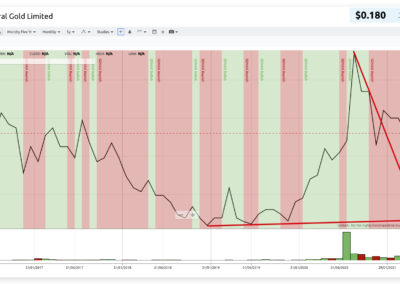

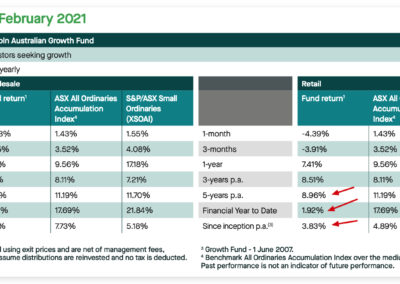

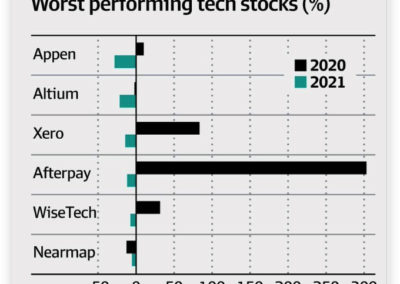

This week: MRC fired their CEO and the price dropped 25% – why didn’t we sell?; Lincoln fund results; ASA webinar by James Holt; WAAAX performance 20/21; CVL down 13% since we bought it; MAH groundhog; Flitman model is out; red flags for companies that might go into a trading halt; why share prices fall after they go ex dividend; how TK decides what to sell when he needs to take cash out of his portfolio; commodity stocks sell lines; sentiment for HAW, AGD, AIS; is GCY now a sell?

Related

QAV 730 – Consistency Is The Key

In this episode of the QAV podcast, we look at recent news involving SGI, ATP, FGM, CVL, AX1 and a deep dive into ABB’s recent share price drop and business fundamentals. We discuss listener Conrad’s successful modification of the QAV investment system, which led to a 31.4% return in the last year and review some advice from O’Shaughnessy’s ‘What Works on Wall Street’ regarding consistency in investing. The after-hours segment includes discussions on examples of outstanding customer service, the benefits of rural call centers, and U.S. politics. We also chat about Tony’s recent golf win, film reviews of ‘Stingray’ (1976) and ‘The Assassination Bureau’ (1969), and recommend the music of The Jim Carroll Band and Grace Cummins and the Doctor Who site, stitchesintime.

QAV 729 – The Trump Bump

In this episode of the QAV podcast, hosts Tony Kynaston and Cameron Reilly are discussing a record-high in the All Ordinaries index spurred by the ‘Trump bump’, Aussie Broadband’s sudden dive (ABB), portfolio results, more FY survey results, MLX‘s bump, the Shipping Crisis, thoughts about integrating “Buyback Yield” into the checklist, and Tony breaks down the history and market stance of Elders Limited (ELD) in a detailed ‘pulled pork’ segment. They also explore the Apple Vision Pro’s new features and its future alongside immersive tech like Oculus Rift, then shift to the political scene with discussions on Trump’s influence on global conflicts. The conversations touch on AI, Elon Musk’s ventures like Neuralink and SpaceX, horse racing updates, book recommendations, and reviews of ‘Better Call Saul’ and Tom Cruise films.

0 Comments