On this week’s episode, Tony did his pulled pork (a deep dive) on Baby Bunting (BBN), the go-to destination for expecting mothers and new mums in Australia and New Zealand. From prams to nappies, this is a retailer that’s been on the scene for over 40 years. But what’s really going on behind those adorable storefronts? Tony shared some fascinating insights.

The Baby Bunting Story

From an original store in Camberwell, Melbourne, the business has grown to 70 stores across two nations. Tony pointed out something interesting: the Nadelman family, who originally set up the company, exited around the time of listing. The reasons? Well, Tony speculated that perhaps there was no one in the family to continue running the business.

The Competitive Landscape

BBN grew to dominate in Australia but Tony warned that New Zealand might be a different ball game, especially with existing competitors like Baby Factory.

Its competitors in Australia now are Kmart, Big W, Target and Myer. That kind of department started off as Prams and Bassinets and other maternity categories as well. But the benefit of Baby Bunting, of course, is the fact it’s all in one place, and it has a much wider range than you’ll find in a K Mart but it’s still possible that people go into Baby Bunting, find the thing they want and go and try and shop around at K Mart and Big W or online and get a cheaper price for it.

Corporate Responsibility

BBN’s focus on Environmental, Social, and Governance (ESG) is admirable and TK noted the company’s efforts in using recycled packaging and avoiding products from countries with slave labor issues. A responsible approach for a brighter future, he observed.

The Financials

The highlights:

- Sales were up 1.7% to $515.8 million

- However, like-for-like sales were down 3.6%. Like-for-like (LFL) sales refers to the growth in sales as recorded by the same number of stores a year ago. Not a good sign.

- Online sales decreased over 8% to $103 million

- Net profit was down 51% to $14.5 million

- The dividend was cut by more than half, to 7.5 cents

- Share price down more than 50% over the last 12 months

- Directors own less than 1% of the stock, and there’s no owner founder.

Tony didn’t mince words about his concerns. Despite these figures, the share price is trending up, but he found the recent dividend cut particularly alarming.

The New CEO

The appointment of the incoming CEO, previously the Global Chief Product and Chief Strategy Officer for Afterpay, raised Tony’s eyebrows. He suggested they might be “backing the wrong horse,” expressing surprise we’re not seeing a very experienced retailer come out of WesFarmers or Kmart or Target or someone like that to take on this role, which might suggested people with more retail experience don’t like the business’s short-term prospects.

The QAV Analysis

All in all, the quality score for this company is 3 out of 15, which is only 20%.

QAV score is 0.03, putting it well below our cut-off of 0.10.

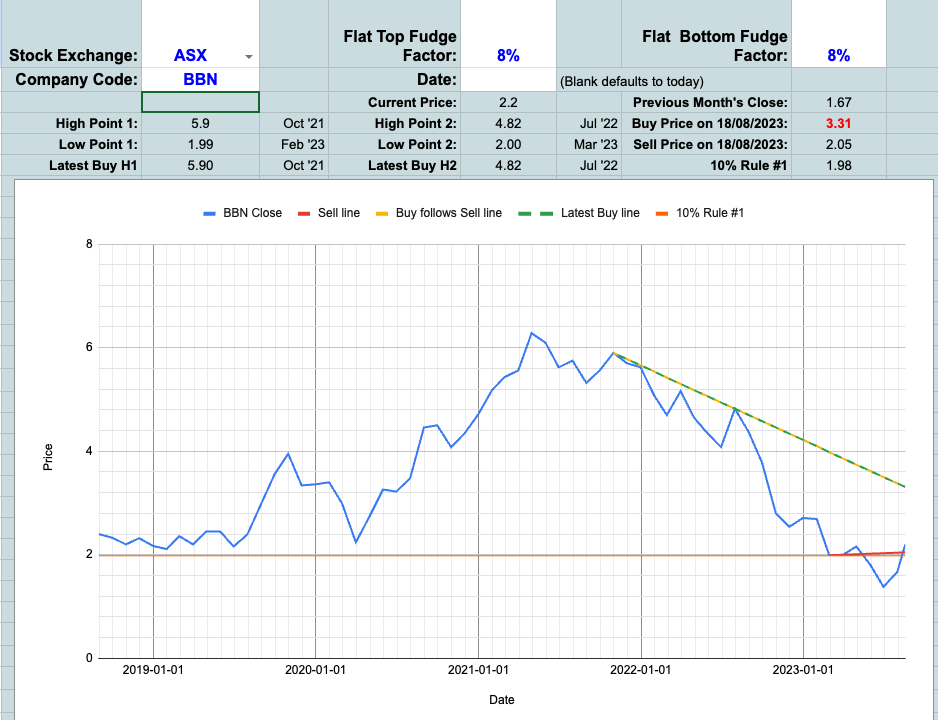

When we looked at the Brettalator, BBN was below the buy line and still had a long way to go.

So there you have it, folks! A look at Baby Bunting through Tony’s eyes. Not a Buy for us at the moment.