Hello QAVvers

You spoilt the game

No matter what you say

For only metal

What a bore

RIP to Steve Harley. TK mentioned in our chat today that “Make Me Smile” is actually a sad song, talking about the Cockney Rebel band breaking up. But for some reason people never listen to the verses, only the “Come up and see me” chorus, so it’s usually thought of a fun, happy song.

I mention this because I heard from one former QAV Club member this week who said he broke up with investing after his portfolio took a hit last year. Sadly, he missed out on the huge run the market has been on since the beginning of November. The market, like life, goes in cycles. “Make Me Smile”, a bitter song about a break-up, turned out to be the Cockney Rebel’s biggest hit.

Let’s have a look at the portfolios.

QAV PORTFOLIO REPORT

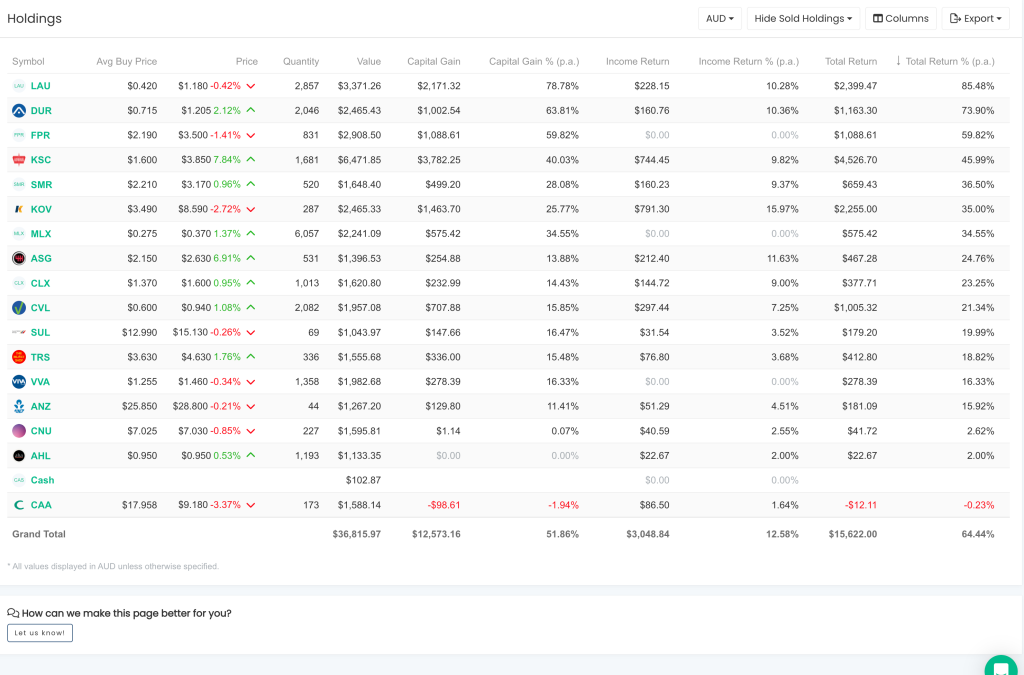

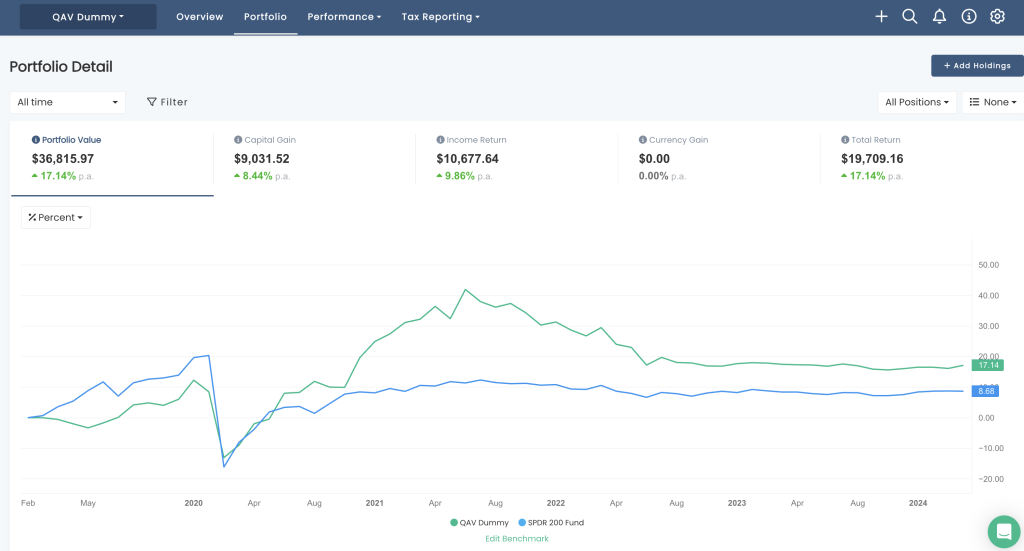

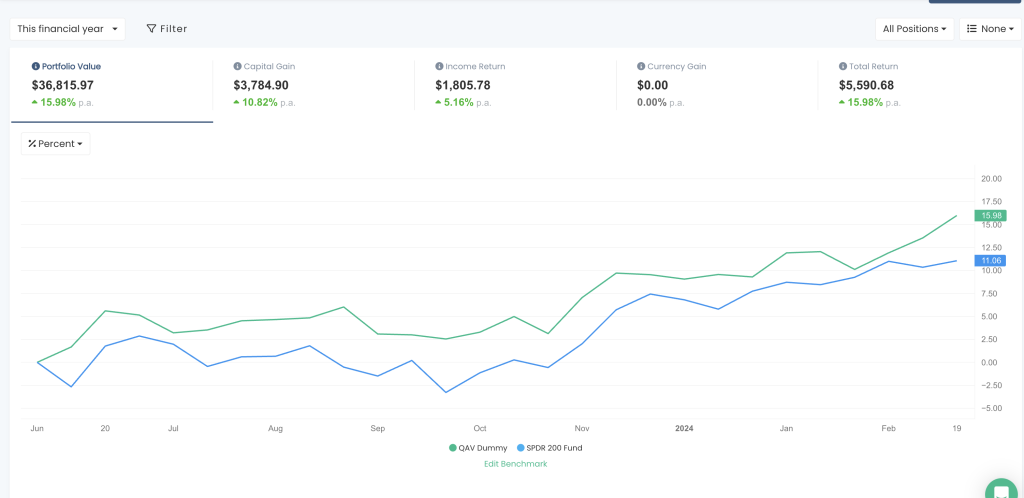

The Dummy Portfolio is performing well against the benchmark over most time frames.

CURRENT HOLDINGS

SINCE INCEPTION (15/04/2019)

Our portfolio is still doing slightly less than double market p.a. since inception (roughly five years). In real terms, the value of the portfolio has increased 75% in 5 years.

CURRENT FY

We’re outperforming the benchmark for the FY, too.

The best perofrming stock in the portfolio during the last week was KSC (+19%). I have no idea what’s going on there. Their last announcement was 21/02/2024, a month ago.

RECENT TRADES

No trades in the last week.

QAV STOCKOPEDIA DUMMY PORTFOLIO REPORTS

QAV AU DUMMY

The Australian Stockopedia portfolio is still underperforming since inception. But its performance since 20 July 2023 is about the same as the 231 Light portfolio, so I don’t know if the performance has anything to do with the Stockopedia limitations.

QAV US DUMMY

The US portfolio is doing okay, but still underperforming the S&P, which, as we know, is largely being driven by the Mag7 stocks, Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla.

STOCKS OF THE WEEK

** As always, please check our work, DYOR, and consult a financial advisor before making any investing decisions.

BUY LIST

Each week we produce a buy list that we share with our members. The intended primary purpose of this buy list is for club members to use as a reference for comparing their own buy list. In theory, all of our buy lists should look pretty similar each week.

As always, please check our work, DYOR, consult a financial advisor before making any investing decisions.

THIS SECTION CONTAINS CONTENT WHICH IS VISIBLE TO QAV CLUB SUBSCRIBERS ONLY.

LAST WEEK’S EPISODE

This week: Delisting of TGA, VUK acquisition, Pulled pork on BOQ.

In the Club edition only: SD fix NWS issue, IRI loses Chair of Audit Committee, Tony’s testing on 2BL sell trigger, Tony answers questions about how to manage a portfolio if you move overseas, reducing our average daily trades to mitigate risks of the QAV spike, the risks of cap raises, different ways how a

Episode Transcription

QAV 711 Club

[00:00:00] Tony: 3.

[00:00:11] Cameron: Welcome to QAV episode 711. 711 is kind of a 911 here, had technical issues. Um, this is the 12th of March, 2024, TK. How are you?

[00:00:25] Tony: Good. Good. It’s 2. 2024. So I’ve had half an hour of

[00:00:31] Tony: fun and games.

[00:00:32] Cameron: It’s time to go to the dentist, 2. 30. Um,

[00:00:35] Tony: ha ha ha

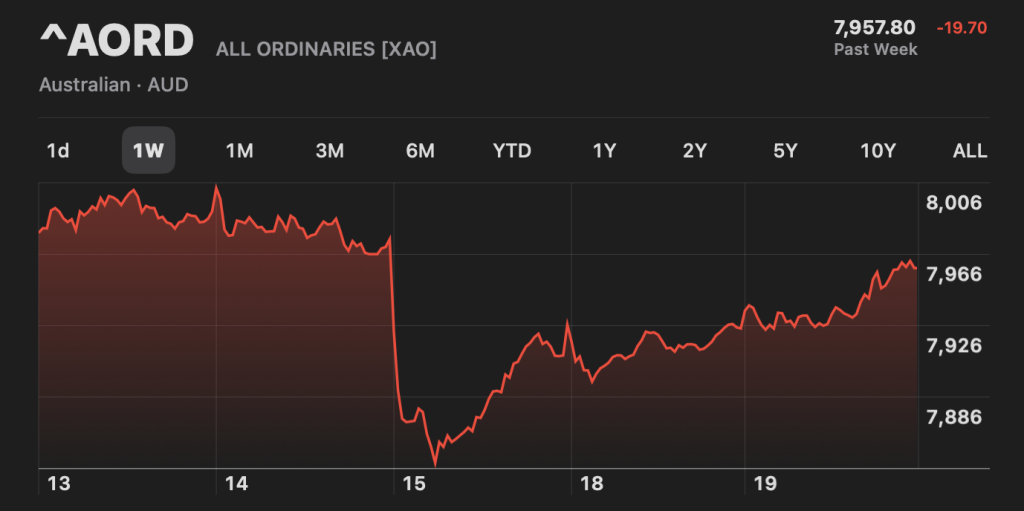

[00:00:37] Cameron: bit of a wild and crazy week on the stock market, Tony.

[00:00:40] Tony: Ooh, yeah, especially yesterday.

[00:00:42] Cameron: Yeah. For anyone paying attention, it kind of was going uppity uppity up last week, and then Monday just crashed back, back to where it was at the beginning of the week, really. It’s not like it’s fallen by that much, you know, in the grand scheme of things.

[00:01:00] Cameron: uh,

[00:01:00] Tony: but it was almost a 2 percent drop in a day, which is

[00:01:02] Tony: unusual.

[00:01:03] Cameron: yeah. So what happened, uh, to cause that? Did you, uh, make any sense of it?

[00:01:11] Tony: Oh, if you believe what you read, there was, uh, there’s some CPI figures coming out in the States tonight, I think. And so traders were taking profits in case the numbers were bad. It’s been a strong, I mean, the US market’s been far stronger than we, our market has. So there’s been some profit taking in

[00:01:31] Tony: case of uncertainty.

[00:01:33] Cameron: Right.

[00:01:33] Tony: So we’ll see what happens tomorrow.

[00:01:35] Cameron: Hmm.

[00:01:36] Tony: Hmm,

[00:01:36] Cameron: Well, always, always fun and games. Um, I’ve got a pulled pork request to add, uh, to the list. Um,

[00:01:47] Tony: I was going through the list yesterday. I thought, I bet your cam’s going to ask for that one.

[00:01:51] Cameron: wow, you know me so well,

[00:01:53] Tony: I almost

[00:01:54] Tony: started prepping it and I thought, well, it’s got an ADT of about 1, 000. I thought, no,

[00:01:58] Tony: I can’t do

[00:01:59] Tony: that.

[00:01:59] Cameron: Oh, this is LVE, Love Group. Love Group Global. Uh, I had a quick look at it. Bunch of sex toys, I think. Sex toy,

[00:02:09] Tony: no?

[00:02:10] Tony: no, dating app, dating

[00:02:11] Cameron: Oh, is that all? Damn, I wanted to hear you talk about sex toys for

[00:02:14] Cameron: half an hour. Ha,

[00:02:15] Cameron: ha, ha, ha. Uh, dating app, oh well, yeah, still fun, but maybe not worth it if it’s got that low an ADT. Um, we, I did notice, uh, at some point in the last couple of days, Tony, that TGA, Thorn Group Limited, delisted at the end of last year.

[00:02:39] Cameron: I couldn’t, I had a look through the notes, I couldn’t see that we talked about that at all. Do you remember us talking about that?

[00:02:45] Tony: Yeah, it was taken over from memory, wasn’t it?

[00:02:48] Cameron: Yes, a company called Summers Limited acquired all of the shares.

[00:02:52] Tony: Right.

[00:02:53] Cameron: Well, they were, they were sort of a bit of a, um, Regular on the buy list TGA, I don’t think we bought them very often though, there was some, some issues with them I think, I can’t remember what it was, but they didn’t really end up. Being bought a great deal, but, uh, yeah, gone.

[00:03:12] Cameron: Part of that thing you’ve been talking about for the last couple of weeks, just M& A activity, taking companies off the ASX.

[00:03:20] Tony: Including, we both picked up on this one,

[00:03:23] Tony: VUK.

[00:03:27] Cameron: of drinking champagne and our, uh, Facebook group, uh, picked it up. Well, the people that for some reason managed to still hold Virgin UK, it’s being acquired, share price shot up. 30 percent in a day and I didn’t own it. I had to rule one it around 2. 90 a while back.

[00:03:48] Cameron: So I was furious that I didn’t hold on. That would have been a good one to have. Congratulations to everyone that

[00:03:56] Tony: Yes. Yes. Congratulations.

[00:03:58] Cameron: to it.

[00:04:00] Tony: And that’s what, I mean, it’s what we were talking about last week and the week before, the shrinking ASX, and someone asks, is it good or bad? Well, this is a case where it’s good.

[00:04:07] Cameron: Mm.

[00:04:08] Tony: And probably Thorn Group was too. I don’t remember the details, but I think Thorn Group was

[00:04:12] Tony: probably taken over at a premium as well.

[00:04:15] Tony: Both companies on the buy list.

[00:04:17] Cameron: Yeah. Yeah. So it’s good if you hold them. Um,

[00:04:21] Tony: Yeah.

[00:04:22] Cameron: did, did you hold v UK last

[00:04:24] Tony: I didn’t. I had it. I had owned it in the past and I was thinking about buying it again. A couple of times I had a look at it, though it was a Josephine, so I didn’t get it when I had money to spend. Um, but yeah, I’ve always liked it, um, ever since it first came on the buy list a couple of years ago.

[00:04:41] Cameron: Mm, I’ve bought and sold it a bunch of times over the last few years and had to rule one it, I think, on a number of, um, number of, uh, buyers. But there you go. So that was a nice win for people that hold onto it. They’re being taken over by who? Exactly.

[00:04:58] Tony: uh, the company’s called Nationwide Building Society. So the background story of the Virgin UK is it was owned by NAB, National Australia Bank, um, many years ago when they expanded overseas. And then when that didn’t work, they spun off What was called back then the Clydesdale Banking Group and it rebadged as Virgin UK, but and it had a dual listing, but most of the most of the shareholders were still Australian based, something like two thirds, I think, because of the fact that they used to be National Australia Bank shareholders.

[00:05:33] Tony: And, uh, Yeah, it’s, it’s, um, it’s been listed here, um, listed over there and now being taken over by a building society in the UK and bulking, bulking it up with the combined, the combined network of both bank branches and technology, et cetera.

[00:05:51] Cameron: And paying a massive premium in order to grab the shares.

[00:05:54] Tony: Yeah, that’s right.

[00:05:56] Cameron: Well, that’s what happens when you buy shares that we think are undervalued. Um, other people think they’re undervalued too sometimes. That’s the, that’s sort of part of the plan.

[00:06:10] Cameron: Um, Well, uh, what else have I got in my list of things to talk about?

[00:06:16] Cameron: NWS, um,

[00:06:19] Cameron: somebody, yeah, somebody’s

[00:06:22] Tony: Hahaha.

[00:06:23] Cameron: attitude. Somebody pointed out, uh, about a month ago that the shares outstanding figure in Stock Doctor, that was you, was it? It looked wrong.

[00:06:36] Tony: Because, I saw, actually last time this happened I bought them,

[00:06:40] Tony: must have been six months ago with their last results. And then realized there was a mistake in the number of shares outstanding in Stock Doctor.

[00:06:46] Cameron: So when you let me know I reached out

[00:06:48] Cameron: to Victor at Stock Doctor and asked him to look into it. He said he would and then a month later got back to me and said yeah the number was wrong and they’d fixed it. But anyone using Stock Doctor to do their analysis on that for the last month would have been getting bad, bad numbers.

[00:07:05] Cameron: So it’s disappointing that it took him that long to fix a data corruption

[00:07:10] Tony: Well, especially when it happened last half as

[00:07:12] Tony: well,

[00:07:13] Cameron: Uh,

[00:07:13] Tony: that is bad. You think you’ve, you know? Dyeriser note or make a

[00:07:17] Tony: code change. So it didn’t happen again, but it’s a shame to say it did.

[00:07:22] Cameron: Yeah, or, you know, when I pointed out that it had happened previously and then it happened again, it took them a month to, should have only taken them ten minutes to look into it and figure out it was wrong, I don’t know why it took so long. Uh, there’s a company called, um, IRI, Tony, uh, Integrated Research Limited, they’re, they were on the buy list, uh, this week.

[00:07:49] Cameron: I nearly bought them for the dummy portfolio until I went and read through their announcements and I saw this, Sydney 6th of March, Integrated Research Limited today announces that Miss Cathy, Ms. Cathy Astin will resign from the board with effect from the 31st of March 2024. Ms. Astin has been a Director of Integrated Research since April 2022.

[00:08:13] Cameron: During her tenure, Ms. Astin served as Chair of the Audit and Risk Committee. The Directors have accepted Ms. Astin’s resignation with regret. I was like, when the Chair of the Audit and Risk Committee suddenly resigns, I’m not sure that’s a good sign. I painted that as a red flag. I know we normally say CEO, CFO, but when your chair of your audit and risk committee all of a sudden, suddenly pulls the pin, it could be nothing, it could also be, no, I’m refusing to sign off on this audit.

[00:08:48] Cameron: So I decided to leave it alone. What do you think? What would your reaction be? Mmm. Mmm.

[00:08:54] Tony: Uh, it’s hard to say. Um, it’s, it’s yeah, I don’t know. I mean, I had a look into it and there’s been three resignations of directors in the last six months. So that’s not a good look. However, if you look at the share price, which is, which is Tanked, um, in the recent past. I suspect there’s a bit of board renewal going on.

[00:09:16] Tony: for directors taking responsibility for bad performance, perhaps. So that could also be the reason, as could any other reason. But yeah, it’s either board renewal, I think, or there’s something, something wrong,

[00:09:28] Tony: um, with the company to see three going in six months is unusual.

[00:09:32] Cameron: Mmm. Well, It’s

[00:09:34] Tony: with a company like this.

[00:09:35] Tony: Like if this was happening to a large cap company, you’d be able to read some stories about it and try and piece together what was going on, but it’s such a small

[00:09:42] Tony: cap. It’s not getting any coverage. So it’s, I don’t know.

[00:09:46] Cameron: Mm. A bit like Fortescue Metals.

[00:09:51] Tony: Well, yeah. Um, yeah, Fortescue is like that. I don’t think it had that many board directors resign, but

[00:10:01] Tony: it certainly had changes in CFOs and CEOs, which is a bit worrying.

[00:10:07] Cameron: And the share price hasn’t been doing too well lately at Fortescue either. I don’t know how much that’s got to do with Iron Ore or how much it’s

[00:10:14] Tony: Yeah, I think I know

[00:10:15] Tony: probably.

[00:10:15] Cameron: Twiggy. Mm. Uh, well that’s all the news stories I

[00:10:20] Cameron: have for this week. Tony, got anything else to talk about that’s taken your interest? Mm

[00:10:24] Cameron: hmm.

[00:10:25] Tony: I, um, wanted to follow up on something we spoke about last week, uh, and that was you’d done some regression or you did some regression testing using the regression tool and had, uh, thought the tool had a bug in it so that it was buying, sorry, it was selling stocks when they fell below their second buy line.

[00:10:46] Tony: Um, and I thought, wow, that’s an interesting concept. And serendipitous and sometimes That can lead to great breakthroughs in science. So I actually did some regression testing myself using our old buy list. And, um, I do a thing, a quick, quick and dirty regression testing, which I call the one stock portfolio.

[00:11:06] Tony: So I just buy one stock and follow it through for the last four years and trade it, um, and do it with a, like, I do that with two different levels, like a high ADT. Threshold to make sure there wasn’t as gear for that. Um, and what I found was in both cases, a one stock portfolio lost money over that time we’ve had buy list.

[00:11:31] Tony: So I went back to August, 2020 and, and run some dummy portfolios through. Um, so I don’t think. I don’t think that was behind the outperformance and the regression testing, it must be something else. But it was worth looking at because I think sometimes these kinds of areas can throw up a bit of a left

[00:11:48] Tony: field.

[00:11:49] Tony: Interesting thing to research, but in this

[00:11:51] Tony: case, it didn’t go anywhere.

[00:11:53] Cameron: hmm. Well, I’m not exactly sure that’s in retrospect having spoken to Matt I’m not sure that’s exactly what his system was doing, um, what it was using is the 3PTL cell trigger, but he fixed that. And I ran, uh, another test this week and the CAGA fell from 25 percent back down to 16 percent when he fixed the cell trigger.

[00:12:24] Cameron: So then I was like, no, no, no, I put it back the way it was.

[00:12:27] Tony: Yeah. But you still think there might be some bugs in that code.

[00:12:32] Cameron: I think there’s a bug in

[00:12:33] Cameron: the buy, uh, line

[00:12:36] Cameron: calculation now. It’s, well, it’s, it’s not taking into account account, the second buy line. So it’s buying stuff too early. If something has become a Josephine, but it’s above the buy line, but below the second buy line, it’s still buying it, even though

[00:12:51] Tony: Mm hmm.

[00:12:51] Cameron: know, it’s sort of a falling knife, hasn’t re established

[00:12:53] Cameron: itself.

[00:12:54] Cameron: So we’re going to work on resolving that next. Um, and then we’re going to have a, I think a, It’ll be interesting to see. Pretty, um, good regression testing system, still not really taking into account commodity prices or qualified audits. I mentioned to Tony off air that I’ve been spending a bit of time over the last week trying to script a way of checking for qualified audits.

[00:13:20] Cameron: Um,

[00:13:21] Tony: Yeah. And if anyone, if anyone out there has a way of, um, or knows of a source of,

[00:13:28] Tony: Annual reports, they can let us know too.

[00:13:31] Cameron: Yes, and I’ve already, I’ve tried ListCorp, and I’ve tried ASX,

[00:13:34] Cameron: and, um, I haven’t gone into the Stock Doctor route yet for some T’s and C’s reasons, but, um, you know, I’m looking at a way of trying to get a quick, reliable, scripted access to it. Annual reports so we can then read them, have an AI read them and look for qualified audit stuff.

[00:13:54] Cameron: It’s turning out to be far harder than I thought it would be to get this scripted, but um, I’m making slow progress. But yeah, anyway, that’s interesting that you did that and found that in your testing the selling that early Was, uh, not a good thing. Yeah.

[00:14:13] Tony: generally, um, was that we were buying on the upswing and then, uh, an upswing is inevitably followed by a downswing of some, at some stage, and, uh, If there was like a, so that, so the upswing was forming the new H1 for the second buy line, if it then dropped off, which it often does, and then kicked up again, there’s your H2, and say we’re getting a new second buy line, um, which was then crossed, so if it went sort of above that again and it came back down, so basically nothing goes up in a straight line, but there was, if there’s a zigzag, it was selling out really quickly, and oftentimes at a,

[00:14:53] Tony: you know, sort of five or ten percent drop on what the purchase price had been.

[00:14:59] Cameron: When I did that regression test and then I went and had a look at what was happening, I found a few instances of that, but, um, whatever, for whatever reason, it still was delivering a 25 percent CAGA. So I haven’t quite figured out what it was doing and why yet, but, um, I’ll have to work with Matt on trying to isolate that so we can, um, We can do some more testing.

[00:15:23] Cameron: Well,

[00:15:24] Tony: That’s all I had, but I’ve got a pulled pork to do if you want to do that now.

[00:15:27] Cameron: yeah, now. we’ve got a couple of questions. Mmm,

[00:15:29] Tony: Yeah, so my pulled pork isn’t on LVE, which I did have a look at. Actually, the other one I had a look at too, which I’m happy to do if anyone wants, is Atlas Pearls. Which I know I’ve done a pulled pork on before. And it’s always been a really small ADT stock, but it has, because its share price has taken off, the ADT is getting bigger.

[00:15:51] Tony: So I did consider it. It’s still, still not very large, but interesting that the business is doing so well.

[00:15:58] Cameron: hmm,

[00:15:59] Tony: It looks like it’s because of the pearl trade, which immediately got me thinking, Oh, it’s a commodity stock. I should go and try and find a five year graph of South Sea Island pearls, or South Sea pearls.

[00:16:13] Tony: But I couldn’t. There are plenty of articles about how the pearl market’s taking off, which has obviously helped Atlas, but

[00:16:19] Tony: I couldn’t find any

[00:16:20] Tony: graphs.

[00:16:21] Cameron: And did you get a sense for what’s driving the pearl market?

[00:16:24] Tony: No, I didn’t.

[00:16:25] Cameron: It’s not used in, uh, NVIDIA aren’t using them in their GPUs or anything.

[00:16:30] Tony: Not that I

[00:16:31] Tony: could see.

[00:16:31] Cameron: We’re growing AIs inside of, uh, clamshells.

[00:16:35] Tony: Yeah, the only hypothesis I could get was that, uh, Atlas Pearls had put a lot of effort into making their, uh, pearls, um, what’s the word I’m looking for, uh, clearer, more concentrated, so they have less impurities, and the market is stronger for that kind of pearl than the one they were producing before. Um, but it still seems like the Pearl market has huge volatility in it.

[00:16:59] Tony: So, uh, Atlas Pearls, even though it’s doing well now, may be

[00:17:04] Tony: subject to volatility in the future as well. But yeah, worth a look.

[00:17:07] Tony: Interesting

[00:17:08] Cameron: to me that in the 21st century there’s still a market for some by product made by a clam.

[00:17:15] Tony: Yeah.

[00:17:16] Cameron: we can make, you know, fake pearls that look just as good, really? I mean, why are we paying crazy money for real pearls? It’s a

[00:17:27] Tony: Well, it’s, it’s interesting. Yeah, it’s like diamonds, but it’s almost like there are some things that we can’t artificially recreate. Like, go and make energy from the sun like a plant does, using chlorophyll. Science still hasn’t cracked that. They can’t do it in the lab. And people can point to differences in engineered artificial diamonds compared to the real things.

[00:17:55] Tony: You know, the artificial ones have like a very rigid latticework structure, whereas the real ones don’t. So, yeah, it’s um, I’m not to say that someone couldn’t grow a diamond that had a less rigid structure, but yeah, maybe they can’t do it for the same price you can through mining, I don’t know. But I had a look at Atlas Pearls and I thought, geez, the CEO of this company has the best job in the world.

[00:18:18] Tony: I was reading through it all and the guy works four days a week, gets paid two or three hundred grand, lives in Bali, um, on a beach.

[00:18:28] Tony: All the processing is just done by hand off the beach. It just looks so idyllic.

[00:18:34] Cameron: That’s where they, that’s where they do it. It’s off barley. It’s not done

[00:18:37] Cameron: in like factories. It’s done

[00:18:39] Tony: No, no, it’s done in the sea. Yeah. Off the beach in Indonesia. Yeah.

[00:18:46] Cameron: Good job.

[00:18:46] Tony: Anyway, worth looking at if you’ve got a small portfolio.

[00:18:51] Cameron: We hold

[00:18:51] Tony: I’m going to do

[00:18:52] Tony: it.

[00:18:52] Cameron: one of the portfolios, Light or the Dummy or something like that.

[00:18:55] Tony: Well, it must have done well, because

[00:18:56] Tony: It’s, like, I think the share price has tripled in the last year or so.

[00:19:00] Cameron: Yeah, I think it’s up about. It’s 35 percent since I got it. It’s, uh, I looked at it this week cause it had, it dropped like 5%, uh, the other day, uh, on the big crash day, but it’s still way, way up since we bought it, which wasn’t that long ago, but yeah, it’s done very well.

[00:19:16] Cameron: Yeah.

[00:19:18] Tony: Anyway, I’m doing a large cap stock today, Bank of Queensland. And, uh,

[00:19:23] Tony: I have to declare straight away that, uh, Jenny’s at a board meeting today for the Bank of Queensland. So,

[00:19:29] Cameron: So we’re getting the inside story.

[00:19:32] Cameron: Just that

[00:19:33] Tony: And she’ll be, but she’ll be, she’ll be pleased to hear that, uh, the stocks are buy.

[00:19:38] Cameron: All

[00:19:38] Tony: as a direct, as a director, she’s meant, she’s meant to buy some and she’s been holding off waiting for it to become a buy.

[00:19:43] Tony: So

[00:19:44] Cameron: Oh, that’s

[00:19:44] Tony: she can tick that box and get some. Um, and I guess I should make it clear that Jenny and I, Jenny doesn’t know I’m doing this pulled pork, I only decided to do it this morning after she’d left. And, um, So she’s had no input into it or any sort of clearance on it. Uh, and I’m not, I don’t think I’m telling any tales out of school.

[00:20:01] Tony: We sometimes talk about Bank of Queensland, but, um, uh, nothing. That’s not in the public domain.

[00:20:07] Cameron: Do you own any?

[00:20:09] Tony: No, I don’t. I may, I may buy some, like I said, Jenny has to buy some, so it’s a good time to buy, and it’s a large ADT stock, which certainly suits me. Um, and we’ll suit everyone listening. So it’s, um, it’s worth investigating.

[00:20:23] Tony: Uh, anyone who doesn’t know, Bank of Queensland is, as it states on the label, a bank from Queensland and, uh, has 154 branches around Australia. And it’s a full service bank, has credit cards, a bit of insurance, business banking. Deposits, mortgages, all the usual stuff. A couple of things that have happened in the last year or two which are important to know.

[00:20:46] Tony: They acquired a bank called Members Equity, ME Bank, which is an online retail bank. So they have spent a lot of effort into both merging with ME Bank, but also into, uh, The digital banking world and ME Bank’s an online bank, um, and also to the attraction of ME Bank is it has a lot of, uh, non Queensland customers.

[00:21:08] Tony: So, uh, Bank of Queensland is always trying to diversify away from its, its, um, customer base historically in Queensland. The other thing which I found interesting when I was doing my research is that Bank of Queensland operates a business bank, um, And it has a lot of experience in banking in Queensland and that skews it a bit towards agriculture.

[00:21:29] Tony: Um, but the interesting thing I think is that, uh, slightly more profit comes from the business banking arm than from the retail banking arm for Bank of Queensland. So I think that’s a, an opportunity for the, rather than necessarily focusing on retail banking, which I’ll get to a bit later on, is, is particularly tough at the moment, and particularly tough for small banks.

[00:21:47] Tony: because of the structure of, um, of the regulations around, uh, around banking. Um, so it might be worth their while to concentrate on the, the business banking side. History for this, for this business goes way back, uh, to 1874. And it started off as, as, uh, Queensland’s first building society, which was called the Brisbane Permanent Benefit Building and Investment Society.

[00:22:13] Tony: And the marketers got a hold of it and said, yeah, it’s called Bank Queensland. Very catchy, yeah. Uh, so three years later it then became a bank in 1877. Um, went along doing that for quite a while. Uh, by about 1942 it merged with other Queensland financial institutions and became a trading bank. In other words, it handles everyone’s transactions, not just their, uh, mortgages.

[00:22:39] Tony: Uh, and in the 1970s, it adopted the Bank of Queensland name and listed on the ASX in 1971. Uh, it wasn’t until 1985 that it opened its first regional branches outside of Brisbane, uh, in Cairns and Townsville. So I thought that was interesting that it waited that long to do that. Uh, and that may have, um, been because there was a bit of a, Building Society explosion up and down the Queensland coast in the in the late 80s early 90s and it seemed like every country town was setting up a building society.

[00:23:13] Tony: And Bank of Queensland actually did merge with one of these in 2007 called the Mackay based Pioneer Permanent Building Society and it also merged with one in WA called the Home Building Society. So, um, It was bulking up during the 2000s. 2010, it bought St. Andrew’s Insurance Manufacturer of Consumer Credit Insurance.

[00:23:38] Tony: 2013, acquired Virgin Money Australia, not to be confused with Virgin UK, which has the licence in the UK, but there is a separate business in Australia called Virgin Money, and Bank of Queensland still runs that as a separate brand, even though they owned it here. 2014, it acquired another bank called Investec Bank, and 2021 it doubled the size of the retail bank by buying ME Bank and it turns 150 in September the 1st this year.

[00:24:09] Tony: So it’s been around for a long time. So that’s, that’s the background on Bank of Queensland. I’m pretty sure people will, will know about it. Turning to the numbers. Share price when I did this analysis was at 6. 21, slightly different today but not by much. ADT for this stock is 10 million, so it’s very large.

[00:24:29] Tony: And I want to point out that this is, like some of the other banks, a financial year that ends on the 31st of August. So we’re using August 23 numbers, which means we’ll get new results in a couple of months. May change things, but we’re using old numbers for now. Uh, this, the share price of 621 is way above consensus target by about 24%, so that’s, I thought that was interesting in itself, and we don’t score it, uh, on that basis.

[00:24:58] Tony: It’s also way above IV1 and IV2, and, um, so we can’t score it for that. Uh, the yield on this bank is 6. 6%, which is just under our threshold for giving it a tick. So even though it’s got a good yield, we can’t score it for that. And for those who are interested, the ROE is only 7. 3%, which is quite low. Now, banks often have a low ROE because of the way their business works.

[00:25:24] Tony: They, they move around large, Blocks of money, borrowing and lending. And so they can have low ROEs, but this is low for a bank as well. Stock Doctor financial health and trend are strong and steady. So it gets a score for those. And it’s a recent three point upturn. So it gets a score for that. It’s been on the down, been a falling knife for a while now.

[00:25:47] Tony: It’s just turned up recently. PE is 8. 5, which is the lowest in three years, so we can score it for that, and there’s no consistently increasing equity, so we can’t score it for that. The big driver for this company being on our buy list is PropCaf, which is 1. 15 times, so huge amount of cash coming in, which is good.

[00:26:10] Tony: Negative equity per share. is 9. 29. So he can buy this company for less than book value, which gives it a score. Um, it gives it a one for that. The other big detractor, which I think was behind the company being below its consensus target price is that earnings per share growth is, is forecast to be minus 39%.

[00:26:32] Tony: So, um, it’s gets a negative one for that. And that’s probably what the Um, consensus price is being driven on, but like with all these kinds of things that come on our buy list because people are expecting them to, to produce lower results in the next half. But the question is, have they found their bottom?

[00:26:51] Tony: Has the market factored in what’s coming? And, and given the share prices declined so much recently and is now turning up, I suspect it has, but that’s, that’s speculation on my part. Uh, going on with this checklist, obviously no owner There’s no Methuselahs on the board. Uh, all that added up is a quality score of 10 out of 17 or 59%, but a QAV score of 0.

[00:27:13] Tony: 51, putting it near the top of our list. And that’s largely because of that PropCaf metric that we have. Um, so that’s, that’s the scoring side. I did want to go through some risks and opportunities for this company, and it certainly had its problems in the last, uh, six to 12 months. Uh, there’s been a CEO changeover.

[00:27:34] Tony: Um, Largely I think around, um, some enforceable undertakings that were, um, were forced on the bank by the regulator. And they had to do with the risk management systems in the bank. And so the bank has had to put 60 million into risk management programs, um, mainly it seems for cybersecurity and anti money laundering.

[00:27:54] Tony: Um, but you know, obviously that 60 million is not coming through in profit. So they’ve had to bulk up, they were forced to bulk up, um, their risk management processes. Um, There has been, I mean the ME bank integration must be, you know, challenging, um, as any integration would be. I’m not hearing anything or reading anything to say it’s going any better or worse than the integrations, but they basically double the size of their bank through that integration, so it would be a large project to undertake.

[00:28:22] Tony: I think, um, the things I wanted to focus on with RISC would be the The mortgage war that’s been going on, particularly amongst the big banks and Macquarie, the big five, uh, and also to the increasing in funding costs. Now, Bank of Queensland has a bit of an advantage over the major banks in that it has a strong deposit base.

[00:28:39] Tony: So Bank of Queensland has to go into the market for less, uh, uh, bond issuances to, to raise money for mortgages. Um, so it’s less reliant on that. However, um, Bank of Queensland being smaller than the major banks also has a, um, Uh, a worse funding cost. So the credit rating agencies generally require Bank of Queensland to, uh, have a hundred basis points difference between the cost of funding that they get versus the major banks.

[00:29:10] Tony: And that makes sense. ComBank is going to be a, you know, a sure bet if you were in the bond market then, um, then, uh, getting your money back from Bank of Queensland. And it’s only a hundred basis points, but, uh, you know, that kind of difference in the mortgage wall can, um, the difference between growing your mortgage book and shrinking it.

[00:29:29] Tony: and Bank of Queensland has shrunk its mortgage book this year. So, it’s not in a good place because of that. But, additionally, there has been a bit of a historical bias against the smaller banks in terms of how much capital they have to retain um, to, to uh, And that started with the, the Basel 2 initiative, which was the worldwide rules around banking capital structures.

[00:30:00] Tony: And then Basel 3 came along after the GFC. And they, they basically say that the, Banks, which are called standardized banks, like, um, like Bank of Queensland, so smaller banks, um, have to carry more capital, which reduces their margin. And I’m trying to think of a way to explain this without going to becoming too technical.

[00:30:22] Tony: If you thought about it as a cost of doing business, then, um, It costs them more to issue each mortgage than it does for Commonwealth Bank, for example, basically just because of the accounting standards, the way that they work to, um, to try and protect in the banking system from the risk of a smaller bank going under.

[00:30:39] Tony: The smaller banks, um, have constraints on, on their ability to raise capital. And so, therefore, when they issue a mortgage, it costs them more to do it. That’s a structural, um, Disadvantage for them and it’s always going to be there I think. Um, there was a bit of a bit of a narrowing of the gap when Basel 3 came out but it’s still there.

[00:30:56] Tony: So that’s a, that’s a risk to note. It doesn’t just affect Bank of Queensland, it affects all the small players like Bendigo Adelaide Bank and the others as well. So yeah, that’s something to take into account. And I think on the, on the opportunity side, I’ve always thought, um, and I did, I did have a, uh, a relative who ran a building society in Queensland, and they loved the fact that they could put a branch office in Sydney and Melbourne and steal market share from the big banks for little cost.

[00:31:27] Tony: They didn’t have to have a branch network to serve, to service customers down there. And, and that they could use their existing technology to write the loans, et cetera. Uh, and so Bank of Queensland, I think. has an opportunity to do that and they certainly have branches in most major cities around Australia.

[00:31:43] Tony: The question is could they be doing a better job of it and I think that’s an opportunity for them. The, the, another opportunity for them is, and they do leverage it well, is their Queensland heritage and so there is a loyal parochial band of people who will always bank with Bank of Queensland or Suncorp in Queensland.

[00:32:01] Tony: Their business bank has very strong ties into the agricultural sector, so there’ll always be a strong regional base of customers for this bank. So somehow it’d be good if they could leverage that into other regional areas in New South Wales and Victoria or around Australia. I don’t think they’ve cracked that yet, but I see the business bank as being the area that they could.

[00:32:19] Tony: Potentially get the biggest opportunity from, um, again, leveraging the fact that they have strong ties to the ag sector in Queensland must mean that there’s a market for them in regional areas for business banking in the rest of Australia. So yeah, so that’s Bank of Queensland just come on the buy list this week, um, large ADT

[00:32:39] Tony: stock and seems to be turning up going into its reporting

[00:32:42] Tony: season in a month or two.

[00:32:45] Cameron: And the share price looks like it peaked back in October 70 and has been sort of consistently falling since then. Sort of hit a bottom about, what’s that, uh, October 23 at 5. 46. So it slid for two years and is now at 6. 12, maybe on its way up again. As you say, we don’t really know, but Yeah, so, a lot of issues the last couple of years, you were saying.

[00:33:19] Tony: Lot of issues and I’m, who knows, but given the context of the upturn in the share price recently and after the huge decline, perhaps all the bad news has factored into the share

[00:33:30] Tony: price.

[00:33:31] Cameron: Mmm. Alright, thank you Tony. You’ll get, uh, rewarded, I’m sure, by Jenny when she comes home for that.

[00:33:40] Cameron: B. O. Q. Alright, well, uh, let’s get into questions. Um, Danny, uh, sent through a bunch. He said we could, like, save them up. Did you wanna answer all of them or just one of them? How many do you wanna tackle today?

[00:33:59] Tony: Now I can tackle them all, but depending on time, but yeah, I’ve

[00:34:02] Tony: certainly prepped for doing them

[00:34:04] Tony: All

[00:34:05] Cameron: All right. Well, let’s start with the first one and see how we go.

[00:34:08] Tony: Yeah.

[00:34:08] Cameron: Um, Danny says, If you plan to move overseas for a few years or even on a permanent basis, what are the things you need to be aware of that can impact your local investment strategy and returns? For example, I know you won’t be able to use your franking credits, which is a slight hit on your net returns.

[00:34:27] Cameron: Keen to hear about what Tony took into account during his time in Canada. Is it mainly BAU? I’m also keen to hear if there are significant implications on investment properties and tax. What’s BAU, Tony?

[00:34:42] Tony: Business as usual.

[00:34:43] Cameron: Oh,

[00:34:45] Tony: Yeah.

[00:34:47] Cameron: there you

[00:34:47] Tony: Which it largely was. Look, I think my, you know, I’ve got to put a preamble into my remarks is that, uh, Danny, if he is going overseas, should really get tax advice and probably from a multinational player. And when we went overseas, both in New Zealand and Canada, we got advice from PWC on how it would affect our taxation.

[00:35:09] Tony: situation in both the new country and in Australia. So that’s the first thing to do, I think. So I can tell you what happened to me and what we looked at, but it doesn’t replace getting proper advice from from a professional. The first thing to note about shares is that when we went overseas, I don’t think the laws changed, but we had the option to draw a line on our CGT base.

[00:35:32] Tony: And then, um, so that meant I had to pay, if I chose to do that, which I did, I had to pay capital gains tax on my shares as that currently existed the day I left, but then I didn’t pay capital gains tax while I was overseas, so you have to sort of weigh up the pros and cons of doing that. So, um, if you think you’re going to be overseas for a long time, it may be worth paying off whatever capital gains are outstanding on paper at that stage.

[00:35:58] Tony: And then not paying capital gains tax until you come back. Um, well, so pay no capital gains tax while you’re overseas. And then it starts again when you come back. Um, so that’s the first thing to note. Uh, the second thing is that depending on where Danny’s going, yeah, we always had Dual taxation arrangements with Australia.

[00:36:15] Tony: So both in Canada and New Zealand, we were taxed in both countries, and then one country gave the other an offset for tax already paid. Which meant you’re basically paying the worst tax of either of those countries. So that’s something to get your head around as well. Um, I mean, there were pretty similar tax, tax, taxing regimes in both countries.

[00:36:38] Tony: There were a bit of, there were one or two quirks that were different in Canada. Um, GST is higher in Canada. They call it HRT over there and it’s 13. 5 percent or it was when I was there. Um, but things like I wasn’t allowed to. Uh, deduct the cost of preparing my tax returns, which I can do in Australia, like accounting costs are deductible.

[00:37:01] Tony: In Canada, they are, if it’s like a bookkeeper keeping your books throughout the year, but the cost of preparing the tax return wasn’t, and that. Doesn’t seem like much, except I was preparing tax returns in Canada and Australia. So it was a double sort of cost. So, um, it was, um, I was unable to claim that in Canada.

[00:37:20] Tony: Uh, the other thing to be aware of is that, um, there’s a thing oftentimes for immigrants, and it depends whether Danny’s going over there to live or to, and to work or just to, to visit. Um, but there oftentimes are colloquially what’s called golden immigrant rules, and there are in Australia as well. But in Canada, um.

[00:37:39] Tony: We had the opportunity to invest in a particular trust structure, which is offered to immigrants who have a certain amount of wealth to invest. And, um, we could buy, uh, we could buy shares in the trust and pay no tax on those shares for the first five years that we were in Canada. But, uh, we, but I couldn’t manage the, the investments of those shares.

[00:38:03] Tony: It’s kind of strange. Again, a bit of an arcane tax situation. The, the, the investment trust was set up in one of the Um, Cayman Island, Cayman, not the Cayman Islands, um, one of the Caribbean islands. So I think it was in, um, wasn’t Bermuda, but it might’ve been in, yeah, I’m not sure, Jamaica or somewhere like that.

[00:38:24] Tony: So yeah, you put your money into a trust. It’s registered in Jamaica and looked after by a custodian in Jamaica and all the banks in Canada had custodian offices in Jamaica. So they were doing it through a bank, a reputable bank. And then I put the money into LICs. And in ETFs, I couldn’t manage it myself, but they were then invested tax free.

[00:38:43] Tony: So there’ll be some kind of version of that in almost every country. The countries love to have wealthy immigrants who are going to invest to go over and spend their money. And I had been told cases in the US, which were even better than that, where, you know, you could go to Certain states in the U. S.

[00:39:04] Tony: and invest a certain amount, um, whether it was in the stock market or a local business or a house and get tax free status for a number of years. So they are attractive and worth looking at, but they’ll be different depending on where you’re going. Um, the other issue I think Um, to be aware of was around your house, and that’s probably the trickiest one.

[00:39:26] Tony: So, and I think this may be changing, so it’s worthwhile getting more recent advice, but when we moved overseas, even though we were renting out our house in Australia, we got a six year capital gains tax exemption. So normally if you live in a house and buy another house but then rent out the first house you lived in, you’d pay capital gains tax on any increase in the value of that house from the day that you started to rent it out.

[00:39:52] Tony: Um, that wasn’t the case if you were living overseas. You had a six year lease. Exemption from Capital Gains Tax. And that was so expats like my wife could go overseas and work and come back and not be paying CGT on keeping the house. I think that may, there was some talk of it being removed. I don’t know if it has or changed, but it’s worthwhile looking at.

[00:40:14] Tony: Um, The other thing to be aware of is, is if you do buy a house overseas, that there are, you do need tax advice and you do need to think about which house becomes your principal place of residency. So, um, Canada had similar laws to Australia. In Australia, we could rely on a six year rule to not pay capital gains tax and we could call our house in Canada, our principal place of residency.

[00:40:38] Tony: And then coming back to Australia, we had to sort out which You know, which was which, so we could avoid paying capital gains tax on either. Um, so yeah, so there are a few. A few different tricks. In terms of investing, um, I operated as normal, and I think I’ve said this before on the podcast, I didn’t invest in Canada on the Stock Exchange there or the US because I struggled to find tools, um, back then anyway, which was as good as Stock Doctor, um, and the AFR.

[00:41:08] Tony: I used to still read, subscribe digitally and still read the AFR every day when I was in Canada and I invested in Australia, um, normally. I did have that money in, um, Canada. investment in the investment trust in Barbados or wherever it was, although that stopped, the government did a reverse turn on that after about a year and we had to take the money out and reinvest it so it went back into the Australian market.

[00:41:32] Tony: So, yeah, there was little difference. In terms of franking credits, Danny, just I think, again, if the company, if the country has a dual taxation regime with Australia, you can still claim the franking credits on your Australian tax return part of things. Um, so yeah, there’s this always, always this, I used to pay tax in Canada first and then get that tax, um, Taken into account when I was paying tax in Australia and the tax in Australia still worked the same way as if I was living here, there wasn’t much difference except for some of those, you know, CGT rules I outlined, um, and then you get credits, but the franking credits still worked on the Australian side anyway.

[00:42:15] Tony: So, um, it was, to a large extent, business as usual for me.

[00:42:20] Cameron: Hmm. Interesting. It’s all a bit muddling. Head muddling.

[00:42:26] Tony: Mmm, it was, and I remember before we went across to Canada spending an Easter at Cape Schanck, going through everything, tax advice and numbers and trying to crunch what was the better option for us to do. But, uh, you do need to do

[00:42:38] Tony: that before you go.

[00:42:40] Cameron: Hmm. They don’t make it easy. All right. Well, the next question from Danny, with the concerns about QAV members jointly buying in or out on shares, would that risk be reduced if we review our average daily trade percentage? From memory, we said you shouldn’t buy more than 20 percent of the daily volume.

[00:42:59] Cameron: To mitigate a bit of risk, would it be safer to look at 10 percent or 5%?

[00:43:04] Tony: Well, I think it would, um, the problem is that then you’re having a bigger portfolio because, uh, You know, if you’re, if you’re working out your ADT, sort of taking 15 stocks, working out your portfolio size and then working out your ADT from there, if you half your ADT, you’re going to have 30 stocks, not 15.

[00:43:23] Tony: So, um, that’s the quid pro quo. So I’m not inclined to do that. I think holding, if you have too big a portfolio, you start to get index like returns rather than, um, outperformance. So, um, I think we’re just going to have to find another way. And we still haven’t proved that we are causing problems with our buying and selling

[00:43:44] Tony: through QAV,

[00:43:47] Cameron: Yes, and I mean, I think we’re on the, our assumption is at this stage that we’re not affecting it, based on your chats with your long term stockbroker and what his thoughts would be. Yeah. Um, okay. Moving right along, during a pulled pork, Tony often creates an awareness that a particular company is likely to issue shares through a cap raise.

[00:44:11] Cameron: This means a risk for shares to be diluted, correct me if I’m wrong, or that you probably should be willing to buy more whenever a cap raise happens. I probably don’t fully understand the logic behind it. Also, with our strategy to always be invested, it means that you may not have capital available to invest whenever a cap raise happens.

[00:44:30] Cameron: So that would mean that buying a share that is likely to go through a cap raise is less appealing for us, even something to steer clear of if you won’t have capital available.

[00:44:42] Tony: Yeah, that’s exactly the issue. I don’t have a problem with a company that’s going to raise capital from time to time. Because there might be a golden opportunity to, you know, double the mine or double the factories or whatever, double the coffee shops that the company operates, double the bank, as the Bank of Queensland did, double the size of its retail bank.

[00:45:05] Tony: Opportunities like that present themselves from time to time and they should be taken. So capital raisings per se aren’t a bad thing. I think what, what I’d like to highlight when I’m doing a pulled pork is if I think a company is going to be a serial capital raiser. And that particularly happens I’ve found with, with unprofitable growth companies that, that they, they grow for a while and then they Um, can’t fund it, and so they raise capital.

[00:45:31] Tony: It’s a bit like, uh, venture capital companies, or unlisted tech companies. You hear about Series A, Series B, Series C fundraisings. It’s expected from those companies that they’ll need capital to keep going, because they’re unprofitable. Some of those companies, Types of companies exist on the share market and they’re the ones that, um, I, I don’t like, um, some people do, but either way, go into it with your eyes open, knowing that if you just bought shares in six months or a year’s time, you’re probably going to be asked to buy more shares or be diluted.

[00:46:02] Tony: So that’s, that’s the issue for me. And as Danny points out, sometimes a capital raising will occur. When you, doesn’t suit you and you don’t have the capital to put into things. So, um, that’s also to be taken into account. So I, I prefer companies that I think, uh, have, well, I know have lots of cash and therefore are less likely to need to raise capital.

[00:46:21] Tony: Um, but they sometimes do, and sometimes it, um, You know, it happens across the market. I remember during the GFC and a little bit during COVID, lots of companies raised capital to strip what they call strengthen their balance sheets, um, in case things got worse. Uh, and that’s kind of like a prudent thing for them to do.

[00:46:40] Tony: Um, and so. The, the rule with those capital raisings or with any capital raising is, you know, is the discount that you’re being offered worth taking up the shares. Um, and so you, you look at the share price when the capital raising is, is about to take place and you compare that to what you’re being offered.

[00:46:58] Tony: And generally you only take up the offering efforts, the share prices less than what the shares have been trading at. So you want get, you wanna get some kind of discount for the dilution. That you’re, um, you’re forced to take and the fact that you have to put more capital in. So, yeah, but in a nutshell, capital raisings aren’t bad.

[00:47:14] Tony: I think serial capital raises are, um, and, uh, you know, if a company’s doing a capital raising, take it as a case by case,

[00:47:24] Tony: um, situation and look at whether you’re getting, um, proper recompense for your dilution.

[00:47:31] Cameron: mean, the sort of filtering mechanisms that we have in

[00:47:34] Cameron: place would tend to filter out companies that don’t generate a lot of capital. Cash, they’re going to be losing some scoring. How often do you think you see serial capital raises coming on the buy

[00:47:46] Cameron: list?

[00:47:47] Tony: Oh, never. Yeah, I mean, we do get companies raising capital on the buy list, but on, of the shares that I’ve owned, you know, it’s probably once a year, if that,

[00:47:59] Cameron: Yeah,

[00:48:00] Tony: and it tends to be, it often is in the mining space. So, you know, gold mining though, or I think, if I think back to Sandfire Resources, they, um, they knew that the Grosser copper mine was going to run out of copper at some stage in the foreseeable future, and so they bought another copper mining company in Spain and raised capital to do

[00:48:20] Tony: that.

[00:48:20] Cameron: Hmm, but for specific projects, not

[00:48:25] Tony: Specific opportunities and products. Or sometimes it happens across the board in GFC type situations where companies are a bit worried about the future. And

[00:48:33] Tony: so they want to bulk up their balance sheets to write about.

[00:48:39] Cameron: want to do another one?

[00:48:41] Tony: Sure.

[00:48:42] Cameron: Danny says, I’d be keen one day to hear about the different ways how a company can take on debt and what the main reasons are. I can imagine it’s usually for M& A activity or a significant fixed asset purchase, for example. What would be the main reasons and what are the different ways of taking on debt?

[00:48:59] Cameron: For example, a cap raise or taking on a loan with a bank. Is a cap raise more appealing than a bank loan? What’s Tony’s reasoning when looking at the debt structure of a business?

[00:49:09] Tony: Oh, if I can start with the, the end of that question first, the debt structure of business, I think is critical. And, uh, I, I prefer companies with low amounts of debt. Um, again, same reason I like companies with lots of cash because they have, they have resilience, um, they’re robust and they have firepower if an opportunity comes along.

[00:49:28] Tony: So. Um, I, I tend to look at companies with about, uh, debt to assets of about 30%, which is debt to equity, depending on their capital structure, usually of around 50%, 50 or 60%, so no more than that. Um, and, and the reason for that is that, uh, if you’re taking on lots of debts, even if it’s for a good thing, like to acquire a, um, a good A good company or a good opportunity, uh, you’ve got to always be careful that the rising, rising interest rates don’t, um, soak up all your profit.

[00:50:02] Tony: That’s, that’s the biggest issue. It’s a bit like, you know, they talk about mortgage stress in the housing market at the moment that, um, people who believe the RBA governor when he said that the interest rates weren’t going to rise and took out as much mortgage as they could. During COVID, and then interest rates have risen in the fastest, uh, accelerations ever.

[00:50:23] Tony: Um, and now those people are sitting on large mortgage bills, large interest bills. Same thing can, same thing can happen with a company. So in terms of the companies which have the least risk, it’s the ones with the least debt, usually. Um, so that’s, that’s the way I view it. And I’m always, it’s always in the back of my mind, although this is not related to company debt.

[00:50:42] Tony: Um, Warren Buffett’s quote that he said, Um, that if he had geared his own shareholding into Berkshire Hathaway, he would have gone broke twice. So, um, even though that’s personal debt, it’s not company debt, he’s basically pointing out that it’s always got to be taken, um, very, very conservatively if you’re going to gear up to do something.

[00:51:04] Tony: Uh, back to capital raisings, um, Why would a company raise capital? Well, usually it’s because they can’t borrow either any more or what they need to raise is too high for its bankers to loan them money responsibly. So, debt’s usually the first option for a company, but if they can’t raise enough to do what they need to do, they’ll raise money via capital raising.

[00:51:30] Tony: And so that’s generally how it works. Um, the other type of company, the serial capital rises that, that, um, I tend not to like, but they can be market darlings, so I should mention now what I call roll ups. And, um, so these are companies like WiseTech Global, which has been rolling up, uh, shipping, freight management software businesses around the world, and it’s done very, very, very well at that.

[00:51:57] Tony: Um, uh, other sort of roll ups I’ve experienced in the past, probably the classic one is ABC Learning, um, way back before the GFC, which was rolling up kindergartens. And so these businesses exist by simply saying, we’re going to be, we’re going to use our Our share script, which has a high PE, to offer to companies which have lower valuations, um, which is attractive to us, in other words, we’re paying less than we would if we were paying cash for those companies, and we’ll offer them shares in our companies and we’ll merge that new business into our existing business and our business will grow.

[00:52:32] Tony: And that’s, that’s a great business model for a while until you can’t roll up anymore. And then you, then you sort of work out whether the underlying businesses as a whole are profitable or not. And, um, you know, I think my experience is that in the best cases, the company rewrites from being a growth company to being a sort of business as usual type company, and the PE can halve or even go down more than that, which means the share price drops off a lot or worse.

[00:53:02] Tony: They, they get to the end of their, Capital raising, or their capital raising and their growth and their roll up, um, period finishes, and they suddenly realize the underlying business isn’t profitable at all. What was, it’s a bit of a Ponzi scheme. What was happening was every time they had to produce some numbers, they acquired another company, which made their growth look good and their sales look good, and, and they could say, well, we’re not making money now, but you know, when we build this great business, it’ll, it’ll have monopolistic um, potential because there’ll be no one else competing against us and we’ll do well.

[00:53:33] Tony: And sometimes they don’t. And, um, yeah, they come a cropper, which was a bit like what happened to ABC Learning. So, um, that’s the other thing to note, but yeah, I’m generally wary of companies that continuously raise capital. I mean, if you’re a good business, why do you need to keep raising capital? Surely you should be funding things from your own cash

[00:53:52] Tony: flow.

[00:53:54] Cameron: And we don’t really look at debt levels or debt to equity levels in our checklists. Why is that?

[00:54:03] Tony: We do. It is a core part of the Stock Doctor health ratings, financial health

[00:54:08] Tony: ratings.

[00:54:08] Cameron: yes, right. It’s bundled into that.

[00:54:11] Tony: Yeah,

[00:54:12] Cameron: All right. Well, the last one from Danny. Share buybacks. I’ve been a member for a few years now, but I’ve never really seen significant share price increases when a share buyback happens. I’m probably wrong. Keen to understand Tony’s views. We always like it, but I’ve never really seen a major benefit. All

[00:54:30] Tony: well, I’ll talk about two companies who have benefited from share buybacks. The one that’s One of the things that is near and dear to a lot of people’s hearts in this forum is Fleet Partners, um, which decided not to pay dividends, but to use that money to buy back shares at an appropriate price and an appropriate time.

[00:54:48] Tony: And I think, you know, they’ve gone at their lowest in the last five years from about 50 cents up to 3. 50, um, in the last, what’s that, 50 cents back in March of 2020 during COVID. And they’re now at 3. 50. So they’ve been a huge, a huge beneficiary of buybacks. Um, and the other one I’ll mention, of course, is Berkshire Hathaway, which, um, has been buying back its shares.

[00:55:15] Tony: In, in the last couple of years. Um, and, and again, there are buybacks and there are buybacks. So, um, Warren Buffet always says he’s happy to buy back his own shares if he can’t find something else big to buy. And that’s the issue for them, is they’ve got so much cash that they have to go out and buy.

[00:55:31] Tony: Industry size companies to make a difference. And so they, they, they force more and more to buy back their shares. Um, the reason why that works is because there’s, um, the same amount of profit going to less shareholders. So everybody’s taken the, in the profit pie goes up, um, which means if the company does pay dividends, your dividends should go up as well, but certainly your share of the earnings goes up.

[00:55:53] Tony: And so the share price reflects that. So the share price generally goes up to reflect the fact that each share is getting more of the profit pie. So that’s the basic, um, math behind share buybacks. But, but again, you’ve got to be careful, um, to, to look at it on a case by case basis. So when a company like Berkshire Hathaway is buying back its shares, it’s basically saying we can’t see any other growth opportunities in our industry or in an adjacent industry.

[00:56:21] Tony: And so it’s, it’s in some respects. Understandably for Berkshire Hathaway, given their cash pile, but in some respects, it’s an admission of guilt or admission of inability for management to grow the business. So that, that can be an issue. Um, if, if you, if the management’s buying back shares of a bad company or paying too much for them, um, then you, you know, you’re in the hiding to nothing with that as well.

[00:56:44] Tony: So you’ve got to be careful that management is, um, is trying to exhaust other options first before, before buying back. But, um, and generally, I guess, um, You know, share buybacks are part of the capital allocation portfolio of options for management. The first one’s got to be, as I said before, going for growth, whether it’s using cash flow or going into debt to grow the company.

[00:57:10] Tony: And then, uh, you know, they’ve got to consider dividend payments. Is it better off, um, are they better off buying back their shares or is the share price too high at the moment and therefore it’s not worth it? So they should be issuing, um, bigger dividends to their, uh, investors instead, which makes the company more attractive to investors.

[00:57:28] Tony: And franking credits in Australia will pay a part of that. And I think it’s a really good picture as well because if a company has lots of, um, lots of tax paid on past profits and are not issuing dividends, then that’s a, you know, a 30 percent benefit to the company. Some investors like superannuants, uh, who can get a, get a franking credit if the company pays a dividend.

[00:57:51] Tony: So there’s, there’s a whole lot of moving parts in, in whether you should do a buyback or not. Um, and it’s, it’s best to look at it on a case by case basis is to see whether it’s doing well or not, but certainly it’s benefited us and fleet partners and it benefits Berkshire

[00:58:04] Tony: Hathaway as well.

[00:58:08] Cameron: right. Thank you, Danny, for those great questions. Thank you, Tony. The only other question we had this week was from Phil, who asked for pulled porks on DGL or MSV. I saw, I did, I did some, uh, looking at the notes. We did DGL 22nd of November last year, but MSV, I don’t think we’ve done since episode 10 on the 7th of May, 2019.

[00:58:38] Cameron: Can you remember

[00:58:39] Tony: happy to go back and,

[00:58:40] Cameron: Mitchell Services since then?

[00:58:42] Tony: I haven’t done it since then, no, but I do remember doing it. So I’m happy to go back and do it.

[00:58:47] Tony: again.

[00:58:47] Cameron: Time for an update on Mitchell Services. Uh, Phil did ask me if I had a list of all the pulled porks anywhere on the website, which I don’t, so I will try and pull that together at some stage. Uh, well that’s it, TK. We’re in After Hours. What has, uh, taken your spare time in the last week?

[00:59:12] Tony: Well, it’s, this seems to happen every year, but, um, at least it happened last year. Netflix, in particular, and the other streaming services as well, to a lesser extent, just release a whole heap of new content. Seems to be around the start of March. So I, um, I’ve been watching, I just finished watching last night, The Gentleman.

[00:59:31] Tony: which was the Guy Ritchie produced short series on Netflix and it was good, I really enjoyed it. Yeah, worth watching. Not, not right up there with Snatch or Lockstock, but yeah, nothing really is, but um, still pretty good, still worth watching. Bray Winston makes a cameo, he’s good in it. Vinnie Jones, an old Vinnie Jones is really good in it too, so yeah, it’s worth watching.

[00:59:54] Tony: A lot of the, you know, photographic tricks that, you know, Guy Ritchie uses of cameras moving with actors as they fall and all that

[01:00:01] Tony: kind of stuff. So, yeah, I enjoyed it. It’s good, worth watching.

[01:00:07] Cameron: Hmm, I liked, uh, it was the name of the film too, wasn’t it?

[01:00:09] Cameron: The one he did with Hugh Grant?

[01:00:12] Tony: the Matthew McConaughey

[01:00:13] Tony: one.

[01:00:14] Cameron: That’s right, yeah, it’s called The Gentleman.

[01:00:15] Tony: so it doesn’t follow on from the film. It’s, you know, slightly different, but still Guy Ritchie’s home turf. British gangsters and aristocracy.

[01:00:24] Cameron: Mm hmm.

[01:00:26] Cameron: Hmm.

[01:00:26] Tony: I started watching Poor Thing, but I haven’t gotten through that one yet. It’s quite long.

[01:00:31] Cameron: is that a film or a series?

[01:00:33] Tony: It’s

[01:00:33] Tony: a film.

[01:00:34] Cameron: Right, it just got some Oscar love, I think I saw in the

[01:00:37] Tony: Yeah, Emma, what’s that, Emma Stone won Best Actress for it.

[01:00:41] Cameron: Yeah, good for her.

[01:00:42] Tony: Yeah, it’s very, very imaginative, very,

[01:00:45] Tony: very crazy and out there, but enjoyable.

[01:00:47] Cameron: I finally got around to watching The Thing From Another World. The 1951 Howard Marks version of the thing story.

[01:00:57] Tony: Ah, and?

[01:00:59] Cameron: And, you know, interesting, not, not as great as Carpenter’s version, I think, but I’d always heard good things about it. Um, I think I saw Tarantino and Stephen Colbert talking about it a while ago and saying that they both loved it. You know, I, uh, not bad for a 1951 science fiction film, but, um, Some of the dialogues, I think the best thing about it for me was the actress in it, Margaret Sheridan, who plays sort of the love interest.

[01:01:33] Cameron: She’s the Catherine Hepburn esque, fast talking, smart, modern woman, who’s basically trying to hoodwink the captain of the plane that flies down there into marrying her. Um, in a Catherine Hepburn y kind of way. But yeah, the whole, the thing that struck me most about it was the anti science Message in it.

[01:02:00] Cameron: Have you seen it? The, the

[01:02:03] Tony: not for a long time. Not since I

[01:02:04] Tony: was a teenager.

[01:02:06] Cameron: It’s got this post Atom Bomb Hollywood thing about the arrogant scientists who think, you know, they, anything in the cause of science is justifiable. And the military guys basically. pulling them into line because there’s this scientist in the North Pole base when they discover the alien craft and the alien that they rescued from it he wants to study it even when it escapes and it’s killed a few people he’s like no no we mustn’t destroy it this is more intelligent than us and it’s a thing and we need to study it and the military are all get out of the way crazy mad scientist we have to destroy this thing it’s a threat

[01:02:53] Tony: very Terminator 2, isn’t it?

[01:02:55] Cameron: Uh, yeah,

[01:02:58] Tony: corporation wants to study the

[01:03:00] Tony: alien, yeah,

[01:03:01] Cameron: well, the thing that I actually was thinking all the way through it is it’s very alien, and aliens, in

[01:03:09] Tony: Oh, sorry, not Terminator. Sorry, not Terminator 2. I meant

[01:03:11] Tony: Aliens.

[01:03:12] Cameron: right, yeah, well there is a thing in Terminator 2 where the

[01:03:15] Cameron: guy who, they go back and the guy who’s built the, uh, who’s, they, the guy who’s building the thing, the, the

[01:03:25] Tony: Oh,

[01:03:25] Tony: Skynet.

[01:03:26] Cameron: guy who’s building Skynet, yeah, no,

[01:03:28] Tony: yeah, yeah,

[01:03:29] Tony: They go to his house.

[01:03:30] Cameron: Yeah,

[01:03:31] Cameron: but no, it’s very alien, and aliensy, and there’s actually, um, a Geiger counter plays a big role in this film, where they’re, they’re tracking this thing’s movements around the base using a Geiger counter, which reminded me of Aliens, the James Cameron one, where

[01:03:48] Tony: Yeah,

[01:03:49] Tony: right.

[01:03:49] Cameron: You know, they can’t see it, but they know that they’re, they’re moving somewhere in the, in the bass.

[01:03:55] Cameron: And just the way that he used that to build tension, they did a little bit of that in the Hawks.

[01:04:01] Tony: Mm hmm.

[01:04:02] Cameron: But, you know, it was, yeah, just this, um, anti science thing, which really struck me. The, the, the underlying message that science for the sake of science wasn’t necessarily a good thing. And I think that was a, a trend in Hollywood science fiction films, um, after World War II and the atom bomb, and a lot of concerns about what the atom bomb had done and all that kind of thing.

[01:04:29] Cameron: They make a few direct references to that.

[01:04:33] Tony: Oh, there’s all sorts of movies about, you know, um, alligators in sewers growing to large,

[01:04:40] Tony: large dimensions and all sorts of, um, other irradiated animals.

[01:04:46] Cameron: Tomatoes and blobs and all that kind of stuff.

[01:04:49] Tony: ants, spiders.

[01:04:51] Cameron: yeah. And it struck me because I’ve been reading A. C. Grayling’s book, The Frontiers of Knowledge. If you’ve ever read any of A. C. Grayling’s

[01:05:00] Tony: No.

[01:05:01] Cameron: British polymath, philosopher, author. He wrote a book, the first one of his books I read 10 or 15 years ago was called The Good Book.

[01:05:13] Cameron: It was his version of the Bible, but written from the perspective of an atheist, philosopher, scientist. Um, and it was written in the style of the Old Testament, but written with a purely scientific, atheistic base, which is interesting. But this one’s more recent, The Frontiers of Knowledge, just talking about, I think the, the, Subtitle is How We, What We Know and How We Know It.

[01:05:38] Cameron: Um, and you know, there’s one quote of his that I, I saved from this. He talks about, um, science is arguably humanity’s greatest intellectual achievement. The scientific method is the paradigm of responsible, Careful, scrupulous investigation into its various subject matters, and it is acutely self critical and controlled by the empirical data of experiment, which is to say by the way the world is, and not by how we wish it to be, which I thought was a good quote.

[01:06:11] Cameron: But the thing that struck me most about this book, he does it, it’s a bit like, um, Yuval Noah Harari’s book on, uh, Sapiens. He’s going back over the history of humanity and when we developed writing and the wheel and, and controlling fire and then the applications of fire and the building of cities and how long these things took.

[01:06:34] Cameron: Like, wheels were known of in certain parts, like I think, like the wheel was I think invented in Sumer or somewhere in Mesopotamia. They knew about it in Egypt for like a thousand years before they actually used it in application. And in different parts of the world, the same thing, they knew about these things, but didn’t actually use them for thousands of a thousand years or so.

[01:06:59] Cameron: But it just struck me how slow progress was for the majority of human history. Like how long it took for language of fire or the wheel or, uh, you know, even things like, Moving from the Copper Age to the Bronze Age to the Iron Age to the Steel Age, just thousands of years stuck in one technological paradigm and then they’d slowly figure out how to put some tin into the copper to make bronze and then that would take, you know, thousands of years to spread around the world and then, you know, you get to the Iron Age, And

[01:07:46] Tony: but it’s like, you could look at the reverse thing too, like, you know, if you’re spending most of your time

[01:07:51] Tony: trying to feed yourself and fend off your enemies, when do you have time to add tin to copper and

[01:07:55] Tony: get

[01:07:56] Tony: bronze?

[01:07:56] Cameron: that’s exactly the point that he makes, you know, people were busy surviving. There wasn’t a lot of spare intellectual resources to experiment with this kind of stuff. But what struck me most is like thinking about for the majority of human history, how slow change happened and then how much change we deal with.

[01:08:19] Cameron: Now, how the change paradigm has exploded, and the fact that we haven’t all gone completely insane.

[01:08:26] Cameron: Like Chrissy was saying to me, I was talking to Chrissy about this over dinner last night, and she was like, Oh, that’s why, you know, we have so many mental health issues today, is just the amount of change that we’re dealing with, people can’t cope with.

[01:08:37] Cameron: And I said, actually, I think the opposite is true. The fact that we cope with it at all is astounding to me. The amount of, like, my mother grew up in a house that didn’t have electricity. Now she has artificial intelligence app on her mobile computing device that she carries. She has an Apple watch like that That’s insanity in her 76 years What she has seen it’s beyond science fiction levels of Progress.

[01:09:06] Cameron: And yet she’s not bat shit insane. She’s a little bit crazy, but she’s not like how?

[01:09:12] Tony: She’s your mother

[01:09:13] Tony: after all.

[01:09:14] Cameron: Yes, exactly. She’s had to live with me for 53 years, put up with the fact that

[01:09:18] Cameron: She’s responsible for unleashing me on the world. But you get what I’m saying? Like how the

[01:09:24] Tony: Yeah. Yeah, I

[01:09:25] Tony: do.

[01:09:25] Cameron: how our brains have adapted to deal with this amount of

[01:09:28] Cameron: change?

[01:09:30] Tony: I think, um, I think there’s a fair bit of disconnection going on too, like, you know, my parents, for example, were always sceptical of technology, always sceptical of change, and, um, they just disconnected, they would have a black and white TV for as long as possible, have a Holden Commodore for as long as possible, and, you know, they just enjoyed the simple life.

[01:09:53] Tony: There’s a fair bit of disconnection, I think, that copes with change, and that’s, I’m not being disrespectful to them, um, Mum was less so, dad was very much in that sort of style of living. Um, and you know, the good side of that was that he loved to work with timber. So he’d go and, you know, make cabinetry and. Use a lathe and all that kind of stuff. They’re very old fashioned type, um, ways of spending your time and doing things. And that was his thing. And that was really great because we got lots of stuff around the house made by dad and that was, that was really good. But yeah, I think people just disconnect.

[01:10:29] Tony: They don’t cope with change. I, the famous story in our household was that, you know, dad retired early at 53 because he didn’t want to, he was about to go on a course to learn how to use a computer and he didn’t want to do it. So he retired. But he had, like dad had. Huge fingers. I think he would have been

[01:10:47] Tony: struggling to hit each individual key on

[01:10:49] Tony: the keyboard too.

[01:10:53] Cameron: But the human brain today, like the brain inside of. Alex, the Twins, or Fox, or us, isn’t that different from the brains that people had in Rome or in Athens in 300 BCE? And yet the amount of change, the amount of complexity. That our brains deal with is at an insane level compared to what they lived with, even though in their days, they thought they were going through a lot of change.

[01:11:23] Cameron: Um, and yet

[01:11:25] Tony: Yes, and yes, yeah, look, I understand what you’re saying, but that’s, they have grown up with that too. Like Alex was using an iPad from a very, very early age. And that’s, I guess that’s the other side of the coin is iPads have been around now for 20,

[01:11:39] Tony: Whatever, 20 plus years. Why haven’t they, why aren’t they touching the air now and having a

[01:11:44] Tony: hologram

[01:11:45] Cameron: iPad came out in 2011, just before Steve died, so.

[01:11:49] Tony: Okay, um, but I find technology moves really slow. It’s infuriating to me that we don’t have hoverboards and jet cars and private jet packs and antimatter, not antimatter, um, transporter beams and all that kind of stuff that I was

[01:12:04] Tony: promised, promised I tell you,

[01:12:06] Tony: as a kid was going to happen.

[01:12:08] Cameron: Yeah.

[01:12:10] Cameron: Yeah. No, that’s, that’s a good point. Mmm.

[01:12:13] Tony: nuclear reactors in my home,

[01:12:16] Tony: powering

[01:12:16] Tony: everything.

[01:12:17] Cameron: Mm hmm.

[01:12:18] Tony: So,

[01:12:19] Tony: so yeah, I’m chomping at the

[01:12:21] Cameron: reactors does Australia have now?

[01:12:23] Tony: one

[01:12:24] Tony: at Lucas Heights for medical

[01:12:25] Tony: research.