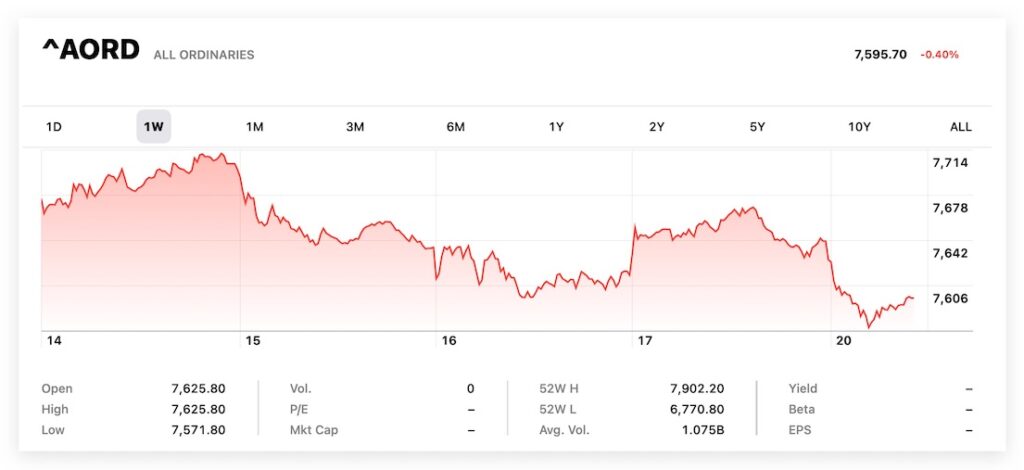

Well the last week was rough yet again for the AORD, with Omicron fears continuing to add to the market’s woes.

Despite the carnage, some of our recent stock tips continue to perform well.

- KRM is up 60% since we recommended it on 20/9/21

- MHJ up 31% since recommended on 28/9/21

- KIL up 15% since recommended on 26/10/21

- CVW is up 14% since recommended on 4/10/21

- AMI up 11% since recommended on 2/11/21

- IGL up 5% since recommended on 13/9/21

Since we started publishing our stocks of the week in September, about 50% of our picks are either up or neutral, while the other 50% are down, some by a little, some by a lot, and if you’re following the QAV system, you’d have already replaced those in your portfolio (QAV Rule #1 – Never Lose Money). Our goal is to have 60% of our stocks perform well over the long term. Obviously, during turbulent markets, finding these is a little more difficult than it is during upbeat markets, but that’s why investing takes patience and a long-term strategy for riding out the cycles.

We have two stocks to bring to your attention to this week. This recommendation is based on Tony’s analysis using data from Saturday, 18 Dec 2021.

1. Small Cap: FEX

Fenix Resources Ltd (XASX:FEX) is a niche Iron Ore producer based in Western Australia. Their current project is Iron Ridge, a high-grade Iron Ore mine located approximately 70km north-north west of Cue, WA.

Some of the reasons we like FEX this week include:

- Based on a share price of 23c, it has a quality score of 90% and a QAV score of 0.51

- Average Daily Transaction volume is $567,000

- Their Price-to-Operating Cash Flow is a very low 1.78

- Financial health is strong

- Current share price is less than our Intrinsic Value #1

- Current PE is less than their dividend yield

- Yield is higher than the current bank rate

2. Large Cap: GMA

Genworth Mortgage Insurance Australia Limited (XASX:GMA) is a leading provider of Lenders Mortgage Insurance (LMI) in Australia. They also provide tailored risk and capital management solutions for lender customers in the Australian residential mortgage market.

Some of the reasons we like GMA this week include:

- Based on the current share price of $2.36, it has a quality score of 88% and a QAV score of 0.35

- Average Daily Transaction volume of $1,817,000

- Price-to-Operating Cash Flow is a low 2.5

- Financial health is strong

- Share price is less than the consensus valuation and less than our Intrinsic Value #2

- Share price is also less than Book Value and also less than Book Value + 30%

- It has a new three point trend line breach

- Growth / PE is less than 1.5

Please Note:

Our recommendations are based on the share price as of the date of the download. If the share price changes, this will affect the QAV score and its ranking on our buy list, so please take price changes into account before making any investing decisions.

Also note that while we apply a high level of science in our selection process, some stocks may not perform well in the short term. Like Warren Buffett, we aim for a 60% success rate (meaning 60% of our stocks will do well in the short term, the other 40% will not). So it’s very important to monitor your portfolio and to sell the ones that don’t perform to your expectations. The way we do this in QAV is using Rule #1 and the 3PTL. If you’re not familiar with how to use those, please listen to the podcast and consider joining QAV Club.

We have very strict guidelines about what we disclose about our own portfolios, and when we buy and sell stocks that appear as our stocks of the week. You can read our guidelines here.

Finally, please also note that this isn’t personal financial advice and you should consult a financial planner before making any investment decisions.