QAV PORTFOLIO REPORT

INCEPTION REPORT

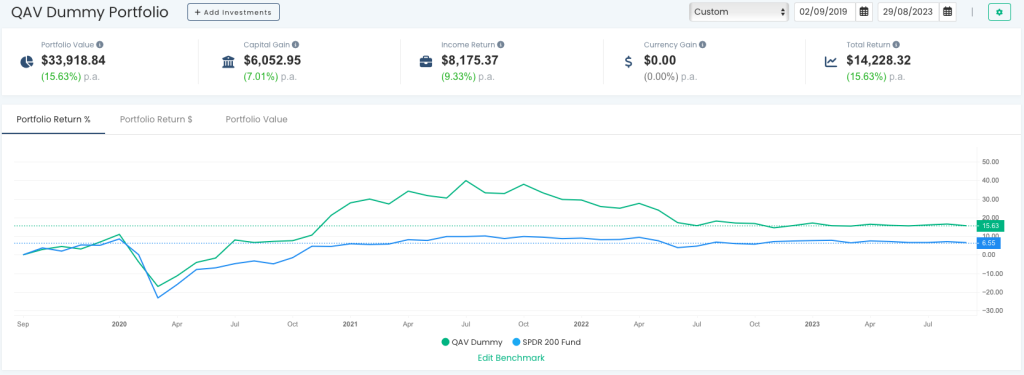

We’re still outperforming the STW by ~2.5 times since inception (02/09/2019).

You can always check out the live version of the portfolio chart here.

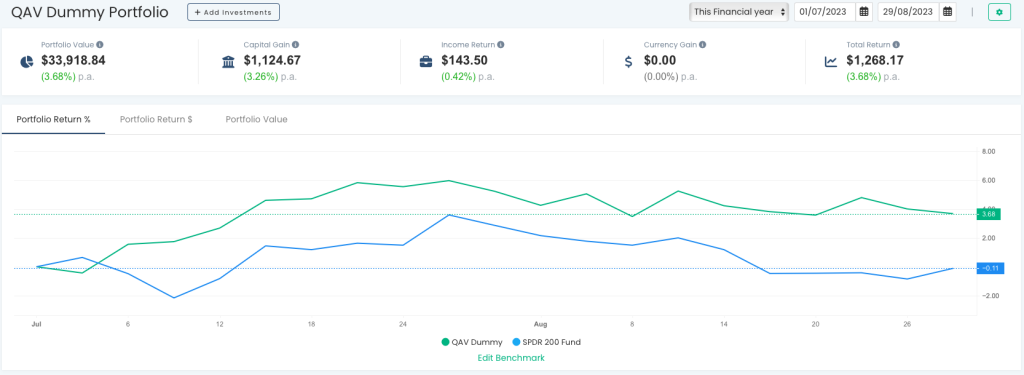

FY REPORT

The DP is up 3.68% vs the STW down 0.11%.

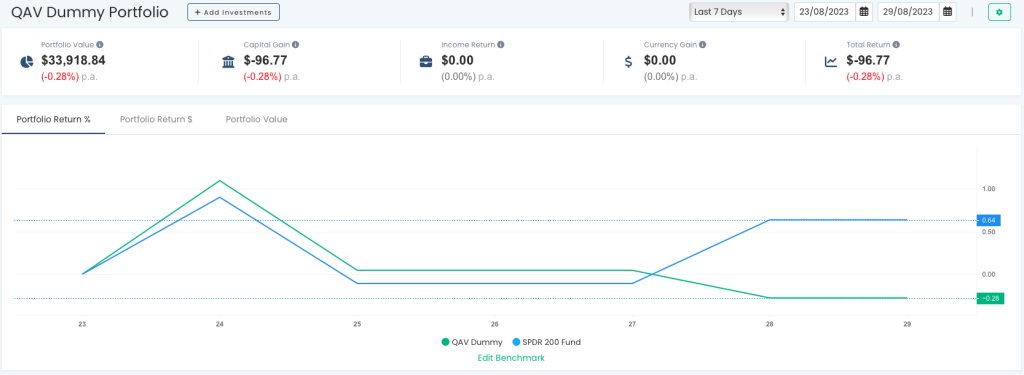

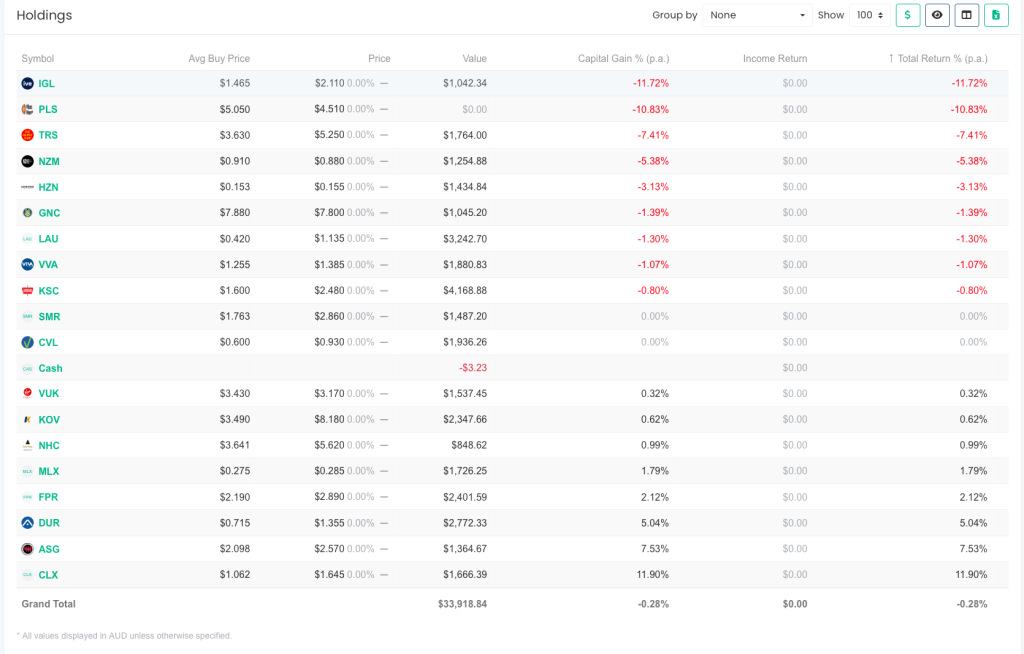

The portfolio was down 0.28% for the week.

Here are how the stocks have performed in the last 7 days. CLX, one of last week’s worst performers, and ASG were the winners this week, while IGL and PLS topped the list of the worst performers.

RECENT TRADES

We sold PLS and replaced it with NHC. As Wheat is now a commodity sell, I’ll be letting GNC go today too and replacing it with AMP.

NEW FREE WEBINARS

I’m running weekly webinars on Thursday nights (8pm Brisbane time) over Zoom. These are an opportunity for everyone interested in value investing, whether you are new to QAV or an existing QAV Club or Light member, to ask questions and share learnings with each other.

Next webinar: Aug 31, 2023 08:00 PM Brisbane

Register in advance is required for this meeting. Click here to register.

STOCKS OF THE WEEK

** As always, please check our work, DYOR, and consult a financial advisor before making any investing decisions.

BUY LIST

Each week we produce a buy list that we share with our members. The intended primary purpose of this buy list is for club members to use as a reference for comparing their own buy list. In theory, all of our buy lists should look pretty similar each week.

As always, please check our work, DYOR, consult a financial advisor before making any investing decisions.

THIS SECTION CONTAINS CONTENT WHICH IS VISIBLE TO QAV CLUB SUBSCRIBERS ONLY.

LAST WEEK’S EPISODE

Detailed highlights of the episode:

-

Perenti (PRN) reported record revenue and earnings but the share price dropped 14% due to no dividend payment. The company is investing cash into new projects rather than dividends.

-

Ongoing negative news about China’s economic slowdown. Growth is slowing but still strong at 4.2%.

-

US bond yields hit fresh 15-year highs ahead of a speech by Fed Chair Jerome Powell. Macroeconomic trends don’t tend to impact value investing approach.

-

Review of QAV Light portfolio performance – mixed results across the 4 portfolios, trailing the benchmark overall.

-

Dummy portfolio still outperforming benchmark by 2.5x over the long term. Up 3% vs benchmark down 1% for FY23 so far.

-

Pulled pork special on Whitehaven Coal (WHC) – very undervalued but faces headwinds due to environmental concerns.

-

Discussion on capital raising options for explorers like Core Lithium. Share placements most common as debt and bonds difficult to access. Dilutes existing shareholders.

-

20% rule one backtesting over COVID period may not represent typical market conditions. More historical data needed for further backtesting.

-

Overview of topics covered in new weekly QAV webinars – open to all interested in learning the QAV process.

-

Update on upcoming art show organised by Alex and invitation for QAV listeners to attend.

Episode Transcription

QAV 634 Club

[00:00:00] Cameron: welcome back to QAV episode 634, TK. We’re recording this on the 22nd of August, 2023. I believe you’re not feeling well, Tony, still.

[00:00:25] Tony: Oh yeah, no, I’m okay. Just got some kind of chest infection that’s lingering on

[00:00:29] Cameron: It’s all that Victorian weather you were exposed to a couple of weeks ago.

[00:00:32] Tony: Well it’s strange. I, it seems like I, I just go on holidays or go away and come back and get sick, so Dunno what it is.

[00:00:40] Cameron: That’s the universe telling you no more holidays.

[00:00:43] Tony: yeah, exactly.

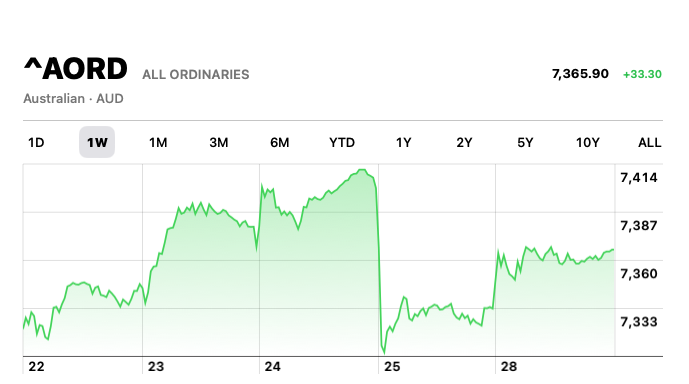

[00:00:44] Cameron: Well, it’s been not a great week in the All Ords. Tony

[00:00:49] Tony: It’s sick as well.

[00:00:50] Cameron: yeah, it’s been sick. We’ll get into that later, but I wanted to start off with the news of the day because I’ve had a number of club members posting and emailing me about this afternoon. Perenti, did you see my email about Perenti?

[00:01:04] Tony: I did.

[00:01:05] Cameron: PRN Delivered Record FY23 Financial Results, Record Revenue, Record Underlying Earnings, 18% Increase in Revenue, 50% Increase in EBIT, 58% Increase in NPAT, and the shares are down by 14%. Last time I checked 13. Now it’s a rule one and a 3PTL sell for most of us. Now funnily, well, not funnily, but interestingly one of our QAV Light subscribers who will remain anonymous because I don’t know if he’s supposed to give us this inside gossip, but he emailed me immediately and said quick feedback from the CEO, CFO didn’t speak. Market didn’t like lack of a dividend, given consideration of a dividend was previously stated when leverage was under 1, but with refinancing due next year, they wanted to keep some buffer, plus allocation of future funds slash investments to electrification, risk management and mining technology, which have a number of years payback rather than shorter term returns for shareholders. Loss of first US tender and big local tender weren’t seen. as large negatives. I you know, I think it’s one of these things that I expect to bounce back, Tony. It actually did bounce back already. It dropped down to a 1. 02. So it started at 1. 21 today. After the announcement, it dropped down to a 1. 02. rebounded up to a 1.065, but has dropped back down to a 1.025 now, so yeah, dunno, I thought I didn’t jump on the rule 1 or 3PTL sell, I thought, I’ll give it to the end of the day and see what happens, but doesn’t look good.

[00:02:55] Tony: Yeah, it’s a strange, it’s a strange outcome. I saw your question about half an hour ago and my notes, I couldn’t find anything when I googled, but my notes said lack of dividend.

[00:03:05] Cameron: Right.

[00:03:06] Tony: so only because I saw that it, it stopped paying a dividend and I wondered whether that was the reason why the share price went down if they didn’t proceed with one.

[00:03:14] Cameron: this is like Mastermind, one of those game shows where you have to hold, you have to hold up your card and we see

[00:03:19] Tony: Yeah.

[00:03:19] Cameron: written on it.

[00:03:20] Tony: The other thing I was looking into was whether something happened with DDH, which is under takeover by Perenti, because they both dropped, which makes sense because their share prices are in lockstep now because Perenti are using shares to pay for DDH. So but DDH didn’t have results today, so I don’t think that’s the driver. It’s more likely to be the lack of dividend. That’s the issue. Yeah, but I tend to agree with you, even though it’s a 3PTL sell, so you got to sell it. That big a drop just because they haven’t started paying dividends is a strange reaction, I think. If you should, I mean, I would have thought if people were in the share market for dividends, there’s plenty of other things to buy. And so I don’t know why people were buying this on the expectation of a dividend. But yeah, it just goes to show off that if the CEO did indicate that there was one coming and they decided not to pay it. It you know, market always rewards saying what you know, doing what you say rather than saying one thing and doing another. So that could be the reason.

[00:04:17] Cameron: Well just a follow up, we might have a follow up on that because the QAV Light member, I’ll just say his name is Michael, it’s probably not going to give away too much, has asked the CFO and the CEO if they’ll come on the show.

[00:04:31] Tony: Oh, okay, cool.

[00:04:32] Cameron: He said now that the results are out, they might be willing to do it. So, thanks for that, Michael. We’ll see how it goes.

[00:04:38] Tony: Yeah.

[00:04:39] Cameron: Well, moving on to other great news. Why China’s slowdown matters on the BBC. After a long period of stunning growth, China’s economy is now slowing. The economy grew at an average rate of 10% a year for the three decades up to 2010. It has slowed markedly. Oh no, hold on. This article’s from 2015. Let me find the latest round of it’s all China’s coming off the boil stories. Financial Review, August 22nd. China faces downward spiral as property crisis deepens. We’ve talked about this before. It’s like just been this constant series of China doom and gloom stories for, well, going back to 2015

[00:05:24] Tony: oh and before that too yeah and China’s still growing it, it’s just announced a downgrade, the expectations will grow at 4. 2% which is about, Twice the rate of Australia’s growth, so, and most of the rest of the world. So 4. 2% still pretty good

[00:05:41] Cameron: But it’s not 20% or 10%. but it was

[00:05:45] Tony: No but I mean, like, you’d be hard pressed to find any economist who would have thought China could keep on growing at 10% per annum, right? It’s been well. Researched and well examined that China was going through a growth phase and then it’s got to slow down. Basically because it’s dragged all these people out of rural poverty and created a middle class and the middle class, you know, wants decent jobs and security and the ability to save for a home and all those kinds of things. Better wages, which means that China doesn’t export as much in the way of cheap manufactured goods and it slows the growth down. So it’s not like this is a train wreck that happened yesterday. It’s been well, well flagged for a long time.

[00:06:23] Cameron: And it was, you know, I think a couple of years ago we were talking about big property crisis over there and large developers defaulting on loans and they keep trundling along. I mean, there’s this constant theme in some of the newsletters that I get talking about whether or not they’re going to end up like Japan. in a boom period in the 80s and then crashing and burning. But yeah, it makes sense that they’re going to have to slow down. They can’t keep that sort of growth up forever. I guess the tough thing for economies like Australia’s is that our economy is predicated in large part on how well, yeah, it does, but that’s particularly the case for the iron ore market. But a lot of Australian exporters got out of China over the last few years because of the trade sanctions that China put on, like the coal exporters in particular as well as the wineries and some of the other barley and some of the other grains, et cetera, just trying to just found reasons not to allow them to be imported.

[00:07:24] Tony: So they’ve all rebounded and found other markets. And yeah, I tend to think that that. They will again. It’s, what they’re saying about China is what they wrote about Australia last year. I mean, we had property companies going bust at a more rapid rate than we’ve seen usually or in the past. So it’s the same sort of thing. The situation in the past has been remedied by China dropping interest rates, which is the same way that we remedy the situation. So it’s like, I this is a headline or a headline in search of some news. I think really it’s it’s yeah, it’s not very illuminating.

[00:07:57] Cameron: Yeah. I mean, the media is all, you know, there’s gotta be, I think it’s written into the contracts with journalists in every media company. Right now you have to write at least two negative stories about China every day. That’s a part of the deal that we’ve got with Joe Biden. You want nuclear submarines, you gotta write more negative stories about China.

[00:08:19] Tony: yeah.

[00:08:20] Cameron: Speaking of the U. S., u. S. bond yields hit fresh 15 year highs, according to the Financial Review this morning. Let’s see this week’s main economic event is Federal Reserve Chair Jerome Powell’s speech at Jackson Hole on Friday. Half his luck. You ever been to Jackson Hole? I love Jackson

[00:08:40] Tony: have it. You have it? Okay.

[00:08:43] Cameron: it’s lovely. It’s where I want to, it’s where I want to retire. After the US Civil War, when property prices crash, I’m going to buy up some property in Jackson Hole. The worry is that Powell would dash investors hopes that the Fed has already hiked interest rates for the final time and that its next move will be to cut rates early next year. So, I don’t know, between the China and US and all this kind of stuff, quite honestly, I find it hard to give a shit, but

[00:09:09] Tony: Yeah, I’m the same. I’ve never been one for following macroeconomic trends or letting it dictate what I do. Doesn’t change the way that I invest at all. And for the most part, it’s just headlines. It’s not it does have impacts on the economy for sure, but we seem to find a way around, ways around it. So yeah, I tend to ignore it. We have to. Yeah. I mean, yeah and also too, whether it’s the last interest rate hike for the Fed and whatever Jerome Powell says on Friday, it’s, almost irrelevant in my world. Yeah.

[00:09:37] Cameron: keep doing what you’re doing.

[00:09:39] Tony: Yeah. Both, you know from the way I live my life, but also the way I invest.

[00:09:44] Cameron: Yeah. Yeah, I was talking to one of our new club members on zoom yesterday. Shout out to Julian. And I was just saying, yeah, you know, the, for me, the great thing about, we were talking about you know running a paper portfolio for a while when you become a new club member and just seeing if the style of value investing, at least the way that we do it suits your. temperament and your personality. I said, you know, I like the fact that it just allows me to ignore the news stories, ignore the noise, ignore the cycles, because I don’t have to get caught up in all of that. I don’t have to stress over it or worry about it. I just wake up in the morning, check my alerts, sell something if I need to sell it. By the way, which is why I haven’t sold Parenti yet. ’cause my rule now is I don’t react on the day. If I get a, if I get a notification that something’s become a sell, I’m like, I’ll worry about it in the morning. And I, you know, , We did a webinar, oh, just a shout out for every, to everyone who came to the new weekly webinars that I did last week. I’m doing them every Thursday now. And basically the first, I thought it was gonna be the first 15 minutes, but it turned into the first hour. Cause I’m a long talker. Was just a quick overview of QAV, right? This is how it works. It’s basically like the sort of thing you and I do when we do the ASA webinar, right? This is the straight, this is basically the philosophy and the strategy. Here’s a look at the checklist and it’s open to everybody, club members, light members, no members, anyone who wants to know more about how we work can jump on Zoom, eight o’clock on a Thursday night. I just walk through, okay, here’s the checklist, here’s the buy list. You know, this is kind of what we do and how we do it. Here’s how alerts work. Here’s the difference between light and club, et cetera, et cetera. And then people get to ask questions and I do a bit of Q& A afterwards. Anyway. Yeah, as I was telling people on the webinar last week, you know I, my, my process is now I’ll open up my spreadsheet first thing in the morning and figure out if I need to do anything for the day and if something. becomes a sell, you know, after 11 o’clock in the morning, it’s okay. It’s tomorrow. That’s tomorrow’s problem, right? Unless, you know, you know the comet is coming through, unless it’s a major disaster that seems really bad, anything be anything below disaster level event. What do they call them in science fiction movies? End of life event? Anything other than Ellie? Anything below an Ellie? It’s like, ah, it can wait till tomorrow. I got other stuff to do.

[00:12:10] Tony: Yeah, it’s a good approach, I think. I mean, you might miss out on a couple of percent selling a day later, but sometimes things regroup the following day as well.

[00:12:19] Cameron: Well, that’s been my experience over the last four years is it’s a 50 50 chance. It could go back up and I don’t have to sell it. It might drop and I might lose a bit. And particularly now with the thinking that maybe Rule 1 doesn’t have to be 10% of money, it’d be 20%, puts even less stress. But, you know, what I was saying to people is, what I’ve learned over the years, and you’ve reinforced this from your experience, is that it’s very rare that things drop quickly. It, you know, I think in four years I’ve been doing this, maybe two or three instances, I’ve seen the bottom drop out of something quickly. But usually it’s sort of a slow process and,

[00:12:54] Tony: well, even when the, but even when the bottom drops out quickly, like it has today with Perenti so you find out it’s already down 10%. If you sell today, you might sell the 10% loss and you might get nine tomorrow. You might get 11 tomorrow. It’s like, it’s generally it’s that it’s the first drop is too quick to catch. And then after that, it goes slowly. There’s been a couple of cases I can think of where it keeps going quickly over a few days, but they’re very rare.

[00:13:21] Cameron: Very rare. And, you know, half the time it drops quickly and then, you know, the market buys back in and goes, You know what? You guys overreacted. I’m gonna snap this up because the fundamentals are good. Which is what, why we bought it in the first place. And as Perenti’s results demonstrate, they’re running a good business. They’re doing well. I don’t care about the dividend, you know. I’m sure other people out there don’t care about the dividend that much.

[00:13:45] Tony: Yeah. And look, I hope it does cross it’s three point trend line buy line. I think that’s the more important one in this case anyway, because as you say, it might go back up above a rule one. Because yeah, we’re not buying this stock for its dividend. It wasn’t part of our calculation or our numbers when we bought it. And now we get to buy 10% cheaper for the same, you know, for the same company with the same story. So I think it’s still an attractive company to look at.

[00:14:08] Cameron: Yeah. Well, just while we’re talking about results dummy portfolio still doing two and a half times the benchmark since inception for the financial year, we’re up 3% versus the STW, which is down nearly 1%. So, so far we’re doing well for the financial year. In terms of the last week big winners for us, not that they were that big, but up three, three and a half percent, were CVL and Horizon. And the big losers, down four to five percent, were CLX and VUK. But all up for the week, we were down nearly one percent. So, yes, you know, as I said, market sort of collapsed. Towards the middle of last week. I think Tuesday, Wednesday morning it collapsed last week and hasn’t really recovered since then. What else, what do you got to talk about

[00:15:07] Tony: A couple of things. So there’s been a number of QAV stocks reporting because it’s reporting season. I focused on one, which is SGM Sims Metal only because I owned it. And It’s similar to most of the other stocks that have been reporting in their QAV world. They’ve been reporting, you know, drops in sales, drops in profit rising costs. And their share price goes up, so Sims went up, you know. 12% I think on the day it announced its results. Nick Scali did something similar. And you look at the, you drill into the results, it’s kind of the reverse of the Perenti one we talked about before, which was a good result. And the share price goes down. These ones have had, what I think are pretty ordinary results, but the share price has gone up. And I think that’s the kind of theme for this reporting season is that things ain’t as bad as people thought it was going to be. So it’s kind of a relief rally for a lot of these stocks. It’s like they’re not going near them. until they report and they’re going, okay, you know, we expected something worse. So it’s okay. We’ll get back in. That’s it’s a funny sort of year this year. So yeah. So Sims, Sims went up, which is good. Although I did check the scrap plot price recently and it’s getting pretty close to a sell. So not sure how much longer Sims will be in my portfolio, but we’ll see. So the last thing I wanted to say, and this is due to Alex, the average mortgage rate in our QAV spreadsheets has gone up this month. So 6. 65%. So if you’re not using the one that gets put out every week, buy Al, you’ll need to update it yourself. And that’s because of rising mortgage rates. That’s the average of the, of what’s on offer. And we use that to test against dividend yield.

[00:16:51] Cameron: Right. Thanks. I better send an alert out just to make sure people plug that into their spreadsheets.

[00:16:56] Tony: I did have a pulled pork to do as well, Cam.

[00:16:59] Cameron: Alright,

[00:16:59] Tony: Yeah, okay, so interesting one today. Speaking of ESG, I’m going to do Whitehaven Coal. Thermal Coal is a buy, again. Just, so it may change, but there has been a tick up recently. And again, this is one that has been controversial for us over the years. We’ve owned, I’ve owned WHC. It’s been in our dummy portfolio in the past. It’s gone up and down, I guess, with the coal price but then we’ve copped, I’ve copped some stick for investing in coal companies um, from

[00:17:25] Cameron: from who? Hmm,

[00:17:26] Tony: from people who don’t want to invest in uh, coal companies and um, I’ve taken the position that buying shares from somebody else isn’t a good If I don’t buy the shares, nothing’s going to change in terms of the planet or its carbon levels, so I’m happy to buy them and do the best from a financial point of view for me. So that aside, if you don’t like investing in coal companies, then you can fast forward. Otherwise here’s Whitehaven Coal. So Whitehaven Coal, large, I think it’s probably Australia’s largest Certainly largest standalone coal company. It’s mainly a thermal coal company. As you know, there’s thermal and metallurgical. Thermal coal is the stuff that goes into power stations. It’s it positions itself as Australia’s largest premium thermal coal miner with an emphasis on premium. And the reason for that is that there are different grades of coal and the one, the premium end of the market or premium into the coal spectrum has lower emissions and is therefore suitable for what’s called HELE power stations, high efficiency, low emission power stations, and that does seem to reduce the carbon emissions. Going out from burning coal. So there’s some upside to this company if you’re an ESG investor, although I’m pretty sure an ESG investor wouldn’t invest in it. The company’s based in Australia, primarily in the Gunnedah Basin of New South Wales, but they have started to expand into the Bowen Basin and also into metallurgical coal, which is the coal that’s used to make steel in blast furnaces, and doesn’t have the same sort of carbon emitting profile as the thermal coal does. I found it interesting researching this company because you know, it’s a classic contrarian value investment. They make a good case in their presentations to say that the analysts in this space don’t have the sort of forecast for the coal price correct, and they make the point that there are a lot of things at play at the moment in the coal space. Russian sanctions, which are temporary, I suppose are definitely at play. And so the coal price will be moved a little bit by what happens in Russia. But also, there are things like the fact that new mine approvals around the world are becoming more difficult to get. There’s a movement towards the high efficiency, low emissions power stations and also power stations that take mixed fuel. So they take premium coal as well as hydrogen, for example, and other biofuels. So that should support the coal price going forward. There is definitely a lot less access to finance and capital if you’re in the coal mining business, so that’s constraining mine development and also too, the governments are increasingly being focused on their own energy security needs, so there are some countries, including Australia, which now put reserves on how much coal can be exported because of their need to keep the baseload of the grid going. And the last point that they make is that the price of coal is still a little bit under the price of gas, which is the one of the alternatives to put into power stations. So all of these things tend to support the coal price going forward. They’re all, they also say there’s a kind of a political element to all this as to why anyway that they feel the future of coal is being denigrated by analysts and economists. They state there’s a institutional bias or disinterest from even researching the market because of the ESG concerns. There’s also an underestimate they feel of demand. and growth in the market. So most economists who look at the coal market are saying it’s it’s terminal and it’s going down when, whereas in fact the volumes are increasing year on year. And there’s also an underestimation of the the growth in the market, largely because people are factoring in a shift to green energy, which is either not happening or happening much slower than anticipated. So I know this is Whitehaven coal. calling out that they think the future is bright for coal and that’s you know, should be taken with a pinch of salt. But there is some legitimacy to what they’re saying and certainly, you know, the reality in the last near term anyway is, has been bearing out their arguments. A couple of other points which are interesting about Whitehaven Coal. In its past, it was selling coal into China, and a couple of years ago, China stopped taking coal from Australia as part of the sanctions that it was levelling against Australia for various reasons, not the least of which was questioning that COVID started in Wuhan. but Whitehaven successfully found customers in the rest of the world and is now a big supplier to Japan and Korea. and the rest of Asia. So if China does open up its coal markets again to Australia that would be a boost for this company. And there, they also point out a number of overseas trends that are happening which will impact their ability to export coal. So for example, Canada has announced that they will have zero coal exports by 2030. Columbia has stopped allowing new open cut mines. And that’s a, they’re a large exporter of coal. And South Africa has cut exports by 50 percent as it focuses on a domestic energy crisis. So there’s a lot of turmoil in the coal market and I think a lot of people are drawing a straight line conclusion that eventually coal will diminish in terms of its use, but we’re not seeing that at the moment, and neither is Whitehaven. I’m not seeing it at the moment, neither is Whitehaven. So anyway, by the by.. That’s the background, I guess, to this company and what’s going on. Using the numbers it comes up really strongly on the QAV buy list. I’m still using December 21 numbers, so it hasn’t announced its results yet. And so, of course, these numbers may change, but using those numbers, the ADT is 39 million, so it’s um, it’s very large uh, a very largely traded stock so we can buy it without any difficulty. Um, I’m using a price of 7. 28, which was on the weekend, which is 90% of the consensus target. So it’s trading just below what the analysts expected to trade at. The dividend yield is currently just under 10%, which is huge. And even though, as I said before, the mortgage rate on average is up to 6. 65%, the yield is still higher than the mortgage rate, which is very good. So it scores for that. The PE on this stock is only two, two times. So you can buy this company for twice its earnings, which is incredible, I think. Again, that feeds into this you know ESG argument that people aren’t looking at it and alternatively are factoring in a decline in the coal market going forward. But buying a, you know, such a strongly profitable company with a PE of 2 is just incredible and, you know, Won’t be seen for a long time again, I wouldn’t think. The PropCaf is 1. 38, which is again incredible. You can buy this company for almost one time’s operating cash flow. It’s just it’s ridiculous. Um, this company does tick our box for a rarely seen metric, which is the yield minus the PE. So the yield’s higher than the PE. Yield minus PE is greater than one. Yes, greater than zero, sorry. So yield’s higher than PE, which is unusual, but it’s a, I found it to be a deep. Value indicator. Financial health is strong and steady in Stock Doctor, which is also good. This company has an ROE of 83%, which I know is not part of our checklist, but that’s a huge number in anyone’s um,

[00:25:02] Cameron: yeah,

[00:25:02] Tony: And the PE of 2. 04 is the lowest in three years. IV1 for this company is 18. 30, IV2 is 29. 40. So intrinsic value is 29. 40, bearing in mind the share price is 2. 70 something. So let’s see, 10 times undervalued, according to that metric, and it’s trading just below its book plus 30 percent. So net equity per share is 5. 87, book plus 30 is 7. 62. So one, one sort of cloud on the horizon is the forecast for earnings per share is to Go backwards by 17%. So we’ll have to wait and see what happens when it reports, but that’s a negative that we score it for, but everything else is a screaming buy, quality score for this company is 14 out of 16 or 88%. And the QAV score is 0. 63, which is way up to the top of the buy list. So what do I think will happen for this company? Do I think it will trade at? 29, whatever the IV2 was, 29. 41. I don’t think so. I think it’s a, I think it’s a great value stock, but this reminds me of stocks like the tobacco companies that when they, the market doesn’t look at them eventually they kind of ask the question, well, why are we listed on the stock market? So I don’t think it’s going to happen anytime soon, but eventually the management may get. So frustrated that they engineer a buyout or engineer someone to buy out this company and take it private which will mean that they’ll, you know, face a lot less scrutiny and being bashed around the head for being a coal miner. And so that’s potentially on the cards for the company. I’m re, I’m reminded of the, I think it was Keynes, the economist, I think he said the share market was a beauty pageant, but not one where you’re trying to pick the contestant you think is the most attractive, but where you’re trying to pick the contestant that everyone else thinks is the most attractive, and therefore, you know, I would think that Whitehaven Coal will never reach its true value because there’s just not enough people in the market attracted to buy this kind of stock, even though it’s really well undervalued. I think it will go up from here because I like their arguments about where the coal price will go. But it’s operating in less than a full market and I think that’s going to be a bit of a drag on it, but have a look at it if you aren’t put off by the ESG concerns and certainly Whitehaven make an argument that of coal miners they’re probably the least worse if that makes sense from an ESG point of view because they they mine premium grades of coal but yeah, it’s certainly an interesting situation, and very, cheap and undervalued.

[00:27:30] Cameron: That’s how I sold myself to Chrissy. I said of all the cis white males that you’re going to meet, I’m the less worse one of all

[00:27:39] Tony: Least worst napoleon podcaster you’ll meet.

[00:27:41] Cameron: Speaking of the move to clean energy, I’ll talk about this more in After Hours, but I’ve been reading one of Vaclav Smil books on energy. Ever read Vaclav Smil?

[00:27:51] Tony: Doesn’t ring a bell

[00:27:52] Cameron: oh man, you’d love him. He’s a Czech Canadian scientist and author. I think he’s written like 36 books. Bill Gates is like his number one fan. Bill Gates has said that he waits for a new Vaclav Smil book like most other people wait for a new Star Wars movie to come out. That’s like the highlight of his year. He’s a climate scientist. He’s a scientist and, you know, he writes a lot of science y type books. But yeah, I’m reading his book on energy. And he’s very skeptical about the move to clean energy happening anytime soon. Not that it shouldn’t, just that it’s gonna happen you know, in any sort of time frame. You know, in 2018, he was saying that coal, oil and natural gas still make up 90% of primary energy sources. And he just said replacing fossil fuels was just gonna take… You know, a huge amount of time for us to retool everything, and the incentives aren’t really there yet you know, in terms of governments forcing companies to do it, and yeah, sadly it doesn’t seem to be moving as quickly as I think we’d all would like to see.

[00:29:02] Tony: No, true. But it’s important to get it right. I don’t know what he’s saying, but does that mean the arguments for things like nuclear are stronger?

[00:29:11] Cameron: I don’t know what his position is on nuclear, but I’ve always been a fan of nuclear. I think nuclear, you know, I know it takes a long time to build a nuclear power plant. Although Gates, getting back to Gates, he’s working on this, he’s been working on this project for years of how you take spent fuel rods and figure out how to squeeze the energy that’s left out of them. I can’t remember. Do you remember what the name of his company is that does that?

[00:29:36] Tony: No.

[00:29:36] Cameron: I think it’s like TerraPower but anyway, yeah. I think nuclear is definitely should have been an option, but it takes like 20 years to build a nuclear power plant and 40 gajillion dollars, it’s not a quick thing to do.

[00:29:51] Tony: Yeah, But if you don’t start now, you’re not going to have it in 20 years time when you need it.

[00:29:54] Cameron: Yeah, but you know, it’s also hard to sell, you know. Yeah,

[00:29:58] Tony: Yeah, so, well, hopefully carbon capture or something similar then might help, but yeah, I’m like, I’m persuaded by that argument, I don’t think we’re facing up to the fact that it’s either going to cost us a heck of a lot to move to new energy, or, which means standard of livings go down, or we’re just not going to get there unless we use something alternative, like that isn’t being considered now, like nuclear.

[00:30:20] Cameron: we’ve got to bite the bullet at some point, but no one wants to bite the bullet. Governments that is.

[00:30:26] Tony: Yeah, funny that, because they rely on people’s votes. People tend to vote with their back pocket.

[00:30:31] Cameron: Yeah, you know, there’s also the consequences of not biting the bullet but I guess they figure well that’s somebody else’s problem. I’ll be out of the game by the time the consequences roll around and someone else’s problem

[00:30:44] Tony: Yeah, I find it a fascinating area to delve into. I mean, like, like you, I’d love climate change to be solved tomorrow. But it’s just been a muddle so far of conflicting incentives to try and get there. And I’ve long argued it’s a tragedy of the commons problem where everyone has a vested interest in the status quo. So the only way you can get there is for the government to impose a solution or someone outside to impose a solution.

[00:31:07] Cameron: is why we need China to take over. I’m deadly serious! I’m not even joking.

[00:31:13] Tony: don’t think they’ve solved the problem though, they’re opening coal powered stations as fast as they can.

[00:31:19] Cameron: Yeah, they are, but they’ve got, I mean, they’re also investing heavily in alternative energy. They know that there’s a timeline here that they have to, in order for them to be competitive with the West economically, militarily, they need to ramp up very quickly as they’ve been doing since 1979. But they also know that there’s a timeline where they need to transition before they cook themselves as well. And now there’s a book I’ve talked to you about before that I’ve been, one of the books that I’m reading is about. The strengths and weaknesses of the Chinese model of governance, versus the strengths and weaknesses of the Western style, the Westminster, or the American style of governance, it is the tragedy of the commons, you know, we can have doofuses get elected, and make stupid decisions that, you know, then get overturned four years later, and then those decisions get overturned four years later, and we run around in circles, whereas if you look at China’s strategy for the last 40 years doesn’t tend to change with who the premier is. It’s just yep. This is where we’re going. It’s this long term plan and they have to adjust from time to time as things don’t go the way that they thought that we’re going to do, but they have this single minded focus, which is. Catch up to the West, surpass the West, you know, take over everything, be the dominant economic and military superpower on the planet, like we should be because of the size of our country and the amount of people that we have and all of those sorts of things, our 3, 000 year history, all this kind of stuff, and getting back to where we were a thousand years ago.

[00:32:56] Tony: Is that actually their stated goal? To become the dominant superpower? I thought they were happy to live and let live.

[00:33:02] Cameron: Well, you know, yeah, sure, I’m happy to live and let live if I’m the dominant superpower as

[00:33:07] Tony: Yeah, Ha. well, protect themselves anyway.

[00:33:10] Cameron: Yes, I mean, you know, obviously they went through the… What they see is the great embarrassment, the tragedy of the opium wars of the 19th century and what the West did to them you know, as a result of them losing the opium wars and it, it took them, it’s taken them what, you know, 150 years, 160, 170 years to rebuild after that and determined that it’s never going to happen again. No one’s going to be able to push them around ever again. So, you know, everyone likes to be the big dog. The U S has loved it for the last 70 years. You know,

[00:33:52] Tony: Yep. No, I agree.

[00:33:53] Cameron: Hey Alex,

[00:33:54] Alex: Hello. How are you? I’m good. Thank

[00:33:57] Cameron: good. How was your trip to Sydney?

[00:34:00] Alex: It was great. It was really nice. Thanks. Yeah. It was nice to celebrate with mum. She forgets her birthday every year. So as I get older, I feel more inclined to make it a big deal for her. So yeah, no, it was really nice. And Sean came up as well. So we had a proper little holiday.

[00:34:14] Cameron: Very

[00:34:14] Tony: Yeah, it’s good. to see you.

[00:34:15] Cameron: You didn’t catch your dad’s lurgy?

[00:34:17] Alex: well, he got tested to make sure that he wasn’t contagious and he wasn’t. So it was good.

[00:34:22] Cameron: Well, that’s good.

[00:34:23] Tony: Hey, this is probably a good time to talk about our giveaway for QAV listeners.

[00:34:28] Alex: Yeah. Yep. Yep. So dad had the great idea of getting a link. Well, so I was given a VIP ticket link to send out to people who I thought might be interested in going to the affordable art fair in Melbourne, which is from August 31 to September 3rd this month. And dad said, Oh, why don’t we get one for QAV people? Because there’s a pretty good Melbourne contingent who might be interested. So I assume that’s what you’re talking about, but

[00:34:55] Tony: Yeah, I am. Yeah.

[00:34:57] Alex: yeah so I’ve arranged for a QAV link, and the, so basically if you click the link, it has my code populated in it. The code name, I think, is Dad, instead of QAV, because my friend set it up for me, who’s working at the affordable fare, so if you see that, that’s why it says Dad. But yeah, I’ll be there every day, and I think Dad will be there on and off during the weekend, so it’d be nice to say hello, anyway. What’s the, what would it normally

[00:35:25] Tony: cost to go, Al, do you know?

[00:35:27] Alex: I haven’t checked, I think it’s about 80 for a VIP ticket which might just be the preview, plus the additional 20 to 40, I think, for the whole weekend. So it’s, yeah, it’s, I mean, it’s probably under 100 for the same ticket, but yeah, this one’s for free. And I think you can book two at a time, but if someone else logs in on a different computer, I think you can. Practically book as many as you want. Yeah. I think we’ve been allotted 70 or something like that. So we’ll yeah, we’ve got plenty.

[00:35:56] Tony: good.

[00:35:57] Cameron: And I guess I’ll put the link in on Facebook and in places like that for people. But just give us a, give us the pitch for the Affordable Art Fair, Alex. Tell everyone again what it is.

[00:36:11] Alex: Yeah, sure. So I think. Well, so it’s based in the UK, the actual Affordable Art Fair brand, and they’ve got quite a few I think they might be reaching about 20 different fairs across the globe. And they’ve been in Australia for the last three or four years, though there was a similar fair about 20 years ago, which I went to with mum and dad, which was called the Affordable Art Fair at the Royal Exhibition Building, where it is again this year. So it’s kind of a full circle moment for me anyway, being at it. Now but basically the pitch is that it’s every artwork’s between 110, 000. So it’s affordable, which not so much for me, but for other people, maybe.

[00:36:53] Tony: Well it’s a great thing for value investors, hey, to pick up something cheap.

[00:36:58] Alex: Well, And

[00:36:59] Cameron: we have a checklist, Tony? And now what’s the art checklist look like?

[00:37:01] Tony: Yeah. I don’t have one.

[00:37:03] Cameron: Okay. Sorry, keep going, Alex.

[00:37:05] Alex: that’s okay. Well, so I’m going to say I’m part of the young talent section, which would be kind of the, I guess, cause we’re pretty cheap comparatively and also we’re up and coming. So everyone in the young talent section is under 35, but most of us are really recent grads from different art schools around the country. So yeah, there’ll be five of us, but otherwise it’s all galleries. So we’re the only ones that are represented by the art fair themselves. And then there are galleries from mostly the Eastern seaboard. And I think a couple from New Zealand. that are going as well. So there’ll be 53 galleries, a wine bar, which is enough of a reason for some people to go, regardless of the art, and cafes and stuff. And it’s in the REB, so it’s quite pretty.

[00:37:47] Cameron: So you’re part of Young Talent Time, is what you’re saying.

[00:37:49] Tony: Yeah.

[00:37:51] Cameron: Close your eyes and I’ll kiss you to my… Don’t let Johnny Young get you alone. Out in the back room, that’s all I gotta say. Let me tell you about the time I repossessed Johnny Young’s car. Tony that’s a story for another time. Alright Alex got any questions for us this week?

[00:38:08] Alex: Yep, I’ve got a question from Max. I think it’s two, kind of wrapped in one. So he says, Hey guys, I always hear about Imugene on the CommSec podcast. Looks like they have a cancer treatment currently in trials. Nowhere near a QAV stock, but does seem to have made more progress than your typical junior biotech. If you are short of ideas anyway, maybe consider this one. The treatment does look promising. And then he has another. Question. So just listen to the backtesting of a 20% rule one. Tony was saying he used three years of data, which is great. My only query on that is that three years ago is when COVID hit. It’s been a very strange three year period, so not sure it is reliable enough for this type of change. The market has been super volatile. So stocks that dropped 15% one week went up 30% the next. In our typical bull market, if a stock drops 10%, there is probably more at play than just standard market moves. I’ll wait for the final results, but reckon it will need further backtesting in your typical market. I can hear Tony now saying what is a typical market, which is a fair point, but even he would say the last three years have been pretty unique. Oh, and then one last point. You can keep, you keep stating the performance of the DP as being 2. 5 times. Is it worth noting the performance of the like portfolios as well? Interested to compare the differences? Cheers, Max.

[00:39:20] Tony: Yeah, so a couple of questions there. ImuGene phew, I wouldn’t, I’d never touch these stocks they’re, bio, biostocks are very definitely in the tech stock category they’re all story, all promise, occasionally one works and you get successor bias which, which drags people into the industry when their friends tell them they made 20 or 30 times their money. on a particular breakthrough, their breakthroughs are very rare. They’re even rarer for Australian companies, even though I guess per capita, we have a reasonable record in terms of discovering and developing medical breakthroughs. But it just hasn’t been a part of our share market for a long time. And there’s been plenty of people who’ve tried and crashed and burned. So yeah, I mean, something like ImuGene, even if it. Does come off. It’s share price is suggesting it’s a long way from that. And yeah I can’t invest in it. I’m reminded of one time I did dip my toe in the biotech world and way back when I first started investing in it. I must admit it was prior to a QAV checklist, but it probably, from memory, the stock still had some good runs on the board and was making money. From memory, the stock was called Biota and it developed a product called ResMed, which I think is still on the market now, and it’s an antiviral inhaler. And the reason I did well at it was because I’d I did the old buy the rumor, sell the fact. So I bought it. The share price started going up a lot on the basis that they kept announcing they were getting closer to clinical trials in the US and then they were passing some, because there’s a whole series of stages in clinical trials, they were passing the early stages and getting close to FDA approval. And then the sort of day before the FDA was about to hand down their final approval and the share price was dramatically up, I sold it. I thought, well, Yep, it may go up a bit further if the FDA approves it, but it’s already had a good run, and it’s going to crash if it doesn’t. So I sold out, and that’s probably the way to play these stocks is to buy the hype, and then as it gets closer to reality, sell them.

[00:41:27] Cameron: And what happened?

[00:41:28] Tony: I actually can’t remember I… I think, from memory, I think it didn’t pass FDA approval, and the share price came down, or whatever the approval was, but then the company was bought out by one of the big, or the product was bought out by one of the big drug companies, Pfizer or Merck or one of those and the share price recovered a bit, but yeah. Yeah, so look, yeah, I mean, there’s so many other cases like this Imugene that you hear of from time to time. They generally are headed up by a, you know, really well qualified professor or researcher or clinician who’s had a storied career and they’re very volatile and very rarely Succeed. So that’s all I can say about this kind of stock.

[00:42:11] Cameron: Have you had a look at the chart for Imugene? IMU

[00:42:13] Tony: a look. Yeah.

[00:42:15] Cameron: at home. Looks like it floated back in December 1993. at about 30 bucks was its share price. It opened, actually no, it opened at 12. 56 and closed at 30. So, float price must have been around 12 bucks. Went up by June of 94, it was trading at 35. And then by February 2002, it was down to five cents. And now it’s trading at 7 cents. So

[00:42:49] Tony: That’s a long time to be listed.

[00:42:51] Cameron: if you bought when it was at 30 bucks and now, and you’re still holding because you believe you’re a big believer at 7 cents. Even like going back to October, November, 2021. It had this massive spike. It must’ve had some good news. It was up trading at 54 cents. It had been around like five, seven cents for 30 years, but all of a sudden it spiked up to 54 cents and now it’s back down to seven cents. So yeah, that’s a hell of a

[00:43:23] Tony: I have, I haven’t done a deep dive on it, but I’m guessing if I hear about a share price like that, there’s been capital raisings, which dilute the shares.

[00:43:31] Cameron: Yeah. Well there, I looked in their announcements, they’re just doing another one or just did another one actually in August, 35 million placement. So yeah, raising a lot of money over the years, I guess, to fund their research.

[00:43:46] Tony: Yeah. And there’s other examples. Mesa Blast brings to mind. I think that was either that one or so MesoBlast was one Company, the product is called SIR-spheres, it might be MesoBlast, I can’t remember now, but Yeah, there’s been people who’ve been around for a long time, and every now and then someone will come to me and say, Hey, I just went to this great lunch, and the guy made a presentation about this great medical breakthrough that’s about to happen, and they’re waiting for approvals, and blah, blah, blah, and I always say, yeah, it’s a, go to the casino, it’s a better, it’s a better deal than backing these companies,

[00:44:18] Cameron: Yeah,

[00:44:19] Tony: yeah.

[00:44:20] Cameron: alright, what

[00:44:21] Tony: And again, we don’t buy stocks on the basis of the story, even if it will cure cancer.

[00:44:26] Cameron: So Max thinks your three year time frame is a bit dodgy, Tony.

[00:44:31] Tony: Yeah, look, I have some sympathy with that argument. Unfortunately, that’s all we have the detailed data for because we need buy lists in the same format so that we can, you know, Run the process the same way we would the QAV since we’ve been doing it in a dummy portfolio, but we did have another year of data, but it wasn’t in the same sort of buy list format that it is now, so it was a bit tricky to use. So yeah, look I tend to agree with it. That’s why I think the rule change won’t come until I, trial it going forward with this, with, you know, a portion of the portfolio, maybe 10 or 20% of the portfolio of my portfolio and see you know, if it does make a difference to us. I’m just holding off for another week until I release the results because I had a couple of questions for Ryan who wasn’t available to work this week, but won’t be long before I can put out the information. You can decide for yourself whether it holds water. Yeah, look, I take the point it is, but the flip side of that is that our rules have to stand up in all types of markets. And I know I’ve hurt, and the DPs hurt in the last year or so from constant rule one selling, the sort of death spiral of buying something, selling it, buying something, going down 10% again and selling it. And yeah, the only way around that was to have a lower stop loss of 20%. So. It does make sense that, I mean, this, Max is right. This market condition may not happen again for a long time, 10, 20 years or whatever, but at least we’ll be ready for it when it does. So I’m turning, I’m leaning towards doing it, but I’m going to run it for a trial first to give me some more confidence.

[00:46:00] Cameron: And I am trying to get access to more historical company data and to get someone to build more of an automated regression testing system for us. You know, at some point, hopefully in the next 20 years, we will have the ability to just hit a button and regression test all sorts of different variables, but we’re not quite there yet.

[00:46:24] Tony: Well, in 20 years time, we’ll have 23 years worth of buy lists. So that’ll be enough.

[00:46:29] Cameron: And AI will be doing all of our investing anyway, so we won’t need to do anything. We’ll just say, yeah, just buy good stocks, AI. Give us better ones than you give everybody else. If you don’t mind. Give everyone else the shitty stocks. Give us the good ones. As for Max’s question about QAV Light Yeah, I do, I only really report on the light portfolios at the beginning of every month because there’s four of them and I just can’t be bothered doing it each week. And they’re a bit all over the place. So the thing with the light portfolios max is we started, the first one closed in April last year, I started it in February and closed it out in April and of course the Ukraine invasion happened in February, so the market was just, you know, terrible time to start a portfolio. So I think that one is still under water. The next one that I started in late April, May is killing it, it’s up like… 26% the last time I looked. So I don’t know why. Oh, I do know why. I think we had one of the, one of the News Corp stocks that had a big consolidation and gave back a lot of cash. Anyway, it

[00:47:41] Tony: Oh, that was a New Zealand one. Sky News.

[00:47:43] Cameron: Sky News. S k t, that’s

[00:47:45] Tony: SKT, thank you.

[00:47:46] Cameron: So we’ve got four light portfolios. 221, 222, 223 and 231. 221 was down 13. 4% since inception. The STW was up 2. 83, so it’s lagging quite a bit. 222 was up 25. 94% versus the STW up 10. 27. So that one’s doing two and a half times the… Benchmark. 223 was down 3. 68% since inception, which would have been sort of late 22, versus the STW up 9. 85. and two three one which we only closed a couple of months ago, was up 1. 02%, and STW was up 0. 79%, so they’re kind of neck and neck. So all up, the QAV group was up 9. 87%. Over sort of an 18 month period versus the STW, which is up 23. 74%. If I, you know, sort of take them all and add them all up. So, you know, it’s all up, it’s trailing a bit and you know, we’re looking for a, waiting for a good stretch. We’re waiting for a good stretch in the market where we can do our thing, but we

[00:48:59] Tony: Yeah, those live portfolios haven’t been operating for very long compared to the dummy portfolio, which has been around for nearly four years.

[00:49:07] Cameron: Yeah, and the Dummy Portfolio really made its bones coming out of COVID. You know, that, you know, sort of June 2020 to early 2022, it had a great run and, you know, that’s where we really got all of our gains. People who missed that you just gotta wait until the market has another sort of good run, I think. which we’ll have sometime in the next couple of years, probably if history is any guide. Alex, do you have any more questions?

[00:49:38] Alex: Nope.

[00:49:38] Tony: No follow ups. You don’t want to invest in gene therapy stocks or cancer drugs or whatever.

[00:49:44] Alex: no. Also, I think like, particularly like something like a cancer company too, it’s pulls on the heartstrings pretty strongly. So it’s always makes me feel cautious when it’s something like that. Yeah, that’s all. Thank you. See ya.

[00:49:59] Tony: Yeah, I definitely agree. It’s the same thing with ESG investing. I feel too, that sometimes people want to do the right thing with their money and there’s nothing wrong with that. But you know, don’t get too starry eyed about doing good for the planet and getting bad returns along the way doing it, you still got to be pragmatic about it too, I think, cause it’s investing for your future.

[00:50:18] Cameron: And there’s no harm in taking some gambling money and throwing that behind some of these things. Some, you know your horse racing money.

[00:50:26] Tony: Horse racing money. Yeah, I mean very small amount. I don’t mind experimenting. You’ll learn the hard way with stocks like this, unfortunately. And you got to be careful because if you do happen to pull the lever and get triple seven on the slot machine from your one time in the biotech space, don’t go and put the rest of the portfolio into the biotech space because that’s a problem.

[00:50:48] Cameron: Yeah, I know how to make this

[00:50:49] Tony: Yeah.

[00:50:50] Cameron: Look at that, I’m a genius!

[00:50:53] Tony: And I’m sure like I’m sure if we had someone on the show who was an investor in this space, it’d be like the people who, you know, do venture capital startups. They’ll have a whole portfolio of a hundred of these companies, hoping that one shoots the light, becomes a unicorn, shoots the lights out, and the rest they can just get rid of over time.

[00:51:10] Cameron: Alright, thank you Alex, thank you Max. We’ll do the last question. Then we’ll get into after hours. Glenn, a couple of questions for TK actually. What are his thoughts on why companies raise capital via a share placement at a significant discount to the share trading price using Core lithium? In parentheses, I’m not an owner. As an example he sent me a PDF. They announced a hundred million dollar placement at 40 cents, which represents a 26. 6% discount to the last closing price of 54 and a half cents on the 15th of August, 2023, Napoleon’s birthday. He didn’t write that. I’m just adding that in. Side note, in case you forgot, and 30. 2% discount to the five day volume weighted average price of 57. 3 cents as at 15th of August 2023, Napoleon’s birthday. Only 243 years, not 343 years as I said on the show, as I was doing the math when I was editing again. This company is an explorer and has years of negative cash flow. Does that limit their capacity to borrow, issue bonds? or other means at reasonable rates. I’d imagine most companies would be able to borrow or issue bonds at rates less than 10%. So in this case, are they issuing new shares as they are trapped for cash, and lowering slash destroying the share price is the only mechanism? In a hypothetical situation, if Tony was running a similar company, what options would he explore to raise capital? Has he experienced a 25 plus percent discount placement raise with a QAV stock, which have positive cash flows? Then he sent me a screenshot about their share price. They dropped 24.77% in a day by the looks of it. Yes. What are your thoughts on Glen’s questions about core lithium? Tony,

[00:53:03] Tony: Yeah, well, it’s we see it happen all the time. We’re just talking about Imugene before, similar sort of situation. So these are companies that aren’t making money. So it’s pretty hard for them to be able to go to a bank and say to the bank, yeah, lend us some money, we’ll pay it back because it’s, their future is. is reasonably uncertain. This company does have a fair bit of cash on the, in the bank, on the books, but it is burning through it also quite quickly as well, which is why it’s raising some more money now. So yeah I tend to think that using script to raise money, which is what’s happening here is the lender of last resort. There is a, I mean, there is A school of accounting called Weighted Average Cost of Capital, which allows you to calculate whether it’s cheaper to issue a bond, or take on debt, or use script. But in this case, given that they’re not making money, it’s issuing script. Similar sort of story to the biotech sector. They’re funding their future through issuing more shares. I imagine it’s not something they’d like to do because, you know, the value of all their own holdings is being diluted as well. Typically, what should happen is that They announced the issue and then the share price should take into account the dilution and rate down, which it seems to have done this, but a little bit more than that. So I think the dilution was 16% and the price drop is 25%, so you know, the market hasn’t reacted kindly to what’s going on, but it it should have probably only fallen about 16%, generally that’s the math, is that you’re diluting the stock

[00:54:36] Cameron: Where are you getting the 16% from?

[00:54:38] Tony: Yeah, so the company is, has issued 100 million shares and a further 100 million worth of shares, a further 20 million available in a share purchase plan. The current market cap is 7 53, so that’s about 16%. new share value being issued which generally is what the share price would drop, all things being equal. This has dropped a bit further than 16%, it’s dropped about 25%. So the market just hasn’t been happy stumping up hasn’t been happy to return, to put more money into this company. That’s about all I can say. I mean, in terms of alternatives I don’t think a bank would lend them money. I know they’ve got assets like property, plant and equipment and I guess mines. I don’t know how the bank would ever take security as a mine given they’re not miners. So that’s different to like if it was a house when they can, they know they can flip the house and get their money back. So banks are going to find it hard to sell. And typically that’s what the bank wants. I guess the bank will want um, A, the ability to repay the debt And, you know, loans are decades long, so they’ve got to convince themselves this company’s going to be around for the length of the loan, and then they’ve got to have some kind of security, which is probably their other main focus, and there’s, apart from a hole in the ground, if this company can’t make that profitable, then I’m not sure how the bank can make it profitable. So they wouldn’t see much security here either. So that rules out debt, for the most part, I would have thought. Issuing a bond is an option, but again this would be a junk bond because it’s being issued by a company that’s not making any money. So again, the market would say, well, how do we know you’re going to be around to, you know, if it’s a 10 year bond, how do you know you’ll be around for 10 years or whatever, if it’s a five year bond bearing that in mind, if they did issue a bond, I would think it would have to be at a a very high coupon rate, so you know, it… I’m not sure what junk bonds are going for now, but it would be up around 15% I would’ve thought in this kind of market. So that’s gonna cost them a lot as well. Every year they’re paying that, so a hundred million dollars is on, $120 million is on issue. Even if they’re, they get a bond away at a 10% coupon, they’ve gotta find 12 million bucks a year to. Pay the bondholders and they’re already cash flow negative. That’s just going to shorten their run time before they burn through all their cash. So the benefit of issuing new shares, even though it hurts the current shareholders, which is probably management as well, is that it doesn’t hurt their profitability. So they don’t have to fund either debt or the bond issuance out of their dwindling cash flows. So that’s, that’s probably the most attractive solution for them. It does. Put the asset on them though to hurry up and get the mine built and profitable. And I know I had a quick look at them today when the question came through and they’re talking about having five years before the mines up and running. So, and it sounds like they’ve changed management to try and focus on that, which I think is a good thing. So you know, I’m not saying this is necessarily a bad situation, but it’s a common situation when you’re investing in companies that aren’t making. Profits and don’t have strong cash flows, it’s highly likely that they’ll come back to you and ask for more money at some stage, whether it’s a mine, whether it’s a tech company, whether it’s a biotech company, that’s just the way they operate. And I imagine that the pros in this area don’t give all their money up front, they probably hold back some for the round two investment, the round three investment, etc, which they expect to be coming down the track based on the history of this kind of stock. So, yeah,

[00:58:12] Cameron: One thing I learned at pimp school, Tony, is you never let your pro, you never let your pros hold on to money. Always get the money from the

[00:58:19] Tony: Well and that’s, you know so Glenn asked what I would do. And I think the,

[00:58:25] Cameron: You’d just open up, you’d just open up your piggy bank if you needed a hundred mil to fund it, wouldn’t you? You’d be just like, yeah, under the, what’s under the couch?

[00:58:32] Tony: Take the company private, but no, well, this, again, this is a bit like the the biotech space. I’d hire a CEO who was a really. or he or she was a really good salesperson and was great at rattling the can in front of investors because that’s the best hope this company has is the ability to raise more money until it becomes profitable which is always going to be a you know a it’s a crash through or crash type strategy so hopefully they know their stuff well enough to be able to build the mind and people get their money back but we’re getting into the whole area of the sunk cost situation again where you need to keep putting good money after bad just to get the good money back and it’s never a great situation to be in.

[00:59:12] Cameron: Have you had a look at their chart?

[00:59:13] Tony: Yeah.

[00:59:14] Cameron: Again, another one of these companies like Imugene, been around a long time. Looks like they floated back in early 2011 at around 13 cents, quickly dropped to about 3 cents and sat there. ever since until late early 2021, went from 4 cents up to. 1. 40 by August 2022. So a year ago, they’d gone from 4 cents to 1. 40. Now they’re back down to 40 cents, but that’s a crazy run.

[00:59:52] Tony: Yeah. And the lithium boom was behind that. And the question I’ve got to ask is, you know, PLS is on the buy list. It’s a lithium miner, which is throwing off lots of cash right now. Why wouldn’t you invest in that over a company like this, which is still trying to get established and taking risks and requiring further investment to do so?

[01:00:13] Cameron: Unless they’re joining Elon Musk to send robots out to one of the moons of Jupiter or something, where they’re going to mine lithium in Ceres or somewhere like that.

[01:00:22] Tony: Well that’s for 10 years down the track when I need more money. Right. That’s, the story there.

[01:00:27] Cameron: Right. I think that’s the plot of one of the Apple TV shows for all mankind. It’s like an alternative Cold War history show and they’re fighting over lithium mining in the remote regions of the solar system or on the moon or something. I don’t think the moon’s got any lithium, but yeah, I think it’s something about space race. Lithium mining is the one of the main plots of that show I’ve heard. Good stuff. Well, there you go, Glenn. I hope that helps. Probably not much. Wouldn’t touch it with a barge pole as Tony’s basic summary there. Well that’s the show for this week, TK, After Hours.

[01:01:04] Tony: Yeah, well, we’ve already touched on that. We had Alex up, which was lovely with Sean celebrated Jenny’s birthday. And watched lots of soccer, lots of women’s soccer. Well, Sean’s a Mad King soccer supporter and his sister actually came up when they went back and stayed with us and she went to the FIFA Female World Cup Final on Sunday night, so she was pretty excited about that. Lovely to have her with, stay with us. Real treat, but yeah, it’s the real zeitgeist, as we were saying before, this women’s FIFA. World Cup, at least in Australia, I hope it’s catching on around the world, but it seems to be like a turning point in female sports, which is a great thing.

[01:01:41] Cameron: I actually broke my rule and watched the Matildas play England because Fox wanted to watch, so we figured out how to watch it, and it was fun. I enjoyed it, yeah, really enjoyed

[01:01:50] Tony: Yeah.

[01:01:51] Cameron: yeah.

[01:01:51] Tony: Yeah.

[01:01:52] Cameron: Not a good outcome for the Matildas, but you know, I

[01:01:55] Tony: game you watched it was a losing game.

[01:01:57] Cameron: Well, it wasn’t losing for England. I mean, I don’t really care who wins. I thought England played really well at the end there. I thought under pressure last, few minutes of the game and they pulled out another couple of goals and, they really, had it where it counted in the last, really took the steam out of the Matildas ability to fight back at the end there. And I thought they did a great job. Yeah, well that’s it. So that’s my one game of sport I’ve watched now. I don’t need to watch another one for five years. I’m done.

[01:02:22] Tony: So why did Fox want to watch it? That’s an interesting thing, isn’t it really?

[01:02:26] Cameron: I think you’ll his friends at school were all talking about it and there’s just like the Matilda’s marketing has been insane. I don’t know what it’s like down there, but up here it’s everywhere and You know, the Coles giveaways and Woolies giveaways or something to kids. It’s just Matilda’s trading cards and stuff like that. He was telling me like a while ago, Oh yeah, like Sam Kerr’s my favorite player and I’m like, you do you ever watch Sam Kerr plays? No, but you know, she’s my favorite kind of thing. Yeah. They’ve done a great job at marketing it. You know, whoever’s behind the whole. campaign has done a tremendous job, I think.

[01:03:06] Tony: very good.

[01:03:07] Cameron: They even our Kung Fu school let us out 15 minutes early that night, so we could all get home in time to see the Matildas game. So I

[01:03:15] Tony: right.

[01:03:16] Cameron: was like, well, shit, if I’m missing out on Kung Fu, I bet this better be a bloody good game. And in my last 15 minutes, I don’t know if you can see, but I’m covered in, I’m covered in scars today. You know, my busted lip, busted cheek. It’s from sparring on Saturday. I get the shit kicked out of me by a variety of people.

[01:03:35] Tony: Sam Kerr?

[01:03:36] Cameron: Cause I didn’t care who won the

[01:03:37] Tony: Yeah.

[01:03:38] Cameron: She hunted me down. Well, I’ve been reading a couple of great books, Tony. I mentioned Vaclav Smil’s book on energy, which is really great. And you know, energy is, it’s one of those things I’ve been having arguments about with people for. You know, ever, decades. It’s a bit like the conversation we had about time a few weeks ago being a construct. Energy is a construct. It’s an abstract concept. You know, you probably don’t sit in as many hippie kind of rooms as I do, but people start saying, well, you know, we’re all made of energy. And I go, really? What is that then? Explain to me what an energy looks like. Well, you know, everything’s made of energy. Eh, is it though? Do you know what that looks, do you know what energy’s made out of? Energy. It’s just it’s a gap filler. Energy is the word that scientists use that when we do, when something’s happening and we don’t know what it is, we go, well, it’s energy. It’s potential energy. It’s kinetic energy. It’s when something is happening, we say that, well, there’s energy happening. What is it? We don’t know. Richard Feynman famously said something about, you know, energy’s like one of the great mysteries. We don’t know what it is, we don’t know how it works, we just know that something’s happening so we have to call it something so we say it’s energy, but no one knows what it is. It’s just the ability to do work. That’s, you know, so Anyway. Anyway, I’m reading Vaclav Smil’s book on energy, which is really And then I started reading Jorge Luis Borges Uh, one of his collections of short stories. You ever got into him? I got the feeling you’d be down, you’d be right into this guy.

[01:05:15] Tony: Nah, never heard of him.

[01:05:17] Cameron: Oh, massive, like probably one of the most revered Latin American writers of the 20th century, died in the eighties. He’s up there with Gabriel Garcia Marquez as one of the great, but he mostly wrote short stories, but very sort of philosophical stories that are mind bending, surrealist, touching on physics and science and time and the universe. But I’ve only read one at the moment, which is, which was fantastic. It’s about, it’s written like It’s non fiction about, it certainly was evident in conversation with a friend of his, and the friend gave him some quote that he really liked, and he said, who’s that quote by, and he said, well, it’s this guy who was the heresiarch of Tlön, and I read about it in this encyclopedia, and then they go and look in the encyclopedia, and it’s not there, so then they go, and it’s like this imaginary country that no one really knows much about, and that’s been hidden from everybody. And then they find out more about it. And these people have their own maths, their own form of science, their own language, which has no nouns or verbs in it. And it’s this long exploration of this fictional society and their mythology and how their mythology presupposes this planet with all this, where this, all the stuff happens. And then over the course of this short story, which isn’t quite so short. This mythology of this place becomes so popular that it starts to take over everything on earth, all of our science and math and mythology starts to get replaced by theirs, and this is, it’s anyway, it’s great, it’s a really good read, I highly, if you’re looking for something. Really engaging to read. Jorge Luis Borges, B O R G E S, Borges, but Borges, I think is how they pronounce it in Spanish, Argentinian. Yeah,

[01:07:08] Tony: Ballhay, maybe?

[01:07:10] Cameron: something like that. Anyway, Borges, probably, yeah. Anyway, it’s a really good show.

[01:07:15] Tony: Yeah. Today’s episode’s being brought to us by SBS.

[01:07:18] Cameron: Well, it kind of reminds me of you know a little bit of Catch 22 guy. Joseph Heller. yeah, a bit of him. And also who was the other guy? You put me onto his books years ago, the World War II stuff. He was actually in Oh, Vonnegut. yeah, Vonnegut.

[01:07:37] Tony: Oh, I love Vonnegut. I love Heller as well.

[01:07:39] Cameron: it’s a little bit like, you know, Latin American version of these guys. I found sort of really that, which is why I thought you’d be all over this guy. It’s that sort of, that’s what it reminded me of, you know, really engaging stories that are a little bit surrealist and, but really smart. And anyway, yeah,

[01:07:59] Tony: You ever read Breakfast of Champions by Vonnegut?

[01:08:02] Cameron: yeah, you put me onto it, like,

[01:08:03] Tony: Ah, okay.

[01:08:04] Cameron: 8 years ago, and, yeah, I just loved it, just, thought it was fantastic, yeah.

[01:08:09] Tony: Yeah! Just covered all the things we’ve been talking about. No free will. Yeah. I forget what the other things were, but it was like our conversation had been written down in a book by Vonnegut.

[01:08:18] Cameron: Yeah, I really love, like, those guys, and, you know, I love Philip K. Dick’s stuff for a similar reason. People who can take deep, scientific or philosophical ideas, but also just put them in a really engaging story that can take you to a different place and mess with your head. Get a kick out of that.

[01:08:37] Tony: Yeah. right.

[01:08:38] Cameron: What I should be reading at night is all the preparatory material so I can sit the RJ 46. I keep telling myself I should be reading that at night, not reading fun, philosophical stuff. So that’s my, one of my goals for this week is to read that instead.

[01:08:55] Tony: okay. Yep. You’re sitting the exam, hey?

[01:08:58] Cameron: Yeah, I gotta sit the exam and I’ve been saying that, but I gotta, I just gotta find the time to do the reading, so, I figured the only time I have to read is at night. So I used to sit down for a couple of hours every afternoon and just try and knock it

[01:09:10] Tony: off.

[01:09:10] Cameron: yeah, right.

[01:09:11] Tony: Yeah.

[01:09:12] Cameron: Well, I’m going to try and get that done over the next couple of weeks.

[01:09:15] Tony: And it doesn’t stop because I still have to keep reading the, you know, whatever it was, 20 hours a year, Tend to do in the last month or so.

[01:09:22] Cameron: I’m just gonna feed it all to ChatGPT and say, summarize this for me so I can understand it , and then use it to, I’m gonna use ChatGPT to test me too. Gonna feed it the documents after I’ve read them and they go, okay, ask me questions. Send me a test based on this and get it to test me, so before I set the actual test. So I’ll see how that goes.

[01:09:43] Tony: Yeah. Good.

[01:09:45] Cameron: All right,

[01:09:46] Tony: good luck. It’s a big thing.

[01:09:48] Cameron: Thanks, Tony. Hope you’re feeling, hope you feel better by the time we talk next week.

[01:09:52] Tony: Yeah, thank you, so do I. Oh, actually, I’ll be away too. I’ll probably be calling in from Wagga, I think.

[01:09:57] Cameron: Too sick to travel, man, what are You doing? You wanna go to Wagga?

[01:10:00] Tony: hopefully I’ll be done by Monday.

[01:10:02] Cameron: Wagga’s a swamp.

[01:10:03] Tony: Wagga.

[01:10:03] Cameron: That’s why you get sick. That’s why you’re sick in the first place. Going to

[01:10:07] Tony: all these different germs, all exposed to the different climates, microclimates. Yeah, so while I go pick up Ruddy, we’re going to Melbourne for Alex’s art show.

[01:10:15] Cameron: Back down to Melbourne.

[01:10:16] Tony: so I’ll be, so we’ll go next, next Tuesday and then Cape Shank the Tuesday after, and then I’ll be coming back up after that on the Wednesday.

[01:10:24] Cameron: Not staying down this time.

[01:10:26] Tony: No, I’ve got a a golf tournament in Coffs Harbour.

[01:10:30] Cameron: Oh, lovely.

[01:10:31] Tony: yeah, play there.

[01:10:32] Cameron: Love Coffs Harbour. Lovely little… Thinking about retiring there.

[01:10:36] Tony: okay.

[01:10:37] Cameron: It’s

[01:10:37] Tony: well as Jackson, as well as Jackson Hole,

[01:10:39] Cameron: Before Jackson Hole. Yeah, I’ll get, well, I’ll retire to Coffs Harbour while I wait for the US Civil War to play out and the you know, the radiation levels to dissipate, but yeah, Coffs Harbour, nice temperature. Like, it’s sort of nice sort of perfect temperature there all year round, I think, up around that sort of northern New South Wales

[01:10:57] Tony: yeah, it’s a lovely area.

[01:10:58] Cameron: Yeah, not great when bushfires go through. I got a good mate there, went to high school with who is a principal of a school there. And yeah not great when the fires hit a few years ago, early 2020 or whenever it was, late 2019. Where were the fires? Around about then, I think.

[01:11:13] Tony: before the floods,

[01:11:14] Cameron: Yeah, somewhere in between the floods and COVID there were, there was fires. All right. Thanks TK.

[01:11:19] Tony: right, okay,