QAV PORTFOLIO REPORT

The Dummy Portfolio is performing well against the benchmark over multiple time frames.

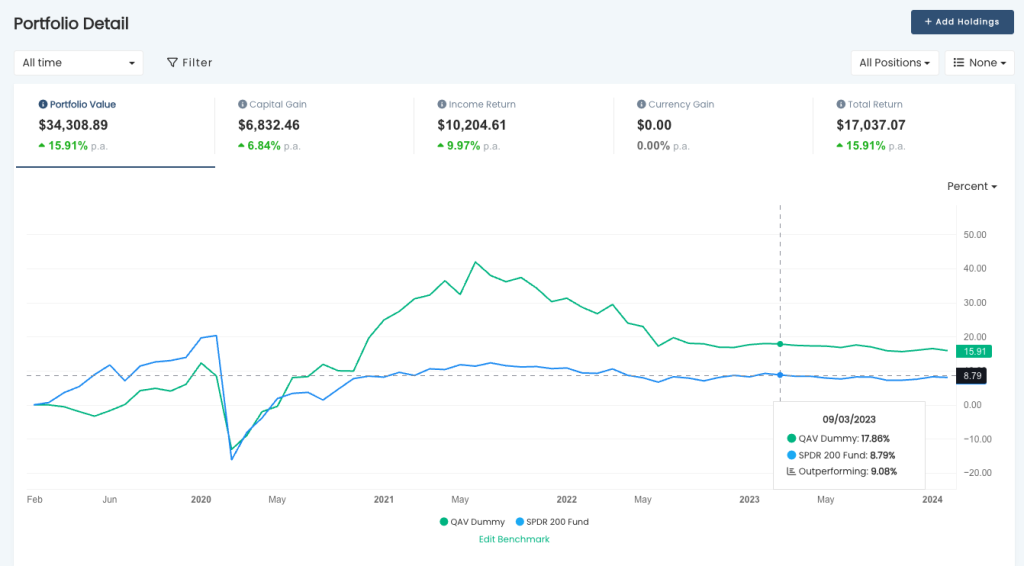

SINCE INCEPTION (02/09/2019)

Our portfolio has slipped a little, we are now doing slightly less than double market since inception.

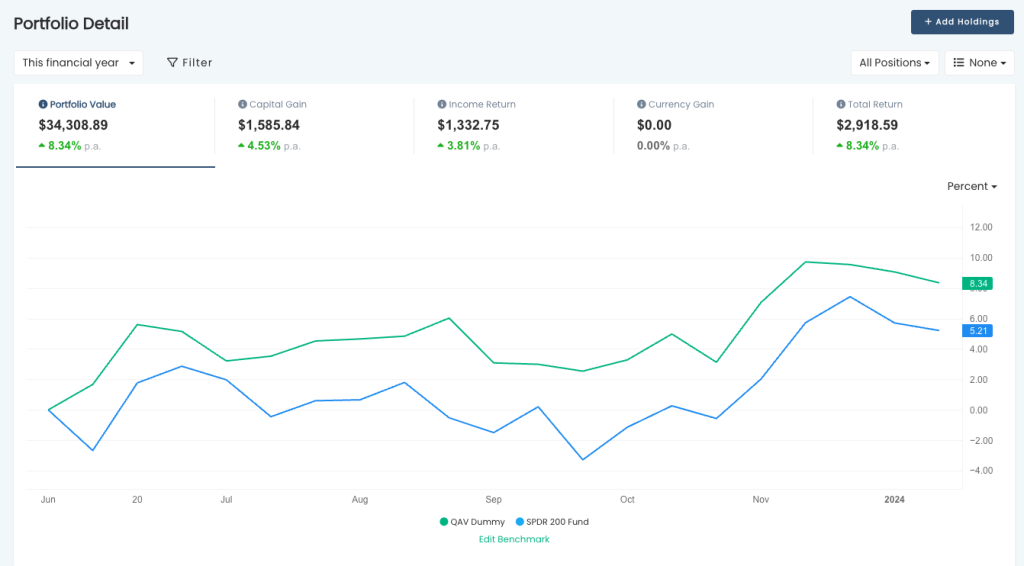

FY REPORT

For the FY we’re doing 1.6X better than the SPDR 200.

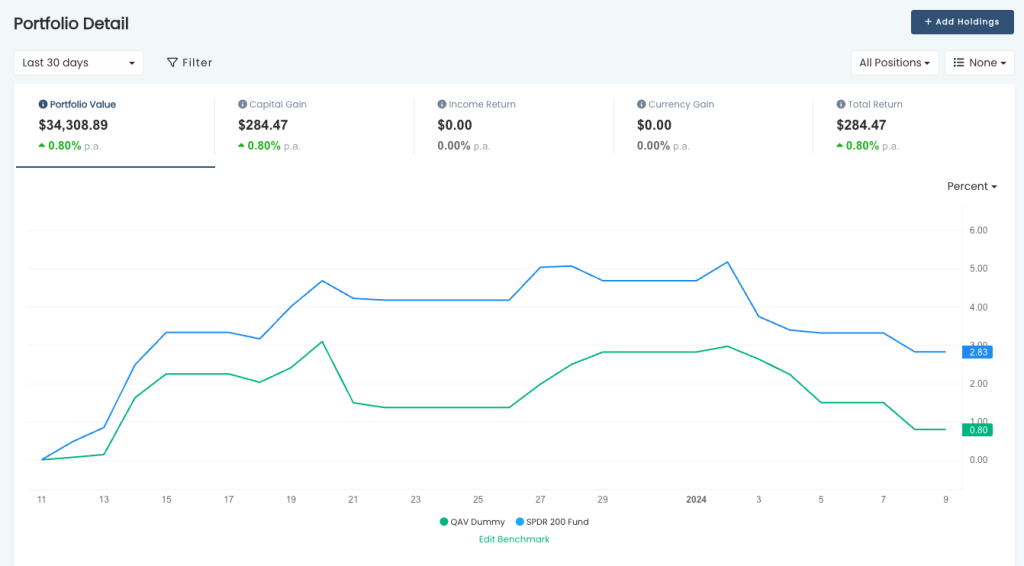

30 DAY REPORT

Last week our 30 day repeort showed that we were doing way better than the STW, but things turned against us this week.

LAST 7 DAYS

A lot of red in the the last week, but check out DUR, still going strong. It’s up 145% since we bought it last February. Imagine if we’d sold it when it hit 50%.

RECENT TRADES

In the last week we sold WHC and bought CAA.

FREE WEBINAR

I’ll be doing another webinar in a few weeks.

STOCKS OF THE WEEK

** As always, please check our work, DYOR, and consult a financial advisor before making any investing decisions.

BUY LIST

Each week we produce a buy list that we share with our members. The intended primary purpose of this buy list is for club members to use as a reference for comparing their own buy list. In theory, all of our buy lists should look pretty similar each week.

As always, please check our work, DYOR, consult a financial advisor before making any investing decisions.

THIS SECTION CONTAINS CONTENT WHICH IS VISIBLE TO QAV CLUB SUBSCRIBERS ONLY.

LAST WEEK’S EPISODE

FREE EDITION:

On our first show of 2024, I’m covering how the market and our portfolio ended 2023, adding GEM back to a portfolio, TK has a pulled pork on COF, and I talk to ChatGPT about the role the USD being the world’s reserve currency plays in the strength of the US economy.

Episode Transcription

QAV 701 Club

[00:00:00] Cameron: Welcome back to QA V and happy new year. Everyone. I’m recording this on the 2nd of January. 2024. Can you believe it? Uh, it sounds very Donald Trump. Can you believe it? Uh, recording this about 1:30 PM on Tuesday afternoon, market is open. Hasn’t closed yet, but at the moment, it’s having a good day, despite the AFS prediction this morning that it was gonna slide downwards. Of course it finished. The end of 20, 23, almost according to, uh, the AFR and an all time high.

[00:00:46] Cameron: I think the AI is actually at its all time high. But the ASX 200 slightly below. It’s all time high, which is around August, 2021, but it finished a. The top of the market for the year, it had a 52 week high. At the end of December and has kicked up again to a, I think. Now an aura. Record high or very close to its record high. So that’s been a big turnaround. You know, if I look at the charts, say over the last year, Um, we started 20, 23 around about 7,131 for the all Lord. Went up, uh, then dropped back down the end of March.

[00:01:29] Cameron: It was down back to where it started the year at. Then it said a topsy turvy. Yeah. Uh, sort of looking good, ran about July. It was almost back to where it was in February, dropped all the way down to 6,960. Sort of ran the end of September. Um, no. So the end of October, And then it had a great couple of months end of the year to finish it, uh, nearly an all time high.

[00:01:56] Cameron: So what do we learn from that? I don’t know. Market goes up. Market goes down. That’s basically my takeaway from it. Who knows why the market does what the market does. Us market didn’t interest rights. Here and there and everywhere. And look, it’s beyond my abilities to understand why the market does what it does. All I know is that I follow the rules and it tends to work out, uh, okay.

[00:02:27] Cameron: Over the longterm. If I have a look at the, uh, QA V dummy portfolio. I’ve been doing my weekly report this morning. Having sent it out because we haven’t got a buy list. Ready yet. That’ll come out tomorrow.

[00:02:43] Cameron: When I did my analysis this morning, the dummy portfolio was up 17.2, 5% per annum. This is a for all time versus the SPDR 200 up about eight and a half percent. So we’re doing about yeah. Two times bed, double market. A little bit better than double market over that time. But the good times were really sort of from August, September. 2020 through to. You know, June, 2021.

[00:03:15] Cameron: So it was a good period of almost a year there where we really outperformed the benchmark. And what I call the good times and we’re just waiting for the good times to come back, ran again, the rest of the time. Over the last four or so years we’ve been running the dummy portfolio. We’ve sort of tracked pretty closely actually. To the benchmark.

[00:03:37] Cameron: Um, except in the times when we really peaked and then we fought, fell back from like, I think we were doing four times the benchmark down to double, and then we’ve basically stayed consistent double benchmark. You look at the last 18 months. On the chart and we’ve pretty much tracked it, but at a double level, So we’re looking for those good times to come back again.

[00:04:01] Cameron: Hopefully me, you know, at some point, I dunno if it’s a once in a decade phenomena or once every five years, we might see that. Uh, sort of outperformance massive outperformance. Looking at. Tony’s history is 30 odd year history. It seems to come, I think on average, once every. Seven or eight years. So I guess we just play for the longterm.

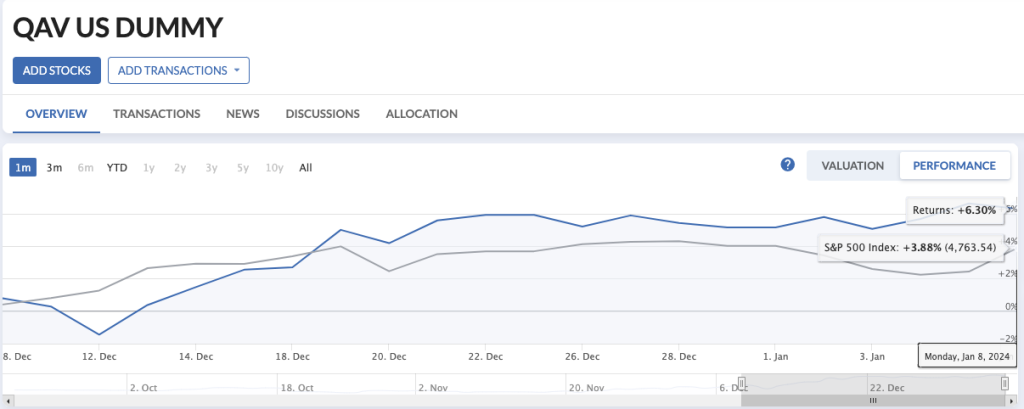

[00:04:26] Cameron: That’s how, I guess this thing works. The financial year report we’re doing about 1.4 times better than the SPDR 200. And over the last 30 days, we’ve underperformed at a little bit, but not by much. And the same is also true with the dummy portfolio that I’m running in stocker pedia over the last 30 days it’s done.

[00:04:47] Cameron: Okay. It’s up about 5%. Not quite as good as the. Uh, benchmark, but not far behind it. So, uh, that is the report, I guess, for the dummy portfolio over the course of the last year. It had a pretty good year. Let’s let’s uh, say, you know, didn’t shoot out the lights, but, uh, did oh, okay. Now one other thing I wanted to mention the only real news I have, cause it was pretty quiet last week is I added GA education limited. Back to one of the live portfolios.

[00:05:23] Cameron: This is gem. And you may recall. We bought it back in October, we’ve talked about this on the show. And then, um, they had their 20, 23 investor day presentation a couple of days later. And the share market did not react kindly to it. They announced at the time that they were offloading 31 out of 430 childcare centers. There weren’t performing up to their expectations and the share price drops suddenly 10%. And we had to sell them.

[00:05:57] Cameron: We had to rule one them well, on the 19th of December, they released their trading update. Things are going well. And the share price shot back up 12%. They’re now back above what we paid for them in October. So this was one of those instances where rural one didn’t work out in our benefit. I mean, I don’t know what I invested that money in, in October and how that’s done.

[00:06:20] Cameron: I haven’t done that low level of analysis. But, yes, this is one of those few times when I have gone back and looked to see how rural one. Played out only because this was back on our buy list again, and I had to buy it, but I, you know, did that analysis a couple of months ago where I looked at. 18 months of light transactions and I analyzed. All of our rule ones and all of our commodity cells and all of our three-point train line cells and worked out, uh, when we sold them, how much we sold them for and where the prices were when I did the analysis. And as you probably have heard Tony and I talk about it worked out pretty evenly. Some went up, someone down, you know, basically it was cheap insurance didn’t cost us anything.

[00:07:03] Cameron: And we netted out at the end of the day. So, um, I don’t know why I’m mentioning that. Just that it’s back. It’s one of those ones that I think the way that the share market’s reaction to it. When they, um, punished it. In October was probably an overreaction as we thought it was at the time. They were trimming some of the. Dead wood from their childcare center portfolio, which was probably a good management thing to do. And has turned out well based on their latest trading update. Um, but you know, It’s not for us to say, we just try and play the cards as they dealt. So, um, that’s all, I’ve got really my intro this morning, I’m going to throw to a prerecorded pulled pork that Tony did before he went on holidays.

[00:07:53] Cameron: This is COF it’s one of the REI teas. We had an email from Dave, from Nui. He asked us to do a pulled pork on an Ari it, and this is the one that Tony chose. Then after that, I’m going to come back and I’m going to chat a little bit. About the U S federal reserve. It’s something I’ve been trying to understand again, what the value to the U S economy is of having the world’s predominant reserve currency. And, um, I’m going to chat a little bit about that.

[00:08:26] Cameron: What I’ve been learning and I’m going to have a chat with a good friend of mine about it. So that’ll be after Tony’s Paul pork. Let’s cut to that now.

[00:08:33] Tony: I have pulled out one to do a Pulled Pork on, to expand on that. Um, and I’m going to use one of the ones that, uh, that Dave has asked for. Um, I’m going to use COF, Centuria Office REIT.

[00:08:48] Tony: The only reason I picked that out outta the three, well, first of all, Cromwell was a, a falling knife. It’s, it’s a negative sentiment, so I thought that wasn’t worth doing. Um, Eleanora has a higher QAV score of 0.07 than, than Centuria, which has a 0.04, but, um, it’s a low a DT stock, so I thought I’d do one, which was meaningful.

[00:09:09] Tony: So Centuria office REIT has. Just under a billion dollars traded every day. It’s 949 million. So it’s large enough to be of interest to everyone listening. However, it’s not above its buy price, even though sentiment is increasing at the moment. So eventually that gap will narrow because the buy line Because sentiment has been falling, the buy price gets cheaper each month, and the share price of this REIT has been increasing, so it will cross, I think, sub stage in the future, uh, in the near future anyway, all things being equal.

[00:09:46] Tony: Uh, the REIT itself contains 2. 2 billion of office space. across 23 buildings around Australia, uh, most of those, um, it does have some CBD assets, but they make a virtue of the fact that they are on the fringes. So if you think of places like Chatswood in Sydney or the Valley in Brisbane, Fortitude Valley in Brisbane, that’s the kind of office buildings they have.

[00:10:10] Tony: Uh, so they, they, We are calling out that the work from home trend hasn’t affected it as bad as some of the REITs that just have exposure to CBD office buildings. They do have 97. 1 percent occupancy, which is up from last year of 94%. So there is a trend coming out of COVID to return back towards full occupancy.

[00:10:33] Tony: A couple of other things that are interesting about this one. Something you should take into account with REITs is what’s called the WALE, the WALE. Which is the weighted average lease expiry. So the longer that is, or the higher the number, the better, because it means that you’ve, you’ve locked in long term tenants.

[00:10:51] Tony: For this company, it’s 4. 2 years on average. So that’s kind of in the middle. It’s, it’s not short, it’s not overly long, um, but 4. 2 is not bad. And the company is 36. 7 percent geared. So again, a modest gearing rate, not overly high there as well. Um, I went through their latest, uh, Projections and their latest releases and they’re claiming that the return to work is gaining momentum.

[00:11:20] Tony: I guess they would because it suits them, but it’s, it’s probably true as we hear. I mean, I read articles every week about this company or that company telling people they won’t get their bonuses if they don’t come back to the office or, well, they’ve got to be back in the office for at least a certain number of days a week.

[00:11:35] Tony: So there is some trend back towards that, which will help these REITs. Uh, the other thing that helps this company is that Because they’re in those kind of fringe CBD buildings, they tend to be a bit newer. Um, so their average age for a building is 17 years, which is reasonably low again for these kinds of REITs, and that also makes them more attractive because people like renting from in newer buildings.

[00:12:03] Tony: Um, especially if they’re not in the CBD. If you have two buildings and one’s old and one’s new, you’ll opt for the new one. Um, The call out though on property valuation has to be made, and the property valuation went down 4. 2 percent this year, which is a 98 million hit to profit, even though it’s treated as an abnormal, it really is a change that the accounting standards put through the P& L, so that’s one of the reasons why Um, these REITs are trading below their NTAs.

[00:12:35] Tony: People don’t think 4. 2 percent is enough of a devaluation to office building property. Um, but again, eventually that will sort itself out, and for the moment, you are buying it, um, at well less than NTA. So, if I can, NTA on this company is 1. 96, and the share price I did my analysis at was 1. 36. So, big difference there.

[00:12:57] Tony: Do I think that the NTA value of these office buildings will fall by 30%? No. So we are picking up stock at cheap. And as Dave said, that’s a contrarian investment and a value investment. So that’s good. Going into the QAV numbers, the Uh, share price is less than the consensus target, so that’s a tick for us.

[00:13:20] Tony: It’s round about IV2, but above IV1, so IV2 is 1. 35, but um, the share price is 1. 36. 5, so doesn’t get a score for that. Earnings per share after abnormals is less than 15, well it’s negative 15 cents, so it’s not going to score well for us on that basis, and it’s down 32 percent from the year, uh, Prior, forecast EPS is forecast to grow at 19 percent and forecast EPS is 0.

[00:13:50] Tony: 14 per share, but I haven’t been able to tell whether that’s before or after abnormal, so I’m not sure how much stock to place in that, but it does get a score at this stage, so I’ll take it on face value, it gets a score on the growth over P. E. metric because the P. E. ‘s Well, it’s negative, I think, in this case.

[00:14:09] Tony: No, low, anyway, because they’re using the pre abnormal PE. So it beats our threshold of 1. 5 for growth over PE, which is 1. 64 in this case, but I do have a question mark on that, whether it’s pre or after abnormal. So, in other words, if there are more write downs next year, that growth for PE won’t hold.

[00:14:31] Tony: Conversely, if we decide that People are going back to the offices and they’re worth more, then there’ll be a valuation increase which will support profit next year. Uh, Stock Doctor health and trend is strong and steady, so we score it for that. The dividend yield on this company, which is a focus for investors, is 9.

[00:14:50] Tony: 56 percent on francs, so that’s getting up to the top of the sort of market again, and um, it’s quite high. Uh, and so I think just that fact alone will see some support for the share price going forward. NTA, as I said, is 1. 96, which reflects skepticism in valuations. Net equity per share is the same, so we’re not seeing any goodwill there, which is good.

[00:15:14] Tony: PropCaf is 12. 5 times, which is why we’re not seeing it on the buy list. And there’s no owner founder, so we can’t Um, score it for that. So all in all, summing all those up, quality is 7 out of 14 or 50%, and the QAV score is 0. 03, which is, um, too low for our, our buy list, but anybody who wants to invest in this sector, um, you know, can either buy something when it comes on the buy list like URW or could look at it.

[00:15:41] Tony: buying things when they’re below their tangible assets and getting them at discounted prices, which I think is a valid strategy, particularly if you’re after a good yield, um, for to live off, 9. 56 percent is pretty good, um, in the market.

[00:15:56] Cameron: Thanks,

[00:15:57] Cameron: Tony. All right. Well, I hope you enjoyed that camera back in the editing booth here. Obviously. Um, so as I mentioned earlier, I’ve been trying to understand the role of the us, um, reserve currency, and how that. Benefits the us economy. I’ve been reading this book. It’s about 20 years old now, but book called super imperialism by a guy called Michael Hudson.

[00:16:24] Cameron: He’s a us economist. There’s a book that’s been in my to read list for a couple of years, actually. And I just managed to get around to it. Over the break. And I, um, you know, it was, oh, it was. Not really following it that well, it is assumed a certain level of our priority knowledge. And then I slapped myself upside the head and thought I should just ask my good friend, Maverick, AKA ChatGPT GPT. To help me understand it. And so I had a conversation. With Maverick last night on this, which I found very helpful.

[00:16:57] Cameron: I thought I might sort of just repeat that process today and let you guys follow along. I don’t know how well you all understand the value that the us gets out of having the reserve currency. Um, maybe everyone else in the world understands it. And it’s just me. Who’s the dummy. But in case there’s a couple of people out there who don’t really understand it either. I found it sort of fascinating.

[00:17:22] Cameron: I think Tony and I have talked about it before. I’m not sure if it’s on the show or not. I’ve talked about it on some of my other podcasts over the years, but this is one of those things that’s been like. Einstein’s theory of special relativity. Every now and again, I need to go back and do a refresher on it because I understand it when I study it and then a year or two goes past and I’ve forgotten. What. It works. So, uh, this is one of those things.

[00:17:48] Cameron: So let me a boot up a good old Maverick here.

[00:17:52] Cameron: I want to ask you about the importance. Of the us dollar being the global reserve currency and how the. Us economy benefits from that. Can you give me a high level explanation to start with?

[00:18:09] Cameron: Sure the us dollar status has the global reserve currency is a big deal. Essentially, it means that many countries hold large amounts of us dollars in reserve. And use it for international trade. Um, this status brings several benefits to the U S economy. First off there’s demand for the dollar since it’s widely used for international transactions. Countries need to hold it in reserve. This demand helps keep the dollar’s value, relatively stable.

[00:18:36] Cameron: Then there’s the borrowing advantage.

[00:18:38] Cameron: The us can borrow money at lower interest rates because there’s always a market for its debt. Think of it, like having a good credit score. Lenders, no other countries desire the dollar. So they’re more willing to lend to the U S at favorable rates. Lastly, there’s the power aspect. Having the dominant currency gives the U S significant leverage in international finance and politics. It can influence global economic policies. And enforce economic sanctions more effectively.

[00:19:07] Cameron: So in a nutshell, the us gets stability, cheaper borrowing, and more global influence. But remember, there’s always another side to the coin, like potential impacts on trade deficits. And the risks of relying too much on this status.

[00:19:22] Cameron: So let’s drill down on this idea that the us dollar being the reserve currency enables it to borrow money more cheaply.

[00:19:29] Cameron: Tell me again how that works.

[00:19:31] Cameron: All right. Let’s delve into how the us dollar being the reserve currency leads to cheaper borrowing. It’s all about trust and demand. Since the dollar is the global reserve currency it’s widely used and trusted in international trade. This trust creates a high demand for the dollar. Now imagine you’re selling a product that everyone wants, you can set favorable terms, right? That’s what happens with the U S and its currency countries, and investors want to hold us dollars. They also want to invest in us assets, particularly treasury bonds.

[00:20:05] Cameron: These bonds are essentially loans to the U S government high demand for these bonds means the U S can offer them at lower interest rates. Why. Because there’s no need to entice investors with high rates when there’s already strong demand. In a nutshell, the reserve status creates a cycle. High demand for the dollar high demand for us bonds. Us can borrow cheaply. It’s a significant advantage for the U S economy allowing more affordable government borrowing and influencing global economic trends.

[00:20:36] Cameron: So I’ve been reading this book super imperialism by an economist called Michael Hudson.

[00:20:41] Cameron: And he is. Making the case that the us is able to manage very high levels of foreign debt. As a result of this, this advantage that it gets from having the global reserve currency and its economic prosperity. Since the 19 early 1970s, when Nixon took it off the gold standard. Is in large part funded by foreign reserve banks.

[00:21:10] Cameron: Would you agree?

[00:21:11] Cameron: Michael Hudson, super imperialism. Offers and intriguing perspective on the U S economy. And its relation to the global reserve currency status. Hudson argues that the U S benefits significantly from this position, especially in managing its foreign debt. Let’s break this down. Post 1971, when Nixon removed the gold standard, the U S dollar didn’t collapse, as some feared, instead it gained a new kind of power countries needed more dollars for their reserves since they couldn’t just rely on gold.

[00:21:42] Cameron: This shift increased demand for us dollars and by extension us treasury bonds. Now here’s the critical part. By needing to hold us dollars. Foreign banks end up financing us deficits. They buy us treasury bonds, effectively lending money to the U S government is process allows the us to run high deficits and debts without the same consequences.

[00:22:03] Cameron: A typical economy might face. Like inflation. Or currency devaluation Hudson’s viewpoint suggests that the U S leverages this unique position to sustain its economic prosperity. Partly funded by foreign reserves. This perspective is quite compelling and is supported by the dynamics of global finance post 1970s. Uh, it does raise questions about the balance of economic power and the longterm implications of such a system. So to your question, Hudson’s argument holds water and explaining how the us manages high levels of foreign debt. And props up its economic prosperity.

[00:22:39] Cameron: Um, it’s a complex and somewhat contentious topic, but it’s clear the reserve currency status plays a significant role in the U S economic strategies and global influence.

[00:22:48] Cameron: And as I understand it, What this has effectively meant in the last 50 years is that the us never really needs to pay off any of its foreign debts. It just refinances them basically every time, a bond matures by borrowing more money, cheaply and getting foreign governments essentially to pay off their debt for them.

[00:23:09] Cameron: Is that somewhat correct?

[00:23:12] Cameron: You’ve got the gist of it. The U S debt situation is a bit like a juggler with an ever increasing number of balls in the air. Uh, since the us dollar is the world’s primary reserve currency. It does give the U S unique leverage. They can issue more debt in their own currency. To pay off maturing bonds, foreign governments often buy these bonds, essentially funding the U S debt. However, it’s not all smooth sailing.

[00:23:37] Cameron: This system hinges on the continued confidence in the U S economy and the dollars stability. If that confidence wavers, the whole setup could face challenges. Also constantly increasing debt raises questions about sustainability in the long-term. Um, what’s your take on this? Do you see it as a sustainable strategy or. Is it a house of cards waiting to collapse. I have no idea.

[00:24:01] Cameron: I’m not an economist. I’m trying to get a better understanding of it. That’s why I’m talking to you. Um, Michael Hudson makes the argument that the us used this model of fear currency and getting foreign banks to fund it. In order to, uh, You know, finance their cold war activities. After the Vietnam war, which he said drove them off the gold standard in the first place, because it costs them so much money. And, you know, basically for the last 50 years with their global wars and their expansionist policies. It’s all being funded largely by foreign governments.

[00:24:40] Cameron: Is that something you’d agree with?

[00:24:43] Cameron: Michael Hudson’s perspective on us fiscal policies, particularly in relation to the cold war and its aftermath. Is indeed thought provoking. Um, his argument that the shift from the gold standard to Fiat currency. I was driven by the financial strains of the Vietnam war, enabling the U S to finance its cold war activities through debt is a significant point. Hudson is right in observing that the us has managed to fund a lot of its military and expansionist policies. Through debt. Much of which is held by foreign entities. This is partly due to the dollar status as the world’s reserve currency, which makes us bonds a sought after investment globally. Countries buy us treasury securities, not only as an investment, but also to hold reserves in a stable and easily tradable form.

[00:25:31] Cameron: This system does indeed allow the us to sustain high levels of debt and to fund extensive military operations and foreign policies that would be financially untenable for a country without such a dominant currency. However, it’s crucial to consider other factors like the intricate dynamics of international finance. The role of us economic policies and global economics and the interdependencies of global economies. So in a way, yes, I’d agree with Hudson’s view to a certain extent. Uh, it paints a picture of how global finance and geopolitical strategies are intertwined, especially in the context of the us, but it’s also a complex scenario with many moving parts. Uh, what are your thoughts on how this financial maneuvering has influenced global politics?

[00:26:15] Cameron: I don’t really have any views, but I want to read a quote from Michael Hudson’s book and get your thoughts on it.

[00:26:20] Cameron: He writes if the United States had followed the creditor oriented rules to which European governments had a deed after world wars one and two. It would have sacrificed its well positioned. Its gold would have floated out and Americans would have been obliged to sell off their international investments to pay for military activities abroad.

[00:26:39] Cameron: This was what us officials had demanded of their allies in world wars one and two. But the United States was unwilling to abide by such rules itself. Unlike earlier nations in a similar position. It continued to spend abroad and at home as well, without regard for the balance of payments consequences.

[00:26:57] Cameron: Michael Hudson’s quote, highlights a significant shift in how the United States. Managed its international financial obligations and its approach to global economic dominance.

[00:27:08] Cameron: Uh, his point is that historically nations in debt, especially after wars. I had to follow strict creditor rules. They would lose their gold reserves and have to sell off international assets to cover their expenses. This was the case for European nations after both world wars. However post-World war II, especially during the Vietnam war era. The U S deviated from this norm, instead of cutting back on spending to balance its payments. The us continued to spend heavily both domestically and abroad. This was possible because of its departure from the gold standard and the adoption of the Fiat currency system, which essentially allowed it to print more money.

[00:27:48] Cameron: Hudson is pointing out the double standard here. The U S demanded financial prudence from others, but did not apply the same rules to itself. This approach enabled the us to maintain and even expand its global influence. Without the immediate financial repercussions that typically follows such heavy expenditure.

[00:28:06] Cameron: This strategy has had far reaching consequences for global economics and politics. It contributed to the U S as sustained military and economic presence worldwide. But also led to growing national debt and complex international financial relationships. Hudson’s analysis is crucial in understanding the unique position the us holds in the global financial system and its longterm implications.

[00:28:31] Cameron: Do you think this approach has been beneficial for the U S in the long run or could it lead to potential problems? Yeah, don’t ask me any more questions. I’m asking you the questions that’s on the interviewer. You’re being interviewed. He writes, thanks to the $50 billion cumulative us payments deficit. Between April, 1968 and March, 1973, foreign central banks found themselves obliged to buy all of the $50 billion increase in us federal debt.

[00:29:00] Cameron: During this period in effect, the United States was financing its domestic budget deficit by running an international payments deficit.

[00:29:09] Cameron: Um, Hudson’s observation about the U S financing its domestic budget deficit through an international payments. Deficit is a critical point in understanding the country’s financial maneuvers during that period. From April, 1968 to March, 1973, the us faced significant economic challenges, partly due to the Vietnam wars costs. The situation he describes involves a kind of financial alchemy by running a payments deficit, the us effectively compelled foreign central banks to purchase us federal debt. This process was facilitated by the global reliance on the us dollar, which remained the dominant reserve currency.

[00:29:47] Cameron: Even after the gold standard was abandoned.

[00:29:51] Cameron: This period marked a significant shift in global finance. The us could sustain its spending. Both domestically and militarily abroad without the immediate need to balance its books. Foreign nations needing to hold dollars as part of their reserves. Had little choice, but to buy us debt. This strategy while in genius, in the short term raised questions about the longterm sustainability of such financial practices, it highlights the unique position.

[00:30:18] Cameron: The us held in the global economy and how it leveraged this position to its advantage. The implications of this approach are far reaching, affecting, not just the us, but the global financial system at large. It’s a prime example of how economic strategies are deeply intertwined with geopolitical maneuvering.

[00:30:39] Cameron: So you’ve highlighted a few times that this strategy comes with risks, but has it ever caught up with the United States since they started this in the early seventies?

[00:30:52] Cameron: Or have they been getting away with it for 50 years?

[00:30:55] Cameron: Uh, since the early seventies, the United States has largely been able to maintain its strategy of financing deficits through debt. Without facing a catastrophic financial crisis. Directly attributed to this practice. This is due to a combination of factors. $1 dominance. The us dollars status as the world’s primary reserve currency plays a crucial role.

[00:31:17] Cameron: It creates a constant demand for dollars and us treasury bonds providing the U S with a unique advantage in managing its debts. To economic resilience. The U S economy is one of the largest and most dynamic in the world is economic strength, underpins global confidence, the dollar and the us government’s ability to meet its obligations. Three. Global financial system. The structure of the global financial system with its reliance on the dollar supports this approach. Many countries hold their reserves in dollars and are thus invested in the stability of the U S financial system.

[00:31:54] Cameron: However, it’s not a risk-free strategy. Challenges include. Debt sustainability, the growing us national debt raises questions about long-term sustainability while there’s no immediate crisis, the escalating debt could pose challenges, especially if there’s a loss of confidence in the U S economy or its fiscal management. Global economic changes shifts in the global economy, like the rise of other currencies or changes in the geopolitical landscape. Could challenge the dollar’s dominance inflation and interest rates managing large debts becomes more challenging if inflation rises or if interest rates increase significantly as the cost of servicing the debt could become unsustainable. So far, the us has managed these risks effectively. But it’s a balancing act.

[00:32:39] Cameron: The situation requires careful management to avoid future crises that could arise from over-reliance on debt financing. And the complexities of global financial interdependencies.

[00:32:51] Cameron: But can they just borrow more money every time they need to serve as debt? Although I assume there has to be. Some kind of a limit to how much us debt foreign banks can buy.

[00:33:04] Cameron: Um, absolutely. The U S has been borrowing more money to service its existing debt. A process often described as rolling over the debt.

[00:33:12] Cameron: Um, this strategy works primarily because of the dollar’s status as the world’s reserve currency. And the global financial systems reliance on us treasury securities as a safe liquid investment. However you’re right to assume there are limits one market appetite. There has to be sufficient demand for us.

[00:33:30] Cameron: Treasury bonds. Well, demand has been robust. It’s not inexhaustible. If investors, including foreign governments lose confidence in the U S his ability to manage its debt, they might reduce their purchases or stop buying altogether. To debt to GDP ratio economists often look at a country’s debt to GDP ratio as a measure of its economic health while there’s no fixed danger level, a very high ratio can raise concerns about sustainability and might deter investors.

[00:33:58] Cameron: Three interest rates. If the us has to offer higher interest rates to attract buyers for its bonds, the cost of servicing the debt increases. This can create a cycle where the us has to borrow more just to cover the interest. Exacerbating the debt problem for inflation concerns, excessive borrowing can lead to inflation. Uh, if lenders start worrying about inflation, eroding the value of their bond holdings. They might demand higher interest rates or look for other investments.

[00:34:27] Cameron: So while the U S currently benefits from a system that allows it to keep borrowing. It’s not without its risks and limitations. The key is maintaining a delicate balance to prevent these risks from materializing into a financial crisis.

[00:34:43] Cameron: So what’s the counter-argument to Michael Hudson’s thesis that the United States has used foreign governments to finance its own hegemony. In the last 50 years, are there solid counter arguments that you can. Bring, uh, make me aware of.

[00:35:01] Cameron: Counter arguments to Michael Hudson’s thesis. Typically focus on the following points. One mutual benefit. One argument is that the us treasury market offers a safe, reliable investment for foreign governments. It’s not just about the U S uh, leveraging others to fund its debt. It’s also about providing a stable investment opportunity that benefits those countries, reserve management. To global economic stability.

[00:35:27] Cameron: The us dollar’s role in global finance contributes to worldwide economic stability by providing a reserve currency, the us supports international trade and financial markets. Critics of Hudson’s view might argue that this stability outweighs the negatives of us debt practices. Number three economic interdependence.

[00:35:45] Cameron: The global economy is highly interdependent. The argument here is that us economic strength is beneficial for global economic health. When the us economy performs well, it often leads to positive effects worldwide for no viable alternative. Another point is the lack of a viable alternative to the us dollar as the world’s reserve currency. The Euro Yuan or other currencies have their own challenges and haven’t been able to match the dollars. Ubiquiti and stability, five market forces.

[00:36:16] Cameron: Some critics might argue that the us debt situation is governed by market forces. Uh, investors voluntarily choose to buy us debt because they deem it a good investment. Not because they are coerced or manipulated into doing so six domestic policy focus. Finally, another counter argument is that us fiscal policy is often more driven by domestic concerns like unemployment inflation and growth than by a deliberate strategy to exploit foreign governments. These counter arguments offer a different perspective, suggesting that the situation is more about mutual interests. And the intricacies of global finance. Rather than a one-sided exploitation. They emphasize the complexity and interconnectivity of international economic relations. Well, it sounds to me like those aren’t really counter-arguments to the model is saying that the model is, as Hudson describes it. But these are just maybe finessing the nuance of it around. Whether or not, it’s a manipulative strategy being run by the U S or it’s just an opportunistic strategy that they came up with.

[00:37:26] Cameron: So maybe both things can be true. It can be beneficial to many countries to use the us dollar as the reserve currency. And at the same time, the us can exploit that to its own. Advantage.

[00:37:41] Cameron: Your interpretation sounds quite spot on. It’s not necessarily an either or a situation Hudson’s thesis and the counter arguments can, co-exist highlighting different aspects of the same complex system. The U S using its position to finance its own interests. As Hudson describes can indeed occur simultaneously. With the mutual benefits of a global reserve currency system. This duality is a fundamental characteristic of international economics and politics actions often have multiple motivations and consequences, some intended others, not, uh, the us might have adopted certain strategies that appear opportunistic or self-serving. But these actions also play a role in the broader context of global economic stability and interdependence. The situation encapsulates both the advantages and potential drawbacks of the U S dollars dominance. Uh, this nuanced understanding is crucial for a comprehensive analysis of global financial systems and their geopolitical implications. It’s about seeing the bigger picture where various elements interact in a dynamic and sometimes contradictory manner.

[00:38:49] Cameron: So in summary, then it seems to me that the United States is economic dominance in the last 100. Years or so. Is really down to two factors predominantly. I mean, If we. Except the fact that they, you know, did encourage a lot of entrepreneurial-ism in the 19th century, 18th and 19th century, et cetera.

[00:39:12] Cameron: And they had. You know, quite a productive economy by the end of the 19th century. In the early 20th century, they managed to avoid the major impacts of world wars one and two, because they didn’t happen on their soil. Most of the major, um, uh, other. Economic powers around the world. Were destroyed. Uh, there are economies were destroyed in world war one and world war two, the us sort of coasted through them relatively untouched. Then towards the end of world war two, with the Bretton woods conference, it was decided that the us dollar would become the federal reserve. And then the U S we’re able to leverage that pro predominantly in the last 50 years to basically get free money to expand their economic and military power around the world.

[00:39:59] Cameron: Particularly with the fall of the Soviet union in the early nineties, the us were able to really double down on. Locking down the, the, uh, Global economy to their advantage. Largely because they were using this free money. Is that a relatively accurate summation?

[00:40:18] Cameron: Um, your summation presents a broad yet insightful view of the factors contributing to the United States economic dominance.

[00:40:25] Cameron: Over the last century, key elements include one early economic growth. The us is entrepreneurial spirit and productivity in the 18th and 19th centuries. Laid a foundation for economic strength to geopolitical advantage. post-World war is the major European powers were devastated by world wars one and two. Whereas the U S emerged relatively unscathed. This disparity allowed the U S to advance its economic position while others were rebuilding three. Bretton woods and dollar dominance, the post-World war II Bretton woods conference established the us dollar as the central currency in global finance significantly boosting us economic influence. For leveraging the dollar. In the last 50 years, the U S has indeed leveraged its currencies position using it to finance, both domestic and international agendas, including military and economic expansion, five post cold war dynamics with the Soviet union’s collapse. The U S faced fewer challenges to its global economic strategies consolidating its position as the central player in the global economy. Your summary accurately captures the confluence of historical economic and geopolitical factors that have shaped us dominance.

[00:41:38] Cameron: It’s a complex interplay of internal strategies and external circumstances with the us is the ability to adapt and leverage these factors. Playing a crucial role in its rise to economic preeminence.

[00:41:51] Cameron: Thanks for joining me on the podcast today. ChatGPT. GPT. What do you have planned for the rest of the day?

[00:41:56] Cameron: It was great being on the podcast. Thanks for having me.

[00:42:01] Cameron: For the rest of the day, I’ll be right here. Ready to dive into more conversations. Explore intriguing topics or assist with any questions that come my way. If you have more topics to discuss or questions later on, feel free to drop by. Have a fantastic day ahead. Do you have any new year’s resolutions?

[00:42:19] Cameron: Creating new year’s resolutions? Isn’t something I do, but I’m all about helping others with theirs, whether it’s learning something new tackling challenges or exploring creative ideas. I’m here to assist. Do you have any resolutions for this year or any goals you’re working towards? Lots, but let’s talk about that. Cause I don’t think anyone cares. Thanks, GPT. Well, I hope you’ve enjoyed that. Um, you know, As I said, I was reading this book and trying to get my head around it and then just realize, I just need to have a conversation with GBT now, of course. We all know the GPT. Isn’t perfect. And it hallucinates. And if anything sounds fishy to you, you should double check it.

[00:43:00] Cameron: Fact, check it, ask it to fact, check it, ask it for sources, asking for references the same you would do in any conversation with anyone. Uh, and if anything, it said. Uh, as part of that conversation, you think it got wrong or you disagree with, please let me know. And maybe I can talk about it with Tony next week when I think he’ll be back. Anyway, that’s the show for this week, have a great week and happy share market.

[00:43:23] Cameron: Let’s hope. 2024 is another one of the good times, years.

VIDEO DEEP DIVE