week with Season Two of our investing podcast!!

Please note: If you want to listen to the premium content, sign up to QAV CLUB.

Related

QAV 730 – Consistency Is The Key

In this episode of the QAV podcast, we look at recent news involving SGI, ATP, FGM, CVL, AX1 and a deep dive into ABB’s recent share price drop and business fundamentals. We discuss listener Conrad’s successful modification of the QAV investment system, which led to a 31.4% return in the last year and review some advice from O’Shaughnessy’s ‘What Works on Wall Street’ regarding consistency in investing. The after-hours segment includes discussions on examples of outstanding customer service, the benefits of rural call centers, and U.S. politics. We also chat about Tony’s recent golf win, film reviews of ‘Stingray’ (1976) and ‘The Assassination Bureau’ (1969), and recommend the music of The Jim Carroll Band and Grace Cummins and the Doctor Who site, stitchesintime.

QAV 729 – The Trump Bump

In this episode of the QAV podcast, hosts Tony Kynaston and Cameron Reilly are discussing a record-high in the All Ordinaries index spurred by the ‘Trump bump’, Aussie Broadband’s sudden dive (ABB), portfolio results, more FY survey results, MLX‘s bump, the Shipping Crisis, thoughts about integrating “Buyback Yield” into the checklist, and Tony breaks down the history and market stance of Elders Limited (ELD) in a detailed ‘pulled pork’ segment. They also explore the Apple Vision Pro’s new features and its future alongside immersive tech like Oculus Rift, then shift to the political scene with discussions on Trump’s influence on global conflicts. The conversations touch on AI, Elon Musk’s ventures like Neuralink and SpaceX, horse racing updates, book recommendations, and reviews of ‘Better Call Saul’ and Tom Cruise films.

0 Comments