TK’s checklist from 2020-09-07

Note from Cameron: Tony sent me this list on 7/9 and I haven’t had a chance to proof them yet, so I’m posting them up here before they get too old. Please do your own numbers. I’m doing my own download today.

- I inserted Ovato (OVT) to the Manually Entered Data tab as it is new to our list following its results. However, it is not in a 3PT buy period yet. Ovato was known as PMP prior to a name change.

- Similarly, I added Wiseway Group (WWG) to the manually entered data tab as well. They are also not in a 3PT buy period yet.

- Beacon Lighting (BLX) became a Shrodinger with its latest results, it is both a buy and sell at the same time now.

- As did, Harvey Norman (HVN). I think Friday’s market sell off has turned this stock and BLX into Shrodingers.

- Small Cap telco and electricity provider TLC Consolidated (TPC) became a buy today.

- Slater and Gordon (SGH) are an interesting case. Their share price crashed 4-5 years ago after a failed expansion into the UK market. So, looking at their 5 year monthly graph they are not a buy. However, looking more recently at a 2 or 3 year graph suggests they are in an upturn. I have left them as a 3PTL sell as the 5 year graph has no clear uptrend, but more aggressive buyers might want to have a look.

- SIV Capital (SIV) have reported and continue to have a qualified audit report.

- I had to add HIlls Industries (HIL) to the manually entered data sheet, but it is a 3PT Sell.

- Small Cap surveying company, Veris (VRS) was added to the manually entered data sheet, but is a 3PT Sell.

- I updated the manually entered data for Medusa Mining (MML) and removed the Share Analysis scores as the site is still down and I can’t check the SA scores against those from the last half. MML still remains on the Buy list.

- Our friends ant Zimplats (ZIM) have reported. Management have suggested that the qualified audit should be removed, but the preliminary figures are still under audit. If the auditors concur and remove the audit qualification then ZIM becomes a Buy with a QAV score of 0.30. I have raised an alert in SD for any price-sensitive announcements and will monitor these looking for the audit report.

- I have had another look at Sandfire Resources (SFR) and think that it is a Schrodinger as it has breached its buy and sell lines and maybe a falling knife. I think it is best to wait for a clear trend on this one.

- I raised a price alert for Automotive Sports Group (ASG) with a buy price target of $1.44.

- Super Retail Group (SUL) has released its updated numbers through SD and become a Buy with a QAV score of 0.17. It is worth watching their share price direction as they are very close to being a Schrodinger.

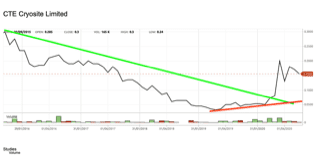

- Small cap Biotech firm Cryosite (CTE) is now a buy. I also had to add them to the manually entered data sheet. They are very small, however with only $400 average daily traded. I wonder if they have this picture on their wall? (Cam: I can’t see how this is above its buy line…. TK replied with the following chart)

- I updated the manually entered data for Austral Gold (AGD) and it remains a buy with a QAV score of 0.21. The stock has doubled in the last month and they announced a takeover of a Canadian Gold miner. AP Eagers (APE) has reported numbers through SD and looks like a Schrodinger, but is worth watching to see if its shares can turn up again.

- Small Cap, Excelsior Capital (ECL) is added to the buy list following its latest results with a QAV score of 0.14.

- I think Westgold Resources (WGX) is technically now a sell. It has reported new numbers in SD and I have set a buy price alert for $2.34. If anyone is holding it, I would continue to hold as it looks to be in a general uptrend for now, it is just see-sawing around a bit.

- I am removing Capral Aluminium (CAA) from the buy list as it has turned down from its 3PT Buy line.

- I raised a Sell price alert for MFF Capital Investments (MFF) at $2.54.